Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

My SMSF in 2022: the good and the bad

Stop whinging about investment performance in 2022. Every market analyst starts the year with a summary of the previous 12 months, and descriptions of 2022 vary from brutal to terrible to disappointing. Among many examples, fund manager Roger Montgomery, mainly an Australian equity investor, started his first newsletter of 2023 by saying:

“Many commentators point to the 12 months to December 2022 as being one of the toughest annual periods for the performance of the share market and the bond market for several decades.”

Not much love there, but was it really so bad for Australian superannuation?

Expectations need a reality check

In fact, including dividends, the broad S&P/ASX200 index rose 1.9% in 2022, and many active equity managers performed well. According to the latest VanEck Australian Investor Survey, 70% of investors plan to increase their allocations to Australian equities in 2023, and what matters most to local investors is local equities.

Delving into my SMSF performance for 2022

No decision made now can change past returns, and the only thing that matters for the future are the buy, hold or sell investments made from this day forward. But looking at the past for lessons can inform the future, both for investment decisions and risk appetite.

Despite no new contributions into our SMSF and drawing the minimum pensions for me and my wife, the total balance in our SMSF increased over 2022. Let’s take a quick look at a few of our investments.

The Good

When switching some money out of equities in late 2021, the investment choices were not exciting. The Reserve Bank of Australia did not start increasing cash rates until 4 May 2022, a poor judgement by Governor Philip Lowe who was at least six months late in moving to control inflation. The cash rate was only 1.35% by July 2022.

Bank hybrids and corporate floating rate notes paying a margin above BBSW offered better defensive appeal. Not only did they generate some cash flow, but the income would rise with the cash rate. Hybrids were purchased at varying margins around 3% depending on price opportunities over many months. Money was also allocated into a range of unlisted hybrids and notes, a senior bank debt fund (ASX:QPON), a subordinated debt fund (ASX:SUBD) and various listed corporate floating rate notes (such as Centuria's ASX:C2FHA and CVC's ASX:CVCG).

Less flattering, a listed fund that invests in floating rate bank capital instruments, ASX:GCAP, produced good income but our investment shows a small capital loss. Our average entry price was $9.27 and it is now trading at $9.05 after a recent recovery.

Source: Morningstar

Three-month BBR is currently around 3.3% (and heading higher) and with margins above that, the income is far higher than anything seen for years. Of course, inflation is also higher and real returns are flat.

These investments down the bank capital structure come with more risk than deposits, but there is reward for risk in a strong Australian banking system. In the deposit market, to increase returns on cash, investments were placed in ASX:BILL and higher-yielding cash accounts.

Listed infrastructure has also held ground despite rising rates, including positions in Argo's ASX:ALI and to a lesser extent, Magellan's ASX:MCSI.

Source: Morningstar

As we moved beyond the first quarter of 2022, with demand for resources looking strong, exposure to Mineral Resources (ASX:MIN) looked worthwhile given its stake in iron ore and lithium, and industry stalwart ASX:BHP offered potential. Two resource LICs, Tribeca’s ASX:TGF and Lion’s ASX:LSX, were both trading at a large discount to NTA which seemed to offer added upside potential.

The Bad

While I was generally lightening the load on equities, I still wanted exposure to the growth and dividend potential of good companies. I like the concept of a core/satellite portfolio - where cost is minimised in index (or near index) funds, such as ASX:A200 (with a cost of only 7 basis points, or 0.07%) and a broad LIC available at a discount such as the Djerriwarrh ASX:DJW – while backing some active managers for potential outperformance. For reasons described in the next section where I exited direct holdings in many tech companies, I decided to build a position with a few equity growth managers.

These managers included listed vehicles from Hyperion (ASX:HYGG), Munro (ASX:MAET), Loftus Peak (ASX:LPGD) and Hearts & Minds (ASX:HM1). Presentations by these managers were impressive. For example, Hyperion was Morningstar’s Fund Manager of the Year in 2021 with outstanding long-term results. Hearts & Minds is a ‘fund of funds’ with experienced people selecting quality managers, with a philanthropic angle. I also thought buying Magellan’s closed-end LIC, ASX:MGF, at a discount to NTA around 20%, was taking advantage of the market loss of appetite for the brand despite the quality underlying companies.

