Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three ways for contrarians to buy gold

As a journalist, I have followed share markets for the past 32 years. I can’t remember a market as unusual as this one. Equities are rife with risk and opportunity.

On the radio last week, an economist discussed if Australia would follow the US into a likely recession. A severe economic downturn in the US seems inevitable as its central bank jacks up interest rates to tame inflation. Yet the US dollar is rallying.

Most economists think Australia will escape recession due to our relatively higher exposure to commodity prices. That narrative could change if China’s economic slowdown intensifies and the US sinks into recession, damaging commodities demand.

Compared to previous cycles, it seems strange to talk about recession when Australia’s unemployment rate is 3.5% and companies scream for workers. Or when retail sales continue to grow strongly, despite cost-of-living pressures, as this week’s figures showed.

What this shows is how quickly things can change. Heavy sharemarket falls this month reflect a changing market narrative in three main areas. First, the market has realised that inflation will be higher and more persistent than previously thought.

Second, market expectations of earnings growth are too high. Consensus earnings estimates do not sufficiently reflect the rising cost pressures companies face. Expect to see more earnings downgrades in the next few months.

The third area is capitulation. This is more gut-feel than anything else, but I don’t think markets have fully priced in the pain ahead for consumers in the next 6-12 months. We are yet to feel the full brunt of rate rises. Sadly, we will see more households go bust as interest rates rise and living costs soar. Others will slash discretionary spending.

The combination of these factors suggests the risks for shares are firmly to the downside, even after recent falls. We will pay a heavy price for central banks underestimating inflation.

Yes, there’s always a danger of being too bearish at the bottom. Smart investors buy when there’s “blood in the streets”. I see value emerging in beaten-up sectors and stocks, and nobody picks the absolute bottom. But I would not dive back into equities just yet.

Gold

Poor performance this year has surprised partly due to the strength of the US dollar.

The precious metal’s poor performance this year has surprised. Gold has historically been an inflation hedge and store of value. Goodness knows, we have enough inflation now. But the US-dollar gold price has slumped about 21% since March.

The big headwind for gold is the rising US dollar. The US dollar index, a measure of the US dollar relative to a basket of foreign currencies, is up about 20% over 12 months.

That’s partly due to the strength of the US dollar as the US Federal Reserve lifts rates more aggressively than other central banks. It’s also due to problems in other currencies, notably the ailing British Pound, Japanese Yen and the Euro (with Europe facing recession).

The US dollar and gold have a clear correlation, as the chart below shows. When the US dollar rises, the gold price falls. Conversely, when the US dollar falls, gold rises.

US Dollar Index (Blue line) versus gold price (orange line)

Rising interest rates worldwide are another headwind for gold. Because gold pays no income, it becomes less attractive compared to other assets when rates rise. Investors seeking a safe haven can get over 4% in a two-year term deposit. With gold going backwards this year, that 4% (even accounting for inflation) appeals.

For gold, the tailwind of rising inflation has been more than offset by the headwinds of rising rates and a higher US dollar. To invest in gold now, you must believe we are nearing the end of that rate-hiking cycle and that the US dollar is about to “pivot” lower.

I don’t see either happening this year. Inflation is proving more stubborn than central banks realised, requiring higher rates for longer. Also, the US-dollar rally could continue to surprise on the upside due to woes in the UK and Europe.

That said, gold bullion (and particularly some gold equities) look interesting. I don’t know when the headwinds hurting gold (rising rates and the US dollar rally) will abate. But I’d be surprised if both of these trends persist long into 2023.

The US Fed is hiking rates like there’s no tomorrow. That cannot go on indefinitely, as a US economic slowdown would turn into a severe recession. Nor can the US dollar rally indefinitely, for it makes US exports less competitive with foreign-produced goods.

History shows a surging US dollar can spark a financial shock as some countries or companies struggle to repay US-dollar-denominated debt. That’s probably how this bear market ends: the dollar forces a crisis, which in turn forces central banks to cut interest rates and take emergency measures. Buckle up for a bumpy few months.

Some US investment banks I follow predict the US dollar will continue to rally this year before starting to turn in early 2023. If they’re right, we could be within a few months of a turn in the gold price. It’s impossible to know, but history shows that the big gains in gold often happen quickly, meaning it’s better to buy too early than too late.

Gold exposure

Retail investors have three main options for gold exposure (assuming they don’t want to own physical gold bullion). They can use an Exchange Traded Fund (ETF) for exposure to gold bullion via the ASX; an ETF that invests in gold equities; or buy gold equities directly on ASX or other exchanges.

