Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three themes and companies to play China’s rise

The structural drivers for China's growth remain intact, and we expect Chinese companies to benefit from trends such as rising incomes and wealth, increasing demand for premium goods and services, and burgeoning sophistication in technology and manufacturing. There will also be opportunities for companies to innovate and move up the value curve. This, coupled with China’s increasing role in global trade, should bode well for exports as well as domestic consumption.

We highlight three examples of long-term themes and companies which are likely beneficiaries.

Industrial automation aims to offset a shrinking workforce

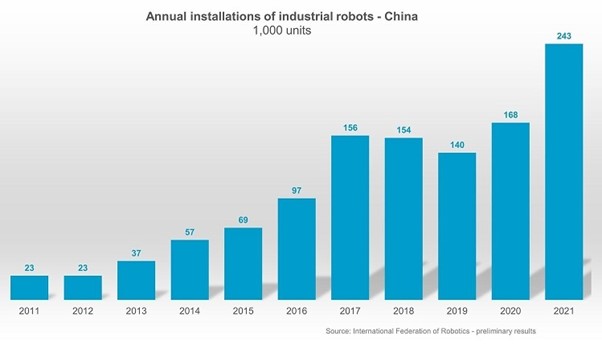

The impact of China’s earlier one-child policy will continue to be felt in the coming decades. Its working age population, or people between 15 and 64, will contract by 22% or 217 million people. To counter the anticipated labour shortages, the government seeks to improve manufacturing through automation and robotics, which means China’s automation market will see strong secular tailwinds. For example, the country set a record of 243,300 industrial robots in 2021, a 44 per cent increase from the previous year.

Shenzhen Inovance is an industrial automation company with leading positions in inverters, servomotors and new energy vehicle (NEV) controllers. It has repeatedly proven its capability in developing new products and entering new markets, where it can compete with multinational peers. As of March 2022, the company has generated 28% per annum shareholder returns since its IPO in 2010, with 40% compound annual growth rate (CAGR) in sales and 35% net profit CAGR*. Despite its size, our view is that Inovance can continue to generate attractive growth over the next 5-10 years as it gains market share and continues to innovate.

Healthcare companies stand to gain market share

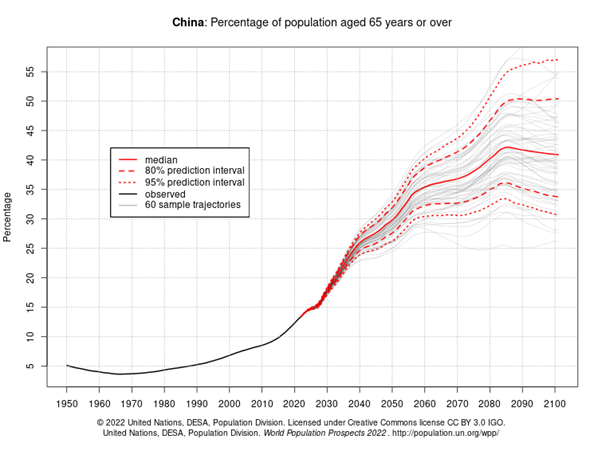

Healthcare spending, while much lower than in developed countries, is expected to grow as China’s population ages. The population over 65 will increase from 14% of the total population in 2022 to 30% in 2050.

Shenzhen Mindray is China’s largest domestic medical devices company and a market leader in patient monitors and life support systems. Growth across categories has picked up in recent years, and Mindray’s market position for each category has been improving as well. It has gained market share from global leaders as it expands its presence overseas and has more than 40% of its sales through exports*.

In the domestic market, we expect increased hospital spending on medical equipment to contribute significantly to its revenue. There are also growth opportunities ahead, as the penetration level of medical devices in China is still low and there is a growing preference for import substitutions.

Domestic brands may benefit from premium consumption

Structural growth is expected to return to domestic spending with the recovery of consumer confidence. Amid weaker consumer demand resulting from the pandemic in the last two years, we focused on buying high-quality franchises and market leaders – those companies with above-average margins and returns, and which can increase selling prices.

One sector we looked at was China’s beer market, which is different from most other countries. It is highly consolidated with the top three companies, China Resources Beer (CR Beer), Tsingtao and Anheuser-Busch InBev, sharing 75% of the market as per our research in 2022*. Despite beer volumes declining since 2014, the improving economy and a growing middle class has seen some brands looking to develop more premium products, improving unit economics. Sales and profitability have also improved as beer companies consolidated their breweries.

CR Beer’s share of premium sales has grown with the help from a 2019 merger with Heineken China, resulting in higher average selling prices. Although the company is a state-owned enterprise, China Resources businesses have typically been well run, with returns comparable to private enterprises. Additionally, while investors were worried about higher prices of inputs like aluminium cans, historically beer companies have been able to pass on costs, while the gross profit margin of circa 40% should limit the impact on profits.

Conclusion

This year marks the 30th anniversary of the FSSA China Growth strategy. While China has changed significantly over the last three decades, the key driver of share prices over the long term remains companies’ ability to generate value by growing their earnings or net asset value. Therefore, we use bottom-up analysis and focus on quality companies, with capable leaders who are aligned with shareholders.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

*N.B. Source: FSSA Investment Managers, company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As of February 2023 or otherwise noted.

Martin Lau is a Managing Partner and Lead Portfolio Manager at FSSA Investment Managers, based in Hong Kong. FSSA is part of First Sentier Investors, which is a sponsor of Firstlinks. This article is intended for general information only. Analysis as at 23 March 2023. This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.