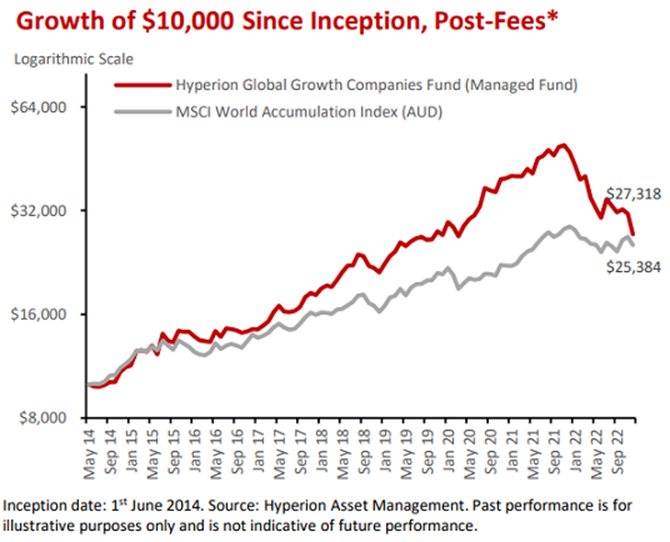

My new satellites took a hard landing when returning to earth over 2022. Yes, I went into this with my eyes open but it was disappointing that the funds did not bank more of their successes in 2020 and 2021. They are all global managers exposed to tech and investors should know what to expect of them. HM1 added fuel to the fire in late 2021 by updating its managers to include up-and-coming tech and growth managers, which were hit in 2022. Hyperion maintains great confidence in Tesla, down 65% in the last year, and 35% of the main portfolio is in three stocks: Tesla, Microsoft and Amazon. All great companies, but the chart shows Hyperion has given back nearly all the outperformance it took eight years to achieve since 2014. Ironically, perhaps the lesson is not to invest with managers after a long and successful run, and wait until they have given some back.

Hyperion Asset Management Global Growth performance since inception

My ‘index’ Australian equity positions were steady. While intuitively, I believe it should be possible to identify active managers who can deliver over time, it’s a long way back since the start of 2022 for some of these growth positions. Fortunately, the build of these active allocations had only started when tech problems hit.

I also held some long-term bond positions, such as in listed bonds, Australian Unity’s ASX:AYUPA paying 5% pa, ECP Fund’s ASX:ECPGA at 5.5% pa and Mercantile’s ASX:MVTHA at 4.8% pa. At the beginning of 2022, selling these would have reduced cash flow from over 5% to around zero, and (like everyone else including the Reserve Bank Governor), I did not expect rates to rise quickly. I decided to take the ongoing income which was likely to be better than cash, notwithstanding the greater (but I judged acceptable for the reward) credit risk.

These three listed securities are now ‘trading’ at about $88, no bid and $94. Not the end of the world but large capital losses on the defensive part of my portfolio were not part of the plan. Liquidity in these small, corporate bond issues is poor despite public listing. Spreads were wide and I sat on the offer for many weeks to reduce these bond positions at a decent price.

Listed property is delivering good income but with varying capital losses depending on the sector exposure. I thought staying away from offices and discretionary retail would protect the portfolio, but the downside on a fund like Charter Hall’s ASX:CLW has surprised. I expected its focus on industrial property, its long leases (average 12 years) to top-quality names (99% blue-chip), 6.8% distribution yield with half of the leases on the 549 properties linked to CPI (and therefore rising rapidly), plus low gearing (29.9% and most leases ‘triple-net’) were compelling. The market may be doubting the NTA at June 2022 of $6.26 because the share price is languishing at about $4.60, and it's the same with many property trusts. Rising rates weigh on cap values and the market is worried about independent valuations. Our average entry price is $4.80.

Source: Morningstar

What about the future?

My SMSF portfolio probably will not suit you. It is designed for my personality, family, age, goals, risk appetite, experience and outlook.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

Graham Hand is Editor-at-Large for Firstlinks. Analysis as at 23 January 2023. This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.