Seven dividend-paying resource stocks

Low interest rates over the last decade have brought equity dividends back to front of mind for investors, despite the return from dividends not being as reliable as an interest coupon from a fixed-income security.

If reliability comes at the expense the of actual yield return figure, it’s been a false security for many investors relying on yield.

This has led many investors to look at share dividends for yield, banking on elevated yields staying – for the foreseeable future, at least – at levels that make more reliable yields from interest-bearing investments look miserly; helped, in many cases, by dividend imputation turbo-charging the share dividend returns in the individual investor’s hands, depending on individual tax rates.

Investors using this strategy in the stock market used to rely on the perceived top income-paying stocks, such as the big four banks and Telstra. That can still be a worthwhile strategy – ANZ and Westpac still offer, on analysts’ consensus dividend forecasts, grossed-up yields of more than 8.8% – but there has been a huge structural shift in recent years toward resources stocks as the market-leading source of yield.

Miners and energy producers are now squarely on the radar screens of dividend-seeking investors, supported by strong balance sheets, rivers of cashflow coming off elevated commodity prices, flexible dividend payout policies and (in many cases) full dividend franking.

Some of the coal producers are great examples of this, for example:

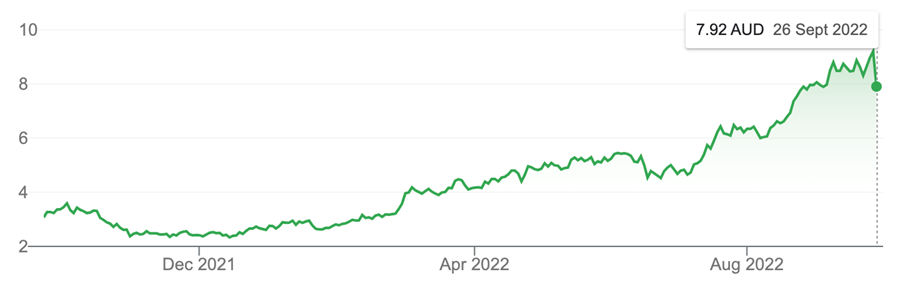

1. Whitehaven Coal (WHC, $7.92)

Estimated FY23 yield: 11.2%, 83.3% franked (grossed-up, 15.2%)

Estimated FY24 yield: 7% fully franked (grossed-up, 9.4%)

Whitehaven Coal (WHC)

Source: nabtrade

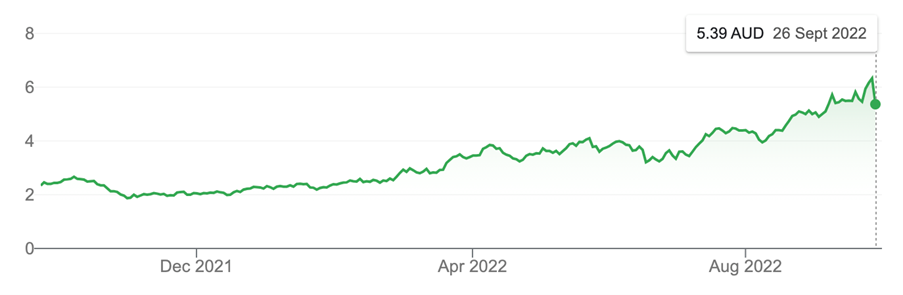

2. New Hope Corporation (NHC, $5.39)

Estimated FY23 yield: 19%, fully franked (grossed-up, 27.1%)

Estimated FY24 yield: 9.4% fully franked (grossed-up, 13.5%)

New Hope Corporation (NHC)

Source: nabtrade

The strength of coal prices – particularly thermal (electricity) coal – is generating massive cashflows for this pair, and that is streaming-off into very attractive dividend yields for FY23 and FY24. But the problem here is that analysts see the share prices as having run too far:

WHC analysts’ consensus target prices: $8.60 (Stock Doctor/Thomson Reuters, 13 analysts), $9.47 (FNArena, six analysts)

NHC analysts’ consensus target price: $5.50 (Stock Doctor/Thomson Reuters, six analysts) $5.57, (FNArena, four analysts)

Iron ore heavyweight Fortescue Metals (FMG, $16.76) is in a similar situation:

Estimated FY23 yield: 10.5% fully franked (grossed-up, 15%)

Estimated FY24 yield: 6.9% fully franked (grossed-up, 9.8%)

Analysts’ consensus target price: $16.41 (Stock Doctor/Thomson Reuters, 19 analysts), $16.55 (FNArena, seven analysts)

There are also concerns that the company’s dividends could come under pressure from its ambitious decarbonisation and hydrogen plans, which will require large dollops of funding – the Fortescue dividend payout ratio could fall from the current 75% (FY22) to about 50% from FY24 onward. These concerns are weighing on the FMG share price.

Using the share market for dividend income runs the twin risk of dividends being cut for various reasons at the company’s discretion; and the share price falling – a high yield is not much good to you if the shares from which it derives fall in price.

The flipside of this is a lucrative yield and a rising share price, which can give you a total return – capital growth plus dividend income – that is much higher than just the dividend yield you have “bought.”

It’s a tight balancing act, because the global economic situation and the subsequent outlook for commodity prices are very hard to predict in the world as it is, but there are plenty of cases where the analysts that follow resources companies believe, given commodity price expectations and the companies’ guidance.

