Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three stocks for the inflation bull

Head of Morningstar equity research Peter Warnes spoke at the Morningstar individual investor conference last week focusing on the current inflationary environment and its impact on investor portfolios. During his talk he explained the need to inflation-proof portfolios to ride out the volatility of the equity market.

“I’m looking for stocks that have got some inflation protection,” said Warnes.

In this article we look at three of the companies he believes provide investors with inflation protection.

Equities with inflation protection

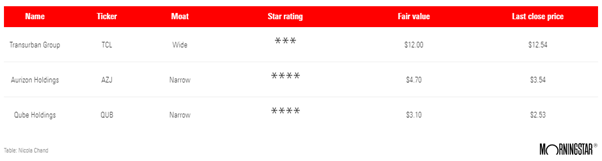

Source: Morningstar

1. Transurban Group (ASX:TCL)

Transurban Group owns toll roads in Melbourne, Sydney and Brisbane as well as the US and Canada. The wide moat company currently has concessions to operate 14 Australian and 3 North American motorways. These concessions give the company the right to collect tolls for predetermined amounts of time.

Transurban’s average concession life of around 30 years and the underlying economics of the assets allows the company to earn excess returns over their cost of capital. Our analysts believe this warrants a wide economic moat rating.

In fiscal 2022 the company generated an EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of $1.9 billion, up 3% from fiscal 2021 and returned $0.36 per share to investors in dividends.

Morningstar equity analyst Adrian Atkins believes Transurban is a beneficiary of a rising inflationary environment as 68% of the company’s toll roads are CPI-linked which provides greater upside than downside from growing inflation.

The three-star stock is currently trading at $12.54, above its Morningstar fair value of $12.00 per share.

2. Aurizon Holdings (ASX:AZJ)

Aurizon Holdings is an Australian freight rail transport company that manages and operates the largest coal rail track network in Australia. Despite the highly cyclical nature of the industry, Atkins believes the company holds significant cost advantages over other forms of bulk commodity transportation.

Aurizon maintains a narrow economic moat rating which is underpinned by its cost advantage and the combination of the limited market size of coal-haulage and high capital costs which acts as a barrier for new entrants.

It’s revenue is shielded from volatility regarding coal price and demand by commercial contracts which typically range from five to 12 years in length.

“These contracts have helped insulate the firm from volatility in coal demand and supply factors to date,” says Atkins.

In addition, Aurizon also holds major positions in the domestic coal-haulage market, claiming up to 70% of market share in Queensland and 30% in New South Wales.

During fiscal 2022 the company’s coal haulage division achieved an EBITDA of $541 million, a 2% increase from the previous year. Atkins attributes the divisions growth in earnings to larger CPI-linked tariff escalations and cost-out initiatives offsetting the unfavourable operating conditions impacting volume.

Aurizon was included in the September and October edition of Morningstar’s ANZ Best Stock Ideas by director of equity research Matthew Hodge. With considerable downside already priced into shares, the four-star stock is currently trading at $3.54, a 25% discount to Morningstar’s fair value estimate of $4.70.

3. Qube Holdings (ASX:QUB)

Qube is an Australian logistics and infrastructure company that specialises in import and export supply chains for containerised and bulk products. Atkins believes the company’s strategy of consolidating a fragmented industry should deliver a growth rate above that of the market while simultaneously scaling benefits.

The company has been awarded a narrow moat rating by Morningstar as it has differentiated its business model by using vertical integration, controlling stevedores, trains, trucks, and intermodal terminals. This business model has given the company a comparative advantage in comparison to traditional logistics operators which struggle to establish an economic moat.

Qube’s underlying NPAT (Net Profit After Tax) in fiscal 2022 outperformed Morningstar’s forecast by 2%, jumping 30% over the year to $186 million, while underlying EBITDA rose 21% to $221 million.

Atkins believes the strong performance in the logistics division of the company resulted from strong volumes across grains, containers and vehicles and widespread price increases.

The stock slid into four-star territory in September and is currently trading at $2.53, a 18% discount to Morningstar’s fair value of $3.10.

Nicola Chand is a wealth and finance journalist with Morningstar. Analysis as at 20 October 2022. This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.