Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Four gas stocks to watch

Australia might be one of the biggest gas exporters in the world, but that doesn’t help it much at home, where it is facing a gas shortfall. In August, the Australian Competition & Consumer Commission (ACCC) released its Gas Inquiry 2017–2025 Interim Report, which forecast that the Australian east coast domestic gas market could be facing a shortage of 56 petajoules of gas in 2023.

That figure represents a gap of about 10% of annual domestic demand. It is no wonder that the ACCC report describes the situation as “signifying a substantial risk to Australia’s energy security.”

One petajoule (PJ) represents 278 gigawatt hours (GWh) of energy. Federal Resources Minister Madeleine King says the 56 PJ figure is the equivalent of 14 cargoes of LNG that would need to be supplied to domestic gas users instead of shipped to export buyers.

For its part, the gas industry (or parts of it) is not convinced that a shortfall will eventuate: a spokeswoman for Origin Energy’s Australia Pacific LNG venture, the biggest of the three Gladstone-based export projects, told the Australian Financial Review in August, “We don’t believe there will be a gas shortfall on the east coast, as there is a forecast 167 petajoules of gas production in excess of demand, and LNG producers, led by Australia Pacific LNG, will continue to offer uncontracted gas to the domestic market, consistent with the Heads of Agreement,” she said.

But there is a committed group of gas explorers who are going with the ACCC view, thinking there will be a big opportunity to bring gas into the east coast market in the near future. Here are four of them, all working in the potentially massive area of the Northern Territory’s Beetaloo Basin (actually a sub-basin of the larger McArthur Basin), 500 kilometres south-east of Darwin, which hosts globally significant gas reserves.

The basin covers 28,000 square kilometres and is estimated to contain at least 500 trillion cubic feet (TCF) of gas; according to the Northern Territory government, the resource estimations in the Beetaloo Basin is equivalent to more than 1,000 times Australia’s current annual domestic consumption in Australia.

That explains why Beetaloo has been touted as the solution for eastern Australia’s gas supply situation.

But the problem – in the eyes of some – is that Beetaloo’s potential appears to be mainly in “unconventional” deposits, in shale, which will require hydraulic fracturing – the notorious “fracking” – to produce fractures in the rock formation that stimulate the flow of natural gas or oil, increasing the volumes that can be recovered. Wells may be drilled vertically hundreds to thousands of metres below the land surface, and can include horizontal (or lateral sections) also extending thousands of metres.

Here are four of what I think are the most exciting Beetaloo drillers.

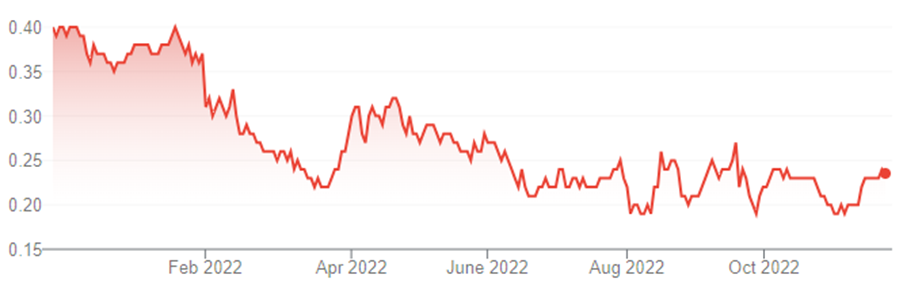

1. Tamboran Resources (TBN, 24 cents)

Market capitalisation: $340 million

12-month total return: –37.7%

Three-year total return: n/a, listed July 21 at 40 cents

Source: nabtrade

When it listed in July last year, shale gas explorer Tamboran Resources was the biggest oil and gas initial public offering (IPO) in almost ten years, at $61 million (plus $23 million of pre-IPO raising.) But the shares had a rough start to listed life, and have never traded above the issue price of 40 cents.

Tamboran is front-and-centre in the Beetaloo Basin (in the Northern Territory,

Tamboran says it could be delivering low-CO2 gas to the east coast by the end of 2025.

The company is an “unconventional” driller, meaning that it uses hydraulic fracturing – the notorious “fracking” – to produce fractures in the rock formation that stimulate the flow of natural gas or oil, increasing the volumes that can be recovered. Wells may be drilled vertically hundreds to thousands of metres below the land surface, and can include horizontal (or lateral sections) also extending thousands of metres.