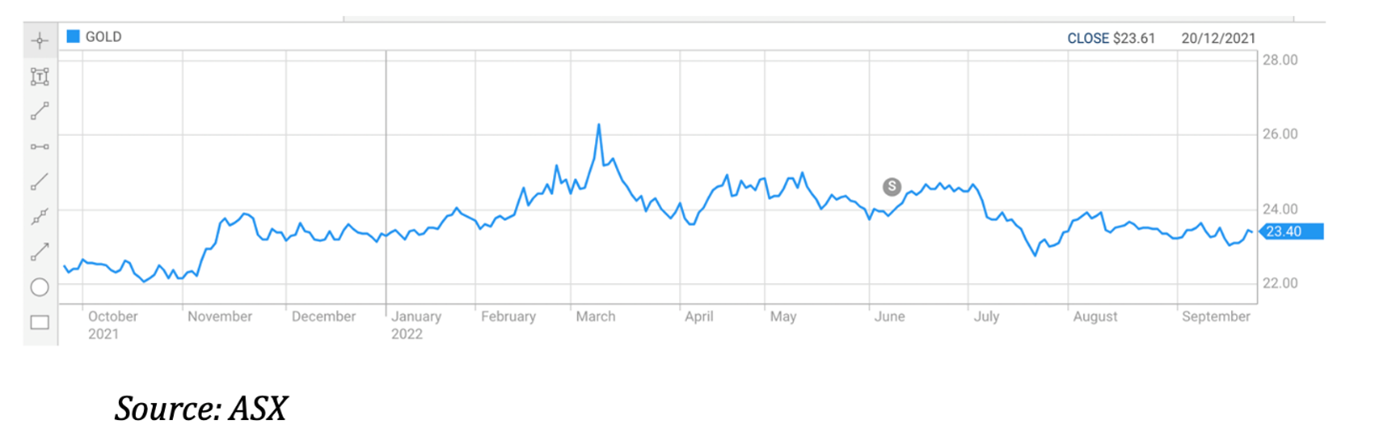

The Global X Physical Gold ETF (ASX: GOLD) is the simplest way to get exposure to the gold price for investors who do not want equity-market or company risk. GOLD lets investors access physical gold via ASX without having to personally store bullion.

GOLD is down almost 5% over three months to 21 September 2022. GOLD is a useful tool to get low-cost exposure to bullion. But it is unhedged for currency movements, meaning investors need a view on the Australian dollar versus the Greenback. GOLD has done better than hedged gold-bullion ETFs due to the Australian dollar.

As mentioned earlier, there’s a good chance that gold continues to struggle this year as interest rates rise and the US dollar rallies. So, I’m not buying GOLD just yet.

Global X Physical Gold ETF

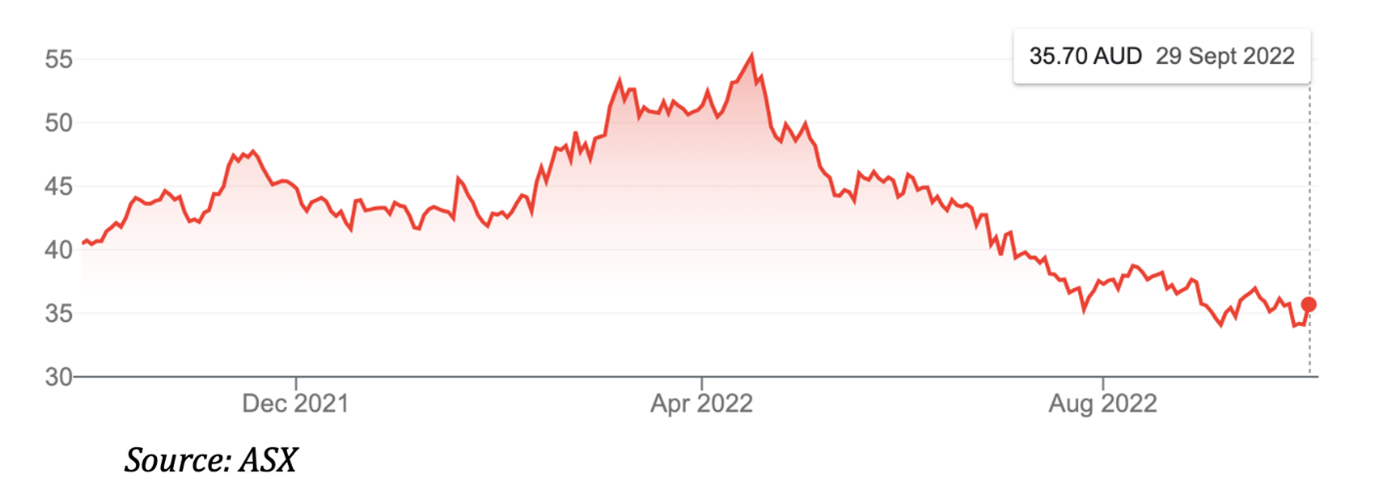

The second option is using an ETF over gold equities. The VanEck Gold Miners ETF (GDX) is an option for investors seeking exposure to a recovery in gold equities. So, too, is the BetaShares Global Gold Miners ETF (MNRS).

