Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

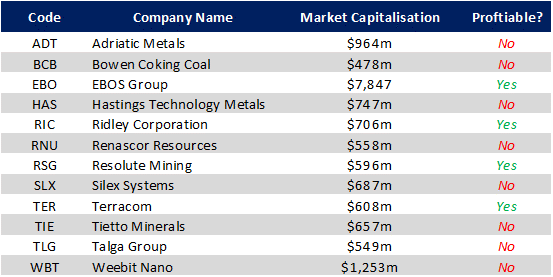

12 new stocks added to the ASX 300 - only 4 make a profit

Chris Prunty | QVG Capital

For the past couple of years, QVG Capital has been tracking index changes with a particular focus on the proportion of unprofitable companies entering the S&P/ASX 300. For example, at the last bi-annual rebalance in September, only 4 of the 14 made a profit and a year ago just 3 of the 13 inclusions were profitable.

Why the ASX300 is a big deal

For those wondering about the significance of the S&P/ASX 300 index, it’s the benchmark that index funds such as the $12.5 billion Vanguard Australian Shares Index (ASX:VAS) seeks to replicate. It’s also the pool that many fundamental portfolio managers use as a cut off for their potential investable universe. With a new batch of additions entering the index last Friday, we felt it was worth reviewing the current crop.

Here goes:

Source: QVG Capital

The table above shows the 12 stocks that have recently been promoted into the index. Every 6 months - in March and September - the keen minds that comprise the S&P’s index committee get together and ‘promote’ and ‘delete’ stocks from various indices. The index committee don’t make exactly clear what criteria they use to make their decisions, but we do know entry and exits are largely dependent on the stock’s market capitalization, rank versus peers and its trading volumes.

We have discussed previously the lack of quality of 300 entries and this batch is little different with just 4 of the 12 companies making a buck. Of the 8 currently unprofitable companies, 4 don’t even have any revenue and 2 will achieve first revenue this calendar year.

Commodities feature heavily in inclusions, but Lithium seems to have done its dash with not one direct lithium play, unlike the last couple of rebalances where the battery mineral featured heavily. This crop of entries is more eclectic than the recent past, with everything from Silver mines in Bosnia (Adriatic) and a memory chip-maker (Weebit Nano). Stocks playing the green theme include Hastings, Renascor, Silex, Talga and are all what my colleague Josh Clark would call ‘zero carbon, zero profit’ stories. Cynic.

What is it with Pet Food?

Of the profitable names, the under-stated Kiwis at EBOS deserve respect for shifting the business away from the challenging pharmacy distribution business and towards medical device distribution and pet food. Similarly, Ridley has undergone a turnaround with a growing branded and contract manufacturing pet food business as one leg of its growth stories. Maybe everyone really did get a furry Covid companion? Gold-producer Resolute always looks cheap but then something always goes wrong in Africa. Remember the time they paid a dividend in physical Gold? Fun times.

So what is the practical application of all this?

We suggest the following:

- Be aware there are technical factors, such as index inclusions, that can drive share prices well above fair value. Index funds don’t care about the long-term prospects of a business; they’re buyers at any price until they’ve got the size they need to replicate the benchmark.

- Don’t get caught up in thematic mania such as green metals. And if you can’t help yourself, keep your bets small.

- If you buy an index product, be aware you’re buying the good, the bad and the ugly.

- And finally, stocks with weak fundamentals that are over-valued for technical reasons can present great shorting opportunities; ones the QVG Long Short fund seeks to take advantage

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

Chris Prunty is a co-founder and Porfolio Manager at QVG Capital. All prices and analysis at 8 March 2023. This information was produced by Chris Prunty and published by Livewire Markets (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.