Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Morningstar’s most undervalued stock on the ASX

Joshua Peach | Morningstar Australia

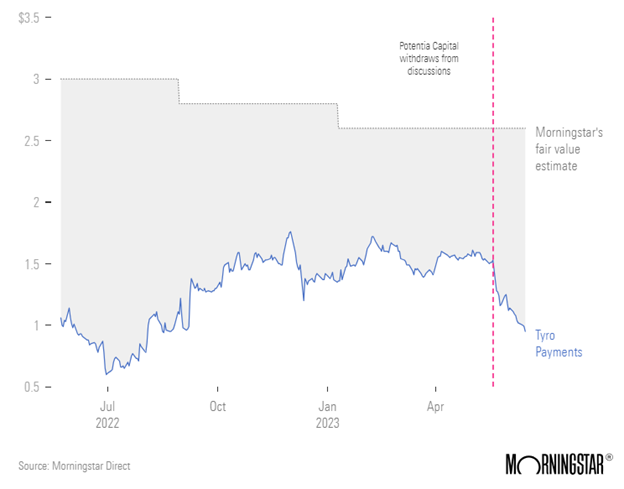

Shares in fintech Tyro Payments (TYR) have plummeted since a proposed takeover deal with private equity firm Potentia Capital collapsed last month, but the market may have been too quick to punish the former ASX tech darling, according to one Morningstar analyst.

Tyro, which operates the fifth largest network of EFTPOS machines in Australia, revealed in May that discussions with Potentia had broken down following two unsuccessful offers. Since then, shares have fallen more than 30%, wiping off almost nine months of gains.

Commenting on the close of discussions, Tyro chair Fiona Pak-Poy said the company’s board and management team were disappointed that Potentia were ultimately unable to deliver a revised offer.

Morningstar equity analyst Shaun Ler calls the news surprising, adding that the statement from Tyro, alongside recent media reports, suggest that it was the fintech’s neo-bank operations that ultimately led to the acquisition falling through.

“[These reports] suggest there were complexities for Potentia to own Tyro's banking operations, which do not align with Potentia's risk appetite,” he says.

“For example, having to hold more capital and/or having go through a long process in handing back the banking license to the regulator.

“The hassles for Potentia to own a bank, together with concerns on a downturn affecting Tyro, likely led to the deal not materialising.”

Despite the news however, Morningstar has held firm on its $2.60 price target for the stock, which combined with the selloff has shot Tyro Payments to the top of Morningstar’s most undervalued companies, displacing embattled media group Southern Cross Media (SXL).

Given the unchanged fair value estimate, Ler maintains that neither of Potentia’s previous offers represented adequate value for Tyro investors.

“Potentia's withdrawal came after it made two offers for Tyro that were rejected by Tyro's board. First, for $1.27 per share in September 2022, and $1.60 per share in December 2022,” he says.

“These bids were opportunistic, considering technology stocks have materially derated since 2022 and are yet to recover.”

Tyro to generate value on its own

While the market seems to have discounted Tyro severely since the acquisition talks collapsed, Ler says that the company remains well positioned to generate value on its own.

“We believe Tyro can improve earnings and generate value to shareholders without any corporate action,” he says.

“Its three successive earnings guidance upgrades for fiscal 2023, most recently on May 15, 2023, strengthen our conviction in its ability to achieve profitability.”

That conviction isn’t without caution, however, with Ler noting that weakening external conditions could slow volume growth and increase bad debts, potentially leading to a loss again in fiscal 2024.

“We assume sales per individual merchant for fiscal 2024 and 2025 to be below fiscal 2023's by close to 20% and 10% in real terms, respectively.”

Given the uncertain near-term factors at play, Tyro Shares currently carry a Morningstar risk and uncertainty rating of ‘Very High’, with Ler noting the relatively difficulty in forecasting Tyro’s earnings growth amid the evolving payments market.

“Given its early growth stages, any changes in market share assumptions—particularly on expansions into new markets and their associated timing—would have an outsize impact on our earnings forecasts and hence fair value,” he notes.

Beyond the near-term headwinds, however, Morningstar’s outlook for the company appears more positive.

“We expect the firm to generate maintainable profit growth starting fiscal 2025,” Ler says.

“We would expect profits to grow more consistently once sales per merchant normalise. Thereafter, we expect sales growth at the individual merchant level to recover to around 3.5% per year.”

In terms of the group’s profitability, Ler says improvements in transaction volume growth and the scaling of fixed costs will likely lead the way, with first-half fiscal 2023 results demonstrating progress in this direction.

“We expect gross profit margins to remain largely flat over our forecast period—higher merchant fees are unmaintainable over the longer term and will likely contract due to competition, but this should be offset by a reduction in variable costs with scale in transaction volumes,” he adds.

Shares in Tyro Payments last traded at $1.07 cents, a 59% discount to Morningstar’s fair value estimate of $2.60 per share.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

Joshua Peach is a reporter for Morningstar Australia. Analysis as at 29 June 2023. This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.