Tamboran owns a 1.9-million-acre land portfolio in the Beetaloo/McArthur Basin in its own right, and is partnering Santos in a promising unconventional gas drilling venture, also in the NT. Having raised $195 million, in November the company bought Origin Energy’s Beetaloo Basin interests, exploration permits (EPs) 98, 117 and 76. Tamboran now owns seven exploration permits located in the Beetaloo, and says it “now holds the largest consolidated position in the deepest section of the Beetaloo Basin,” and is working to commercialise these world-class assets.

Tamboran now operates four permits covering more than four million prospective acres with about 150 TCF of net prospective gas resources. The company said at its annual general meeting in November: “We now control the pace of development in the Basin.”

Tamboran is drilling two lateral (horizontal) wells before the end of the year, the Amungee-2H and Amungee-3H wells (the ‘H’ denotes a horizontal component), which will effectively tell it whether the proposed EP 98 pilot development is commercially viable. Both wells are fully funded, with the company holding a current cash balance of about $130 million.

The EP161 joint venture (JV) with Santos, in which Tamboran owns 25% and the bigger company is operator, is drilling into the Velkerri B area (part of the Velkerri Formation, the oldest proven petroleum source rock in the Beetaloo Basin): the JV has drilled two wells, Tanumbirini-2H and Tanumbirini-3H – both of which reported impressive gas flows.

In July, Tamboran signed a deal with privately owned gas company Jemena to supply 100 terrajoules (TJ) of gas a day through the Northern Gas Pipeline, currently the only pipeline connecting the Northern Territory to Australia’s East Coast. The agreement will underwrite Tamboran’s proposed Maverick pilot development, planned for the end of 2023, within its wholly owned EP 136. Tamboran plans to drill three horizontal wells as part of Maverick, which, if successful could deliver approximately one TCF of 2C (that is, “contingent” resources, defined quantities of gas estimated to be potentially recoverable, but which are not currently considered to be commercially recoverable) of gas, which would be sufficient to support Maverick. Tamboran is targeting initial production from the development by the end of calendar year 2025.

Corporate Connect Research Pty. Ltd. — which conducts commissioned research – has a 12-month price target on Tamboran of $1.10. In research commissioned and paid for by Tamboran, but conducted at arm’s length, Corporate Connect notes that the Tamboran team “have the experience of having drilled more than 5,000 wells in North America, and will bring unprecedented US unconventional (that is, shale) gas expertise to an Australian project.” Corporate Connect says Tamboran’s assets are “world-class unconventional gas acreage,” in a Basin that is a “world-class gas play whose potential is being underestimated by the market.”

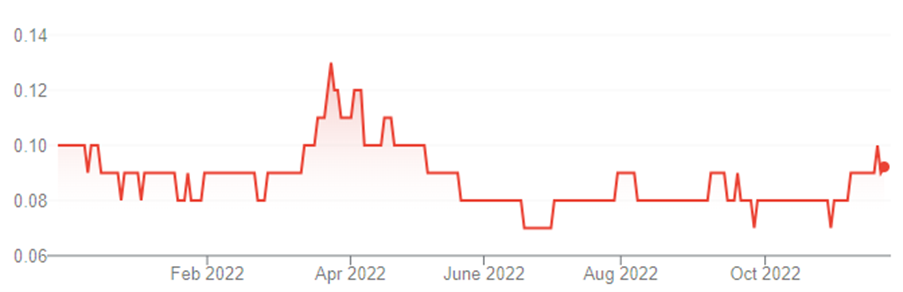

2. Empire Energy (EEG, 23.5 cents)

Market capitalisation: $182 million

12-month total return: –32.9%

Three-year total return: –22% a year

Source: nabtrade

Empire Energy has a rare combination of producing oil and gas assets in the US, as well as 113,000 square kilometres of wholly owned tenements across the McArthur Basin and Beetaloo Sub-basin, a land package that is laden with unconventional gas targets.

Empire’s US assets give it a nice revenue flow. They consist of about 2,400 conventional wells, spread across 67,000 square kilometres in New York State and Pennsylvania, that are all stable, long-life producing assets, with upside potential (the company also owns the underlying shale rights to the New York assets. In 2021 (Empire uses the calendar year as its financial year) the US assets generated revenue of $8.5 million (a 31% increase on 2020) from net production of 4.63 million cubic feet equivalent per day.

Empire has been working in the McArthur Basin since 2010, and has built-up total Beetaloo Sub-basin 2C contingent Resources of 554 billion cubic feet (BCF) of gas. In October 2020, the company’s first well in the NT – Carpentaria-1 – found liquids-rich gas across a thick section of shale in the Beetaloo Basin. The second well, Carpentaria-2H, drilled in December 2021, encountered thick liquids-rich gas shales over across four target formations in the Velkerri Foundation.

