The best property trusts for 2023

Value or value trap? That question keeps emerging as I consider the outlook for Australian Real Estate Trusts (A-REITs) in 2023 and the best ideas. (AREITs are often referred to as property trusts).

On some measures, A-REITs look cheap. The S&P/ASX 200 A-REIT Index is down 20% (on a total-return basis) this calendar year. The ASX 200 is flat (after dividends).

High inflation and rising interest rates this year have thumped A-REITs and other interest-rate-sensitive sectors. Trusts with lots of debt face higher interest costs and rising bond yields make A-REITs relatively less attractive.

Cash is critical. With one-year term deposits now paying more than 4%, an A-REIT that yields 6-7% is no longer as compelling for income investors, given the risks and uncertainties facing the property sector.

The big unknown, of course, is inflation. I have been bearish on inflation for the past 18 months. I disputed the consensus view last year that higher inflation was transitory because of supply-chain bottlenecks during COVID-19.

I still believe the market is underestimating how long higher inflation will persist. Deglobalisation or “onshoring” as more companies manufacture back home is inflationary. It costs more to make goods in the US than in China.

The ageing population will also underpin higher inflation. As Baby Boomers leave the workforce completely or cut back their hours, labour shortages will worsen. That means higher demand for labour and wage pressure.

Energy security is another factor. The push towards decarbonisation – and lower investment in fossil fuels – has driven up energy costs. So, too, have geopolitical risks from Russia and other autocratic nations. Higher energy costs for longer are baked in.

To be clear: I’m not suggesting inflation won’t come down from here. Recent US data suggests inflation there might have peaked, although I fear the bulls are getting ahead of themselves. My view is it will be harder – and take longer than the market realises – to bring inflation back towards 2-3% due to deglobalisation, labour shortages, energy costs and other factors.

The upshot is interest rates will remain higher for longer. Yes, Australia’s cash rate might peak in May next year as some big-bank economists forecast. I believe the risks to those forecasts are on the upside. The timing of rate cuts could be delayed.

Then there’s the fallout next year from higher rates. We’re yet to see the full carnage as rates climb even higher from here, pushing more mortgage holders to the brink. Consumer spending has been surprisingly strong, but that won’t last.

What happens to retail rents in shopping centres when consumers eventually rein in spending? Or office vacancy rates when more businesses cut staff numbers? Or property values when rising rates weigh on valuations?

COVID-19’s effect on commercial property is another consideration. I don’t see many colleagues rushing to return to the office five days a week. Many cherish this new hybrid model of working between home and the office each week. A growing push for a four-day work week, in its infancy, is another potential long-term threat to office demand.

Deglobalisation has implications for industrial property. As western multinational corporations bring more manufacturing capability back onshore, demand for industrial property will be affected. It’s hard to know how this megatrend will play out, but I see this trend favouring industrial property owners in the west.

I could add other risks facing the A-REIT sector. The good news – at least for prospective investors – is that many A-REIT valuations have fallen as the market re-rates the sector. I see more A-REITs trading below their Net Tangible Assets (NTA) and more brokers putting buy recommendations on leading A-REITs.

If you believe interest rates in Australia will peak in the first half of the year, and that we will have a mild economic slowdown rather than recession, several large-cap A-REITs look cheap. GPT Group, Dexus Property Group and Mirvac Group head that list, in my view.

However, I see the A-REIT sector continuing to underperform the ASX 200 in the first half of 2023 as inflation and rates remain high, and as threats to property valuations rise in the next 12 months. That sector – in good shape now, judging by FY22 earnings results – has many challenges.

There will be a time to buy the A-REIT sector. It’s getting closer, but not yet. For those who want to buy earlier, here are three themes for 2023 to consider.

1. Defensive retail

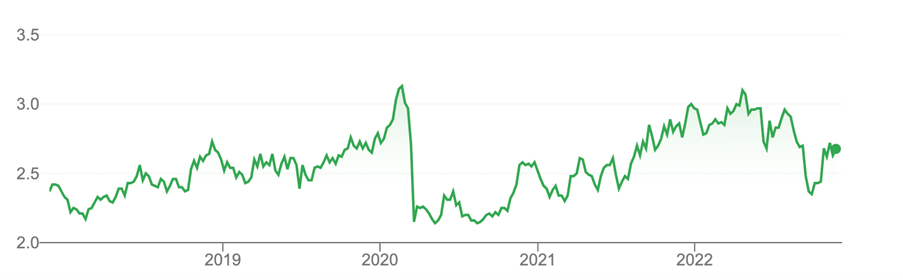

Shopping Centres Australasia Property Group (SCP) has been among my favoured A-REITs for the past few years. After rallying last year, SCP peaked at $3.16 in April 2022. SCP now trades at $2.68, having fallen in line with broader sector weakness.

SCP owns neighbourhood and sub-regional shopping centres. These centres typically have an anchor tenant, such as Woolworths, and some smaller shops around it. It’s a convenient place to shop rather than a destination.

This type of property appeals on two fronts. First, it is more defensive. Unlike large retail A-REITs that rely on discretionary spending, SCP’s tenant base focuses more on groceries and other staples. That’s a better place to be when the economy slows.

SCP’s second appeal is property growth. Neighbourhood and sub-regional shopping centres benefit from property developments in new areas. One new centre I visited was quiet at the start. A few years later, it was booming as more homes were built nearby.

SCP is no screaming buy. But it’s a well-managed A-REIT and a solid performer. After falling 15% from its high, SCP looks reasonable value for long-term income investors.