GDX provides exposure to 54 global gold/silver companies. Almost half of the ETF is invested in Canadian miners (only 14% is invested in Australia). GDX is down 22% over one year to end-August 2022. Over three years, its annualised return is minus 7.7%.

As readers know, I like using ETFs for leverage to beaten-up sectors. But I don’t think it’s time to “buy the gold sector”, given the ongoing interest-rate and US-dollar headwinds.

VanEck Gold Miners ETF (GDX)

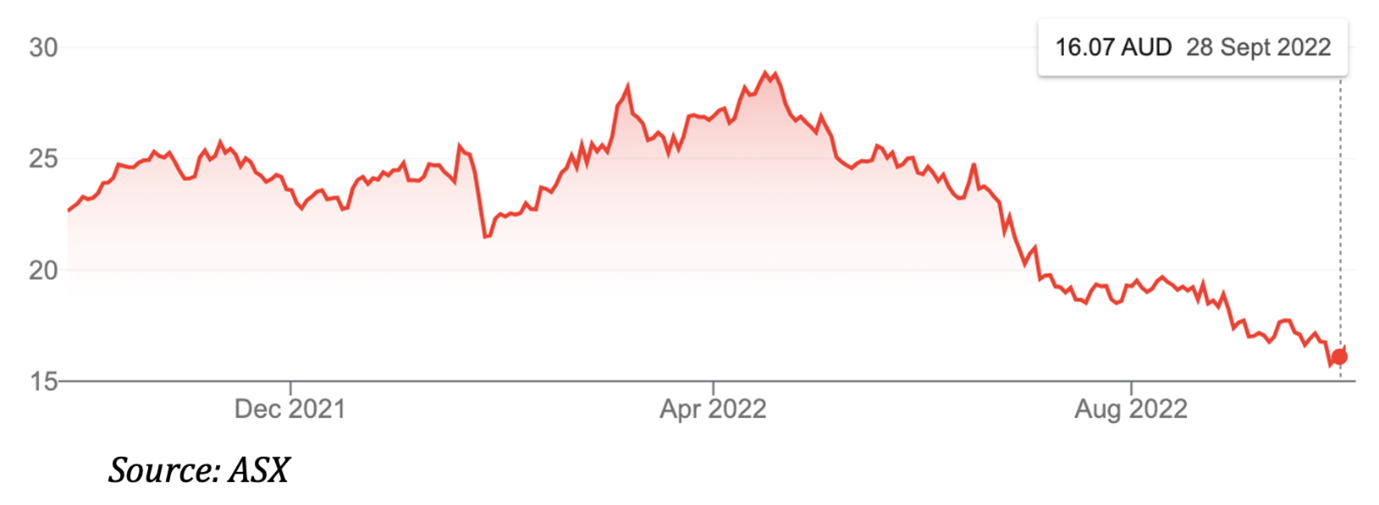

The third option is buying equities directly. In Australia, Newcrest Mining is the largest gold producer. It’s also among the more undervalued stocks in the S&P/ASX 200 index.

As the gold price has fallen (from its peak above US$2,000 an ounce in August 2020), Newcrest has slumped from about $36 in mid-2020 to $15.96.

Over three years, Newcrest’s average annualised return is minus 20%.

But every stock has its price. At $15.96, Newcrest is on a forward Price Earnings (PE) ratio of about 10 times FY23 earnings, yielding almost 6% (after full franking), on Morningstar estimates. Morningstar values Newcrest at $31 a share.

An average price target of $25.11 (based on the consensus of 15 analysts) also suggests Newcrest is undervalued at the current $15.91.

Obviously, much depends on the gold price. Newcrest has long-life, low-cost gold mines, reasonable prospects of a production recovery at some key mines, and a promising development pipeline. The market is too bearish on Newcrest at the current price.

That’s not to say Newcrest won’t fall further if the US dollar continues to rally and interest rates climb as inflation proves harder than expected to combat. But Newcrest now trades on a high single-digit PE or low double-digit PE for FY23, depending on which forecasts one uses. Morningstar has Newcrest’s PE at 12 in FY24.

Over the past five years, Newcrest has traded on an average PE closer to 20x. It hasn’t traded anywhere near a single-digit PE in the decade of data I examined (the lowest average PE was 15.1 in FY21).

If I’m wrong, Newcrest already has much bad news priced into it – and a decent fully franked yield to placate investors as they wait for a turnaround in the gold price.

If I’m right, and gold starts to recover next year as the US dollar pivots, Newcrest has high leverage to a gold rally and through improving production.

Either way, Newcrest looks undervalued at the current price for long-term investors and its balance-sheet strength appeals, given market uncertainty. It’s my preferred Australian exposure to gold. But investors who buy now must be able to withstand further potential short-term losses in gold bullion and gold equities.

Newcrest Mining (NCM)

All prices and analysis at 28 September 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.