Since then, Empire has been busy on the fracture simulation (the notorious “fracking”) and flow testing of Carpentaria-2H, which reached a peak flow rate of 11 million cubic feet of gas per day with an initial production rate of 2.4 million cubic feet of gas over a 30-day cycle. Over a longer 51-day cycle, the well achieved an initial production rate of 2.2 million cubic feet of gas per day. The Carpentaria-2H testing program “fracked” 21 stages — a record in the Beetaloo sub-basin.

Then, earlier this month, the record-breaking Carpentaria-3H well was drilled on-time, and under budget. Carpentaria-3H was drilled to a total depth of 4,460 metres, with a horizontal section length of 2,632 metres – representing by far the longest horizontal section drilled in the Beetaloo Basin so far. Next month, Empire will start fracture stimulation operations and production testing of Carpentaria-3H, which will be fully funded from existing cash reserves. Also in December, the company will start drilling Carpentaria-4, a vertical well.

It is fairly clear that Empire’s EP187 assets, which tap into the Velkerri shale, are likely to yield very large volumes of gas, on a commercial scale. Empire speaks of potential commercial production by 2024. It says that “incredibly tight” Australian gas market conditions are driving significant commercial interest from potential customers for its low CO2 gas.

Financial information site Wallmine.com says the consensus of analysts’ 12-month share price targets for Empire is $1.00.

3. Vintage Energy (VEN, 9.2 cents)

Market capitalisation: $69 million

12-month total return: –6.1%

Three-year total return: –17.2% a year

Analysts’ consensus price target: 11 cents (Stock Doctor/Thomson Reuters)

Source: nabtrade

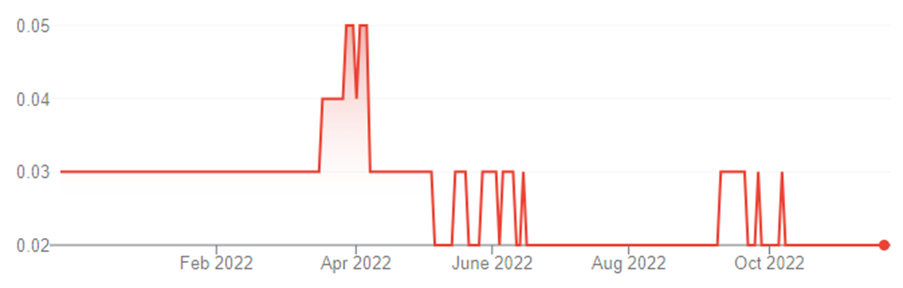

4. Metgasco (MEL, 2 cents)

Market capitalisation: $21 million

12-month total return: –41.2%

Three-year total return: –12.8% a year

Source: nabtrade

Vintage Energy and Metgasco are partners in the ATP 2021 joint venture (JV), along with private company Bridgeport: Vintage holds a 50% stake, and is operator, while Metgasco and Bridgeport own 25% each.

The JV is poised to enter production at its Vali field located in the ATP2021 permit, located in Queensland near the South Australia border, from which first gas is expected to flow to the east coast gas market in January, via the Moomba system. Commissioning was set for December, but will now occur in January after the Christmas and New Year break.

Vali currently has 51 PJ in 2P (proved and probable) gas reserves and 65 PJ in 2C (contingent) resources. First gas from the field is contracted to AGL under a binding contract signed in March this year. AGL will take between 9-16 petajoules (PJ) of gas from Vali, from first production through to the end of 2026. As part of the transaction, AGL pre-paid $15 million to the JV to help fund of the field’s development, through to first gas. At its peak, Vali is expected to yield up to 12 million cubic feet per day (MMcfd), from three wells.

The JV also owns the Odin gas field in the Cooper Basin in South Australia, a field that was discovered by the Odin-1 well in May 2021. The JV partners have also decided – given the east coast gas shortfalls – to fast-track Odin, to get gas to the east coast markets sometime in 2023.

The strategy is to develop a gas production hub through the core Vali and Odin assets, while continuing to explore the surrounding area contained within the ATP2021 permit. Vali is estimated to have a field life of about 30–40 years, which would go a fair way toward underpinning the JV’s business.

The JV has decided to fast-track connection of the Odin gas field to the processing facilities currently being built at Vali, and then on to the Moomba gas-gathering network at Beckler, to get gas to the east coast markets sometime in 2023. The gas in the Odin field is uncontracted, and the JV says is attracting plenty of customer interest.

Financial information site Wallmine.com says analysts’ consensus is for 18% upside for Vintage Energy over the next 12 months; for Metgasco, that potential upside is 138%.

All prices and analysis at 21 November 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.