Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

China reopening in 2023 and Henry Jennings' view on where the opportunities lie

Henry Jennings | Marcus Today

Made in China

2022 was the year of inflation and central banks raising rates. There is still plenty of talk about that and obviously more to come as inflation remains stubbornly high, but what does 2023 hold? The Year of the Rabbit. The biggest theme, at least for the first half of the year, is China. Make no mistake, China reopening is a huge deal. Massive. The world’s second biggest economy has been isolated for three long years. That is a lifetime of restrictions and lockdowns. Can you remember how we behaved in Australia after our isolation ended? Seems so long ago. But there was revenge spending. Travel. Huge build up in savings after three years of watching Netflix. We wanted to celebrate. Cafes and restaurants are still enjoying that boost. Still. Multiply that to the ‘Nth’ with China and you can see the huge opportunity that exists. There is not only opportunity, but also a risk.

Firstly, the opportunity for Australia is massive. We are a resource-based economy. We have the biggest mining company in the world leveraged to a Chinese recovery. BHP. We have iron ore and copper giants leveraged to the reopening of China. We supply raw materials to China, from lithium and coal to wine and vitamins (hopefully to come again). Our economy has massive leverage to Chinese economic expansion and stimulus. We going to do well out of the reopening. The budget bottom line is already seeing the benefit. Resource companies have rallied in anticipation. BHP, Rio Tinto (RIO) and Fortescue Metals (FMG) have been driving our market higher. That will not change. They need our raw materials.

Lithium is fast becoming a key export. Pilbara Minerals (PLS) has been making extraordinary dollops of cash to its piggy bank. Over $800m in the last quarter alone. Our coal companies have been adding similar cash piles. Buybacks and dividends will continue. Remember when FMG became a cash printing machine and debt was no longer an issue. Huge jump in dividend payments and yield.

This is a new wave resource boom. It has been happening already. So, is it too late to get on the China train? No. There are plenty of opportunities. They may be different from the one last year. In 2022, all the great intentions of green and clean were pushed asunder as Russia threatened the globe with higher prices and lack of supply. That is not the issue now, hopeful we can get back to the ‘greenification’ and the lust for EV commodities. Battery tech, graphite, lithium, copper. Last year there were 5.67m EVs and Hybrids sold in China. 4m all electric. Five times more than the US. BYD is now the biggest car company in the world. But the Europeans are coming. German President Scholtz is in South America trying to secure supply and talk up Euro EV companies. President Biden is fighting back with a huge push into EVs and new tech (the EU is pushing back against the US on the Inflation Reduction Act). All good for Australian companies. The boom will continue and is spreading to New Kids on the Block like Patriot battery Metals (PMT) which has been heavily bought up after former PLS CEO joined as chair. Helps that drilling results have been good. 2023 is a year when lithium producers, that have processing capacity outside China, or are located in strategic areas, will benefit. Sovereign risk and strategic factors will be so important. Canada will become even more important. Winsome Resources (WR1) has been a big mover and deservedly so, and others will follow. Sayona Mining (SYA) is another one that will do well. Piedmont Lithium (PLL) too. Closer to home we have been reminded by Mineral Resources (MIN) and Liontown Resources (LTR), that bringing on supply is not just about turning the key and also that projects are costing more and taking longer. That is good for lithium pricing and that looming supply does not seem to be quite such a issue. Pricing will remain elevated. Demand is set to increase 15% according to Albemarle.

Many investors are nervous of resource companies. Too cyclical. Too hard! Impossible to forecast commodity prices. Remember though that resource companies see the ‘published prices’ of their product every day. Commodity markets around the world. Producers can even hedge. We know the prices. How many of you will know the price of data centre storage on a daily basis, or the cost of blood plasma? Resources are cyclical. Yes, but then so is everything. Banks go through cycles. Pharmaceutical companies go through cycles. Pathology goes through cycles. Telcos go through them. Travel companies do. Everything does.

Don’t be afraid of resources. If you want a more conservative approach, the Resource ETF is a good way to play the bounce. QRE. But bear in mind that 39% of this ETF is BHP. 11% is WDS. So, half in two stocks. Perhaps MVR is a better less concentrated investment. Still has large holdings in BHP at around 8% and WDS at a similar number but far more diversified and not dissimilar performance.

We do resources very well here. Our biggest customer is back and hungry for what we produce. That is something to celebrate in the Year of the Rabbit.

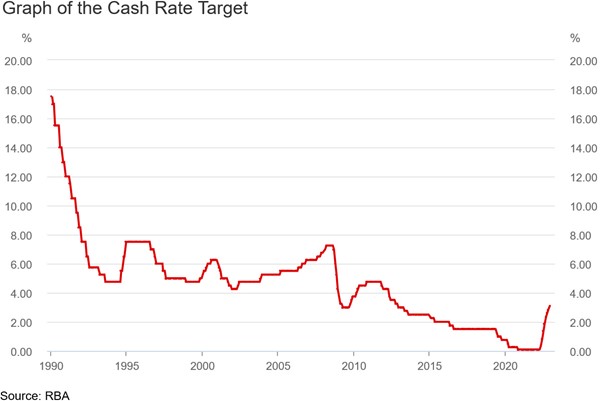

I wrote earlier that there was some potential downside to the reopening. The danger is that the China will stoke inflation worldwide again. Oil and other commodity prices will get pushed higher on renewed demand and the cooling that we have seen recently becomes short term and inflation stays stubbornly high. It could be a long road to get the official rates into the target band. That means higher rates for longer. Maybe we will have to get used to the new normal. It was the normal, after all, before the GFC. And a one in a hundred-year pandemic.

Maybe we are close to the top of the central bank raising cycle. In which case, the experts and talking heads will move on to a new obsession. And that could be China. Already started.

Go Australia.

A free trial of the Marcus Today newsletter for nabtrade clients is available here.

Analysis as at 30 January 2023. This information has been provided by Marcus Today (AFSL is 473383), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.