Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three small caps set to shine

“Small-caps,” or companies considered by professional investors to be small in terms of total market value (or capitalisation), are usually regarded as offering higher capital-growth prospects than their larger “big cap” counterparts – but with commensurately higher risk.

Here in Australia, the term “small caps” is usually taken to mean the stocks that are not large enough to make the S&P/ASX 100, but are in the S&P/ASX 300. That effectively means that the small-caps are members of the S&P/ASX Small Ordinaries index, which is the institutional benchmark for small-cap Australian equity portfolios. Effectively, the Small Ordinaries begins, heading downward, at about $4.3 billion in market cap and ends at about $790 million. Anything below that is a micro-cap – but the border between what constitutes a small-cap and micro-cap is a grey area that can vary widely between fund managers.

The small-cap sector is a happy hunting ground for specialist investors, with the caveat that bad news from a small cap – such as an earnings downgrade – can bring an eye-watering share price fall, and quickly. But many investors prefer it to the large caps. Here are three small-caps that I think look to be very attractively valued right now.

1. Nick Scali (NCK, $9.23)

Market capitalisation: $748 million

12-month total return: –31.9%

Three-year total return: 19.9% a year

FY23 (June) estimated yield: 7.8%, fully franked (grossed-up, 11.1%)

Analysts’ consensus price target: $12.70 (Stock Doctor/Thomson Reuters, seven analysts), $13.66 (FN Arena, two analysts)

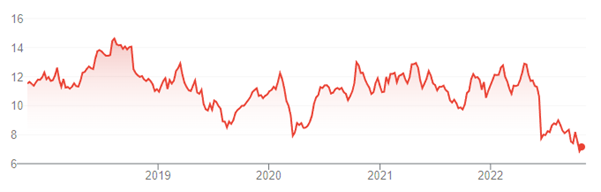

Source: google.com

Furniture retailer Nick Scali is emerging from a period of a disrupted supply chain from the impact of lockdowns in China, which flowed into the FY22 result. While total sales increased by 18.2 per cent, to $441 million, net profit for the year slid 11.1 per cent, to $74.9 million. The company said underlying net profit after tax was $80.2 million, down 4.9% on FY21.

The share market doesn’t appear to have liked the result, particularly the build-up of Nick Scali’s order book – furniture that the company has ordered from suppliers but has not received – which swelled by 67.1% to $185.3 million in FY22, because of supply-chain difficulties. But that should normalise in the current year; the annual general meeting in a month’s time should deliver some better news on that front.

Nick Scali should also be seeing the real effect of the acquisition of sofa specialist plush, which it bought in October 2021. Integrating the Plush business has added a network of 46 showrooms and a strong e-commerce platform to NCK: the two brands now operate a combined number of 109 stores across Australia and NZ and the group intends to open four to six more stores during FY23 under a long-term strategic target to double the total number of stores. As supply-chain pressures ease, the order bank – Plush’s was similarly inflated – should not only normalise, it should turn into a positive driver for NCK’s revenue and earnings. Trading on a price/earnings (P/E) ratio of 8.9 times forecast FY23 earnings – and a double-digit grossed-up dividend yield – NCK looks to be really good value at these levels.

2. GUD Holdings (GUD, $6.86)

Market capitalisation: $967 million

12-month total return: –34.8%

Three-year total return: –8.5% a year

FY23 (June) estimated yield: 7.3%, fully franked (grossed-up, 10.4%)

Analysts’ consensus price target: $11.24 (Stock Doctor/Thomson Reuters, eight analysts), $11.52 (FN Arena, five analysts)

Source: google.com

Diversified industrial business GUD Holdings is another company that has suffered from constraints in its supply chain, downgrading its FY22 earnings guidance in June, and being rewarded with a 20% share price plunge – the market was annoyed that just two months earlier, GUD had said that sales were rebounding.

GUD, which has been a listed company since 1962, manufactures, imports and markets aftermarket automotive products, water pumps and pressure systems. Its businesses include Ryco Filters, AutoPacific Group (APG), Permaseal automotive gaskets, Goss engine management and electronic replacement parts, Injectronics automotive electronic remanufacture and repair solutions, Vision X and NARVA automotive lighting and electrical equipment, Projecta battery maintenance and power products and Davey pumps.