Chart 1: Shopping Centres Australasia Property Group (SCP)

Source: Google Finance

2. Industrial Property

For years, I watched Goodman Group (GMG) head higher, wishing I’d identified it for readers. Goodman is an exceptional business, but its valuation always seemed demanding. It’s a lesson about being prepared to pay for high-quality future growth.

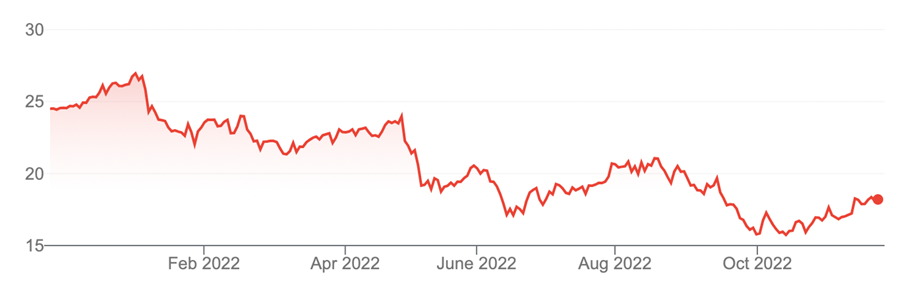

Goodman, an owner of global industrial properties, has fallen from a 52-week high of $26.96 to $18.16. Like other A-REITs, Goodman has been affected by higher interest rates and waning sentiment towards the A-REIT sector.

Recent news that Amazon is laying off thousands of workers has spooked some investors in industrial-property REITs. And as I wrote earlier, deglobalisation – and the onshoring of more manufacturing facilities and warehouses – is another unknown.

For all the potential headwinds, industrial property has good long-term prospects as companies race to build e-commerce centres and modernise their supply chains. The digitisation of business will be a boon for data-centre owners.

The result has been strong rental growth in industrial property as tenants compete for space in high-quality facilities. Unlike commercial and discretionary retail property, industrial property can maintain this rental growth for longer.

Some analysts cite deglobalisation and onshoring – a result of growing geopolitical tensions – as a risk to Goodman. I see this trend adding to demand for industrial property in geopolitically stable Western countries. It’s a long-term trend, but something to watch for with Goodman, an industrial-property giant.

Goodman’s history of remarkable returns will inevitably slow as competition for industrial property rises and more A-REITs enter that sector. Or as industry superannuation funds compete harder for unlisted property assets. But Goodman has an excellent portfolio of industrial properties here and overseas in prime locations.

At $18.16, Goodman trades below the consensus analyst target of $21.88 (based on 13 analyst recommendations). After price falls this year, Goodman’s current valuation provides some margin of safety for prospective investors.

New investors in Goodman must be able to withstand further price weakness and have a longer-term view. It could take time for Goodman to regain its previous high, but it’s been a long time since you could buy the stock near fair value.

Chart 2: Goodman Group (GMG)

Source: Google Finance

3. Childcare

ARENA REIT (ARF) has been my top niche A-REIT idea for many years. I like ARENA’s portfolio of childcare centres – a long-term growth sector as more women enter the workforce, populations grow and childcare demand increases.

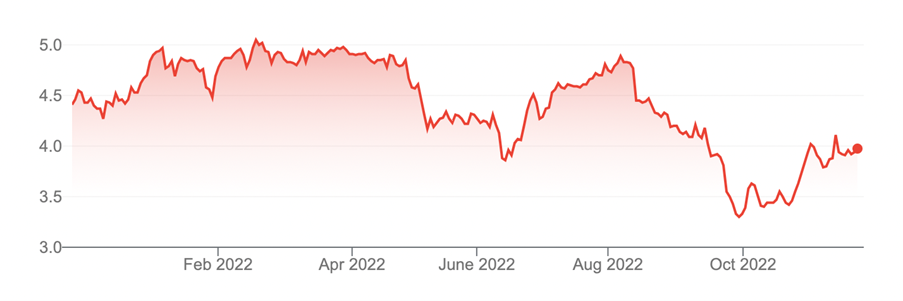

ARENA has fallen from a 52-week high of $5.18 to $3.95. The extent of that fall seems mostly due to A-REIT sentiment rather than fundamentals.

ARENA reported 8.4% growth in net profit to $56 million in FY22. Its net asset value per security rose 32% to $3.37 on a year earlier. Like-for-like rents rose 4.1% and the Weighted Average Lease Expiry was almost 20 years.

Perhaps ARENA faces weaker demand for its property as the economy slows next year and some people cut back on childcare. I can’t see it. ARENA’s two key sectors – early learning and childcare – have strong macroeconomic drivers behind them.

ARENA has an excellent record of property investments. Its net asset value has grown from $1.97 in FY18 to $3.37 in FY22. ARENA’s gearing at 20.2% is conservative.

Granted, ARENA at $3.95 trades at a decent premium to its $3.37 net asset value. With many A-REITs trading at discounts, ARENA looks relatively more expensive.

But ARENA is a high-quality manager with a high-quality portfolio in a defensive sector with good long-term growth prospects. That’s why investors pay a premium for it.

After price falls this year, ARENA looks more attractive. As with other A-REITs, further underperformance can be ruled out as inflation and higher rates linger. But the time to buy A-REITs, such as ARENA, is when the sector is out of favour.

Chart 3: ARENA REIT (ARF)

Source: Google Finance

Tony Featherstone is an expert contributor to the Switzer Report. He is a former managing editor of BRW, Shares and Personal Investor magazines. All prices and analysis at 28 November 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.