Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Six guidelines on how to allocate SMSF cash

I took the unusual step at the start of December 2021 of advising readers that I was switching some of my SMSF portfolio from equities to cash.

“However, while I recommend anyone with a long-term investment horizon should stay substantially invested in equities, I am starting to reduce some equity exposures as I personally believe the market will experience a decent fall sometime in 2022.”

I’m not a fan of timing markets but the frothy valuations of 2021 were due for a correction, and then conditions worsened with the war in Ukraine and higher-then-expected inflation and interest rates. An advantage of running an SMSF is this flexibility to make changes that suit personal risk appetite, or it can be a curse if the ins and outs are badly timed. In most cases, better to leave it for the long term. As legendary investor Peter Lynch famously said:

“Far more money has been lost by investors preparing for corrections, or in trying to anticipate corrections, than has been lost in corrections themselves.”

It is also more difficult to decide when to restore risk towards equities, and while money is saved by selling before a fall, money is lost in not re-entering. If the market continues to rise and money is left in cash, the long-term benefits of equity investing may be lost.

And while all that involves guesswork, there is one thing that is a sure-fire way to generate more income. While the money is in cash, make it work harder and earn the higher rates on offer.

The first check is to ensure the normal SMSF banks account is paying a decent interest rate, especially for those whose cash balances have built up. Many accounts are not following the increase in cash rates as banks use the rise in rates to rebuild their net interest margins.

Guidelines for investing my cash

It’s overdue for me to find some better way to invest what might loosely be called ‘cash’ as in the last few months, significantly better rates are available. I have different needs for this money, leaving me to set the following (sometimes conflicting) criteria and a mix of allocations:

1. Maintain liquidity for opportunistic investments

Regardless of market conditions, there are always opportunities arising, and they may require a quick response. For example, a new hybrid issue, a Share Purchase Plan or an attractive price target for a company may come along, requiring immediately-available cash.

Term deposits are a commitment for a given maturity and banks are now pushed by the regulators not to allow easy repayment, including forgoing interest, and are not a source of quick liquidity they once were.

2. Stagger term maturities

Some term deposit rates and listed bonds are now offering 4+%, which while not generating positive real returns with inflation heading over 7%, at least give some decent income on high quality investments.

But long term commitments reduce flexibility and the threat of inflation and interest rates rising more than expected cannot be ruled out. Staggering maturities leaving some at call in a high-yielding cash account, plus term deposits or bonds at 3% for 6 months, 3.9% for 12 months and maybe a little longer term at around 4.5% retains more flexibility.

3. Lock some away at decent rates

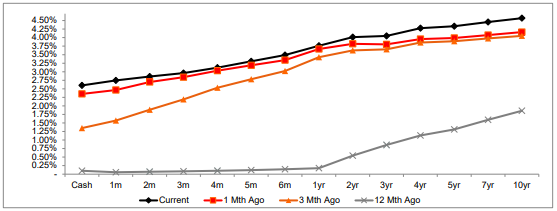

The chart below from NAB shows how much the bank swap curve has increased over the last 12 months and even the last month, and with cash rate futures pricing in 4.25% by September 2023 versus the current cash rate of 2.6%, there is an argument that markets have gone too far. Yes, this is having it both ways (fixed some, float some) but it was only six months ago when the Reserve Bank was not expecting any increases until 2024.

Source: Firstlinks

4. Minimise the pain and time involved in paperwork

We all feel differently about the effort of investing but I have a low pain threshold. For example, the application processes for some new accounts for SMSFs are manual and require certified copies of identification documents for a company trustee, the super fund and directors of the company. It can be a long and drawn-out process of sourcing and signing trust deeds and company certificates.

5. Check listed cash ETFs

The range of Exchange-Traded Funds (ETFs) continues to expand and open opportunities across many asset classes which were previously only available in unlisted funds.

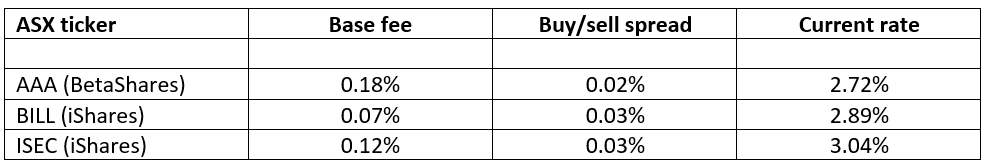

There are three ‘cash’ ETFs and many bond, note and private credit funds which are worth considering, but sticking to the cash comparison gives the following choices.

Sources: Issuer websites as at 25 October 2022

AAA is the market leader and by far the biggest cash ETF with the best liquidity and tightest spreads. It has become a popular place to leave cash and for a relatively quick in and out, it’s the best choice. But it’s also the most expensive, making the others more attractive if money may be left in cash for a while. Note that ISEC carries somewhat more risk than the others as it can hold up to 20% in floating rate notes rather than short-term securities.

6. Don’t compromise on risk in search of returns

A common investment technique to drive better returns during 2020 and 2021 as cash rates were held at 0.1% was go move up the risk curve in search of yields. This may include lower tiers of the bank capital structure, such as subordinated debt or hybrids, or high-yield credit, such as non-investment grade company debt.

These opportunities still apply, and while there is some room in portfolios for higher risk, they are not direct substitutes for the security of cash and bank term deposits. For example, this week, CBA issued a new hybrid offering a margin of 2.85% over the Bank Bill Swap Rate (BBSW, the rate that closely follows the Reserve Bank cash rate). At current rates, this pays about 5.8%, and if BBSW goes to the predicated 4.2%, then CBA will pay a healthy 7% plus. Not bad for a bank credit of such quality, and the transaction was swamped and closed in a little over a day.

However, margins on hybrids can widen in times of market distress, driving prices lower with potential capital losses for anyone who needs to sell. While the current margin on hybrids across the range of transactions is 2.91%, it rose to 7.34% in March 2020 at the height of the pandemic when investors were worried about bank loan quality. It’s the same with lower corporate credits, where spreads can widen and generate capital losses if sold early, or even default in recessionary conditions.

So what did I do?

I am not claiming I have surveyed every bank, security and opportunity, and I’m willing to forego returns for ease of execution. This is a guide to the diversity available but is not exhaustive.

- Switch some cash to a High Interest Cash account with nabtrade paying 2.75% on the full balance. My SMSF already holds an account with nabtrade, so no account opening was necessary.

- Open a new term deposit with one of the banks offering 12-month rates paying around 4%, while more flexibility comes with 6 months at a lower rate.

- Invest in listed cash ETFs, ASX:BILL and ASX:ISEC, where the fees are lower than the market leader, ASX:AAA. The latter may be better if cash is required soon, allowing for brokerage.

- Invest in some hybrids, accepting that these are not like-for-like risk versus cash, but a floating rate exposure in a rising rate environment has a place in my portfolio. It is not necessary to join the competition for new transactions as dozens of existing hybrids are available on the ASX. For example, I bought on market Macquarie’s MQGPF set to yield about 8% to maturity, and ANZ’s ANZPI at about 7.4%, accepting the extra risk versus cash.

- Plus some modest investments in listed companies and index ETFs to start a gradual return to the market after the cash build of most of the year.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

Graham Hand is Editor-At-Large of the financial newsletter Firstlinks. Analysis as at 29 June 2019. This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.