Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three ASX stocks fund managers are buying

Joshua Peach | Morningstar Australia

Each month we sift through the recent portfolio movements of Morningstar-rated funds to discover notable buys by reputable management teams.

The aim is to uncover potential investment opportunities, in a manner timely enough for investors to gain value.

In compiling the list, we target ‘new-money’ or ‘high-conviction’ stock purchases, bought by funds with a Morningstar rating of either gold, silver, bronze or neutral. High-conviction purchases reflect a meaningful addition in relation to the portfolio’s size. New-money buys are where a manager purchases a stock that did not exist in the fund’s portfolio in the prior period. View the full criteria here.

Due to portfolio disclosure lags, purchases may have been made weeks or months before the listed disclosure date. Investors should always assess for themselves the attractiveness of any stock mentioned, as well as their individual risk appetite and investing goals.

Three stocks fund managers are buying

Ramsay Health Care (RHC)

Ramsay Health Care is a global provider of private healthcare, which operates more than 460 facilities worldwide—78 of which reside in Australia.

Following Ramsay’s interim 2023 results back in February, Morningstar analyst Shane Ponraj said the second quarter results showed a marked improvement from the first, as impacts from the COVID-19 pandemic continued to ease.

“Second-quarter underlying group EBIT was up a remarkably strong 85% from the first quarter, with the combined estimated negative impact of coronavirus in Australia and the United Kingdom declining to immaterial levels,” he says.

Ponraj adds that the healthcare provider still faces other material pandemic headwinds, such as hospital staffing issues, but says that Ramsay remains well positioned to service surgical backlogs and benefit from long-term underlying growth driven by demographic factors.

“We are more optimistic on Ramsay's long-term outlook with increased planned investment in the Australian development pipeline,” he says.

Following a choppy year to date, shares in Ramsay are trading at around $65.00 and are considered “fairly valued” by Morningstar, with a fair value estimate of $68.

Stockland (SGP)

Shares in Australian diversified property group Stockland have performed strongly in recent months, jumping more than 20% since the start of the year.

Despite the rise, shares in the company remain in the ‘fairly valued’ territory, based on Morningstar’s fair value estimate of $4.53 per share.

While the company’s most recent half-year report revealed lower sales and impacts from poor weather, Morningstar analyst Alexander Prineas says the outlook for the company remains positive, even in a more challenging property market.

“We believe Stockland can gain market share in a more difficult market by winning share from smaller rivals who exit during tough times, although we don't expect a return to the heady residential sales volume and margins achieved in the decade to 2022, “ he says.

“Stockland’s commercial property business is performing well on the whole. Retail has largely recovered from COVID-19 impacts, office looks to be at or near the low point, and industrial is experiencing incredibly strong rental growth, which bodes well for Stockland’s substantial development pipeline.”

However, Prineas says there are other listed property stocks that offer better value, with Mirvac (MGR) and Dexus (DXS) trading at double-digit discounts to Morningstar’s fair value estimates.

Sonic Health (SHL)

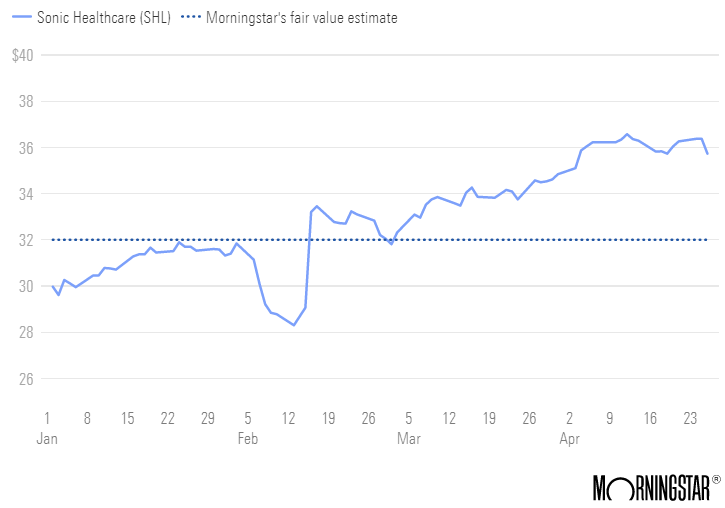

Sonic Health has spent much of this year in our 'fairly valued' territory.

Source: Morningstar 2023

The healthcare stock offers pathology, radiology, corporate and general practice medical services across Australia.

Shares in the company surged following the onset of the COVID-19 pandemic amid higher demand for medical testing. However, commenting on the company’s future prospects, Ponraj presents a mixed outlook.

“Coronavirus testing has been a boon for Sonic Healthcare and driven explosive earnings growth. However, we think longer-term, higher vaccination rates and testing fatigue will lead to fewer tests related to travel, compliance and precautious safety, and the majority related to symptomatic infection,” he says.

While Morningstar forecasts a continuing decline in COVID-19 testing, Ponraj adds that Sonic's base businesses remain well placed to service the build-up of medical service backlogs.

However, investors should note that, following a strong year-to-date performance, shares in Sonic Health have rallied above their Morningstar fair value estimate of $32 apiece.

Morningstar's latest outlook report ranked healthcare as one of the most overvalued sectors on the ASX.

For investors seeking opportunities in the sector, Morningstar recently named PPE manufacturer Ansell (ANN) as one of its top picks.

Trading at around $27, shares in Ansell are considered undervalued compared to Morningstar’s fair-value estimate of $30.

Ponraj says the outlook for the company is positive as the supply and logistics headwinds that impacted the company’s operations in previous quarters continue to ease.

“We expect input and shipping costs to ease as supply chains normalise, and pricing for undifferentiated single-use gloves to stabilise lower around pre-pandemic levels by fiscal 2024,” he says.

“With a healthy balance sheet, Ansell has plenty of headroom to seek discounted acquisitions as well as continue opportunistic share buybacks to enhance shareholder returns,” he says.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

Joshua Peach is a reporter for Morningstar Australia. Analysis as at 2 May 2023. This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.