In its automotive core, GUD manufactures products that cover the life of a vehicle, from accessories for new vehicles to service and replacement parts. Its products are sold through various channels including original equipment manufacturers (OEM) and automotive retailers. The growth strategy revolves around being a leader in the Australian and New Zealand 4WD accessories and trailering in Australia and New Zealand (ANZ), and developing that export potential; growing its global niches in automotive lighting and vehicle power management, and building its share of the “undercar” upgrade market, which covers the wear, tear and repair needs of five-years and older cars). In this area, GUD has captured the structural shift of the Australian vehicle market toward SUV and “pick-up” vehicles – these vehicles have higher upgrade rates than lighter cars – and the company has also positioned itself well for the move away from internal combustion engines to electric vehicles (EVs).

But the market has not forgiven it for its June downgrade. So, at 8.1 times forecast FY23 earnings – and 7.5 times expected FY24 earnings – GUD appears to be excellent value, with a kind of high dividend yield that one would expect from a stock where the market still has doubts.

3. Johns Lyng Group (JLG, $6.13)

Market capitalisation: $1.6 billion

12-month total return: 1.8%

Three-year total return: 50.9% a year

FY23 (June) estimated yield: 1.5%, fully franked (grossed-up, 2.1%)

Analysts’ consensus price target: $7.90 (Stock Doctor/Thomson Reuters, ten analysts), $8.00 (FN Arena, two analysts)

Source: google.com

Leading multi-national building services group Johns Lyng has become a bit of a market darling in recent years, popping-up in quite a few small-cap fund managers’ portfolios. Founded in 1953 and floated on the stock exchange in October 2017, JLG delivers building and restoration services, and commercial building services, in Australia and the United States.

The differentiating attraction with JLG is that its core business is built around insurance-related restoration and rebuilds of property – both commercial and residential – after damage from insured events such as weather, fire, defects, and catastrophic events.

Officially, JLG calls itself “Australia’s largest integrated disaster recovery and building services provider,” and describes its business as being a crucial part of the global “catastrophe management chain.”

The client base comprises major insurance companies, commercial enterprises, local and state governments, body corporates/owners’ corporations and retail customers. In the aftermath of catastrophic events, the company starts work on the jobs that arise from claims made with the relevant insurance companies.

For example, JLG’s US business Steamatic went straight into Florida after Hurricane Ian in August, while in Australia, Johns Lyng is doing ongoing floods-related work in the Northern Rivers region of NSW and south-east Queensland, and last week the company was appointed last week by the Victorian Government’s Emergency Recovery Victoria (ERV) to work with communities affected by the ongoing floods. Last year, Johns Lyng worked with ERV on clean-up and make-safe work on private homes that were destroyed during violent storms in Victoria.

In FY22, group revenue rose 57.5%, to $895 million, while earnings before interest, taxes, depreciation and amortisation (EBITDA) improved 58.9% to $83.6 million, and net profit surged 40.1%, to $38.5 million. The core Insurance Building and Restoration Services (IB&RS) division contributed 84% of revenue.

Continuing the good news, the stock was added the S&P/ASX 200 benchmark index in September. But then, earlier this month, JLG shares hit the skids, when chief executive Scott Didier sold four million shares, to raise $26 million shares. That announcement went down like a lead balloon with the market, and JLG shares fell 15%. The company explained that Didier – who has relocated to the US to oversee Johns Lyng’s expansion there, which has been turbocharged by the December 2021 acquisition of Colorado-based Reconstruction Experts – needed to buy a home in Colorado, and had further living expenses and tax liabilities. After the sale, he holds about 49.3 million shares, or 19% of the company, and stated that he remains committed to the CEO role.

JLG has a strong balance sheet, with $21.7 million in net cash, plus $50 million in undrawn loan commitments. The company has given FY23 guidance of revenue of $1.03 billion (representing a 15.2% lift) and EBITDA of $105.3 million (which would be up 26% on FY22). Although that puts it on 31.6 times expected FY23 earnings, that is below its long-term average P/E multiple, and the recent share price weakness makes Johns Lyng look very nice value. However, it’s not a great dividend stock.

All prices and analysis at 28 October 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.