Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

What should you look out for in bank reporting season? Who will star?

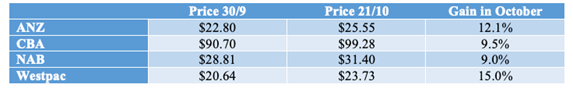

Notwithstanding Friday’s pullback, the banking sector has been a top performer in October as institutions switch out of resource stocks and re-weight towards banks. In a month where the overall market is up by 3.1%, the major commercial banks have recorded the following gains:

(Macquarie Bank is only up 3.2% over this period.)

Driving the interest in the major commercial banks has been a realisation that the impact of higher interest rates will lead to a more rapid increase in net interest margins, plus that the fear of higher bad debts was overdone and certainly won’t happen to any material extent in the short term. BOQ’s profit result on 12 October confirmed this thinking. In recent days, a strong start to the US quarterly profit reporting season by the major US banks has also leant support.

This week, our ”bank reporting season” kicks off with the ANZ on Thursday and Macquarie (MQG) on Friday. Over the next few weeks, each of the major banks will update the market on how they are faring as per the following timetable:

ANZ Thursday 27 October Full year

Macquarie Friday 28 October Half-year

Westpac Monday 7 November Full year

NAB Wednesday 9 November Full year

CBA Tuesday 15 November 1st Quarter

What should you look out for in these reports? Who could star, and who do the brokers fancy? Here is my take.

Things to watch in reporting season

a) Cash profit

ANZ reported a cash profit for the first half of $3.1bn. It didn’t provide a number with its third quarter trading update, but did say that revenue was up 5% and costs were essentially flat. Bad debts should still be low, so the market is expecting a second half outcome of $3.3bn to $3.4bn. Full year cash profit of $6.4bn to $6.5bn.

NAB’s first half cash profit was a touch under $3.5bn. In its trading update for the third quarter, it said that it had achieved a profit of $1.8bn for the quarter. Consensus numbers are still being worked through, but a half year outcome of around $3.7bn is on the cards. This would give a full year result of $7.2bn.

Westpac’s first half cash profit was $3.1bn. Similar to ANZ, it didn’t provide a third quarter trading update, however its capital statement implied net asset growth of $5bn. Westpac should be the beneficiary of an improved net interest margin, so a cash profit of around $3.2bn is possible (full year $6.3bn).

b) Net interest margin (NIM)

The market will look very closely at the trajectory of the net interest margin (essentially the difference between the average lending interest rate and the average deposit rate). Second half NIM (which is an average over the period) might still be down on the first half, but the fourth quarter should be higher than the third quarter. Some banks will describe their “exit NIM”, which is typically a measure at the end of the period for the final week or month.

Comments about “NIM considerations” will be closely scrutinized for information about the margin trajectory. This might relate to competition for deposits, the level of liquids being carried, basis risk and hedging costs etc.

c) Volume growth

With banks unable/unwilling to increase fees, or develop “non-banking” adjacencies, revenue growth can only come from an improvement in the net interest margin and/or volume growth. Outsized volume growth is viewed as a positive by the market.

In mortgages, NAB grew its book in the first half by $13bn or 1.2 times system growth (i.e. it gained market share). Westpac added just $2bn, while ANZ was flat (effectively losing market share).

Growth in the second half will be lower due to the impact of higher interest rates on the housing market. However, the market will be looking for growth, and an improvement from both ANZ and Westpac is expected.

Business lending is also an area of intense competition. So far, credit to businesses is holding up pretty well, so most banks should report increases in their loan books. The market will reward banks that are growing above the system growth rate.

d) Cost control

Flat operating costs (compared to the first half) will be rewarded. Due to inflation and pressure on wages, cost growth in the order of 1.0% to 2.0% will be tolerable, but much more than that will be frowned upon.

If revenue is growing strongly, higher cost growth will be tolerated, provided that the bank is achieving positive jaws (that is, the rate of growth on income is higher than the rate of growth on costs).

e) Bad debts

Bad debts (impairments) are expected to be low, well below the long term average. In some cases, they might still be a negative (adding to profit due to the reversal of provisions made during Covid-19). In these situations, cash profits should be “normalized” to give a clearer representation of how the bank is performing. Alternatively, compare operating performance (revenue less operating expenses, excluding loan impairments).

f) Dividends

A material increase in dividends would be a strong signal to the market.

The market is expecting:

ANZ: a final dividend of 72c (unchanged from the first half and the same as FY21). This will be paid on a higher share base following the 1:15 rights issue in July;

NAB: a final dividend of 78c per share, up from the first half dividend of 73c and the FY21 final of 67c;

Westpac: a final dividend of 61c, unchanged on the first half dividend of 61c but up 1c on the final dividend of FY21. I think the final dividend might be a little higher at 62 or 63c.

g) Capital returns

Capital returns (through buybacks) are probably unlikely this time around. However, if a bank had strong capital generation and announces a buyback, this will be rewarded by the market.

h) CEO confidence on earnings trajectory

The outlook statement, particularly as it relates to expectations around the macroeconomic environment and the impact on banking, is a key part of the results presentation. Share prices are ultimately about future earnings, not about what has happened in the past, so the CEO’s confidence about the earnings trajectory is a really important piece of data.

What do the brokers say?

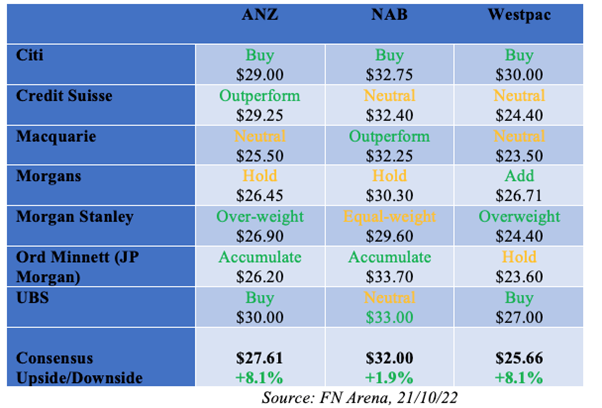

The table below shows by bank the recommendations and target prices from the seven major brokers.

Collectively, they see the most upside with Westpac, with a target price of $25.66 compared to Friday’s close of $23.73. ANZ’s upside of 8.1% is about the same, while the upside for NAB is just 1.9%.

In terms of “top pick”, Macquarie and Ord Minnett like NAB best, while Credit Suisse and Morgan Stanley favour ANZ

The views on Westpac are more diverse. While it is Morgans preferred pick, is the least preferred by both Macquarie and Ord Minnett.

Most of the brokers continue to feel that CBA is expensive. There are no “buy” recommendations (5 “neutral” and 2 “sell), with a consensus target price of $93.91, 5.4% below Friday’s closing ASX price of $99.28.

Here’s my pick

I have been on NAB for most of the last two years and been amply rewarded. In July, ANZ was sold off heavily for its rights issue and I switched allegiances to it. Since the end of July, ANZ has rallied by 11.6% compared to NAB’s gain of just 2.6%. So I am moving back to NAB. It is the best run bank of the three, and has the most momentum in terms of volume growth.

Who could surprise? The most obvious candidate is Westpac. With its strong retail deposit base, it could do well from the increase in interest rates. Further, if it has made measurable progress on its (very ambitious) cost program, and delivers volume growth, it is capable of delivering an earnings surprise. But it is an “if”.

All prices and analysis at 24 October 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.