Here are five resources situations that look like excellent income-yield situations on their own, but which should be augmented by share price appreciation.

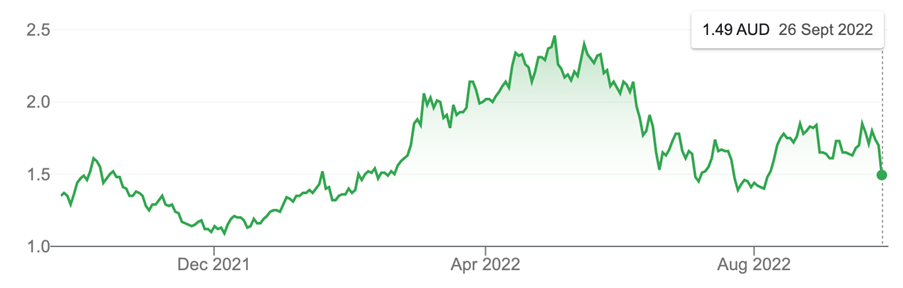

3. Coronado Global Resources (CRN, $1.49)

Estimated FY23 (December) yield: 30.4%, unfranked

Analysts’ consensus target price: $2.23 (Stock Doctor/Thomson Reuters, eight analysts), $2.68 (FNArena, three analysts)

Steelmaking (metallurgical, also called “coking”) coal specialist Coronado Global Resources mines coal in both the US and Australia (in Queensland’s Bowen Basin). Although steelmaking coal has not surged in price to the extent that thermal coal has done – and Coronado did not pay a dividend in 2020 or 2021 – the dividend flow is expected to start pouring out of Coronado this year: analysts expect about 31.5 US cents (Coronado reports in US dollars) in FY22 and 32.7 US cents in FY23. On the current share price and exchange rate, that equates to a yield (albeit unfranked) somewhere in the vicinity of 28%–30% in both 2022 and 2023. And analysts think there is plenty of scope for the share price to rise, as well.

Coronado Global Resources Inc (CRN)

Source: nabtrade

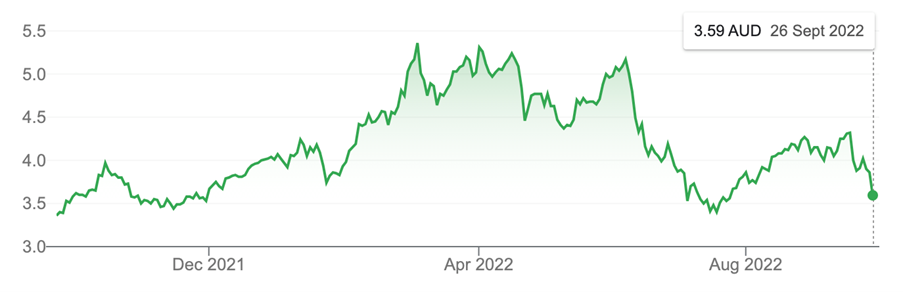

4. South32 (S32, $3.59)

Estimated FY23 (June) yield: 6.7%, fully franked (grossed-up, 9.6%)

Estimated FY24 (June) yield: 6.6% fully franked (grossed-up, 9.5%)

Analysts’ consensus target price: $5.02 (Stock Doctor/Thomson Reuters, six analysts) $5.01, (FNArena, seven analysts)

Diversified miner South32 reported record earnings and cash flow in FY22, with a full-year ordinary dividend of 22.7 cents a share – more than four-and-a-half times the 4.9 US cents paid in FY21 – and a special dividend of three US cents a share (South32 also reports in US$), up from two US cents last year. Just considering the ordinary dividends, if that haul were repeated in FY23, the yield (at current exchange rate) would be 11.1%, fully franked, or 15.8%. But analysts’ consensus expects a dividend cut, to 19.5 US cents – for a yield of 12.9%.

Coal – mostly steelmaking coal – contributes 31% of South32’s earning, with aluminium next, at 20%, and the company also produces nickel, manganese, zinc and lead. All of these operations lifted their profit contribution in FY22, and while overall company profit is expected to decline over FY23 and FY24, South32 will still be generating a very solid yield – with the stock seen as under-valued, too.

South32 Limited (S32)

Source: nabtrade

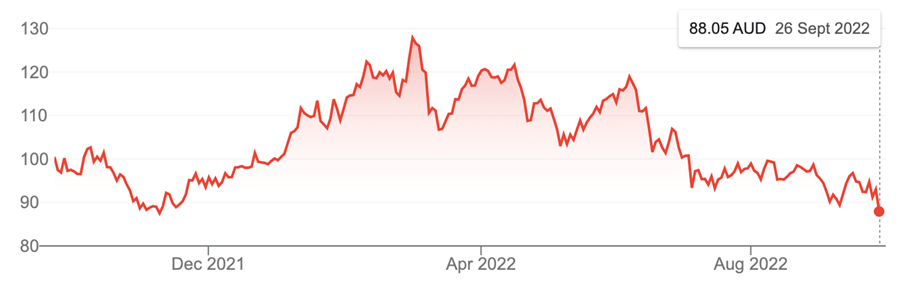

5. Rio Tinto (RIO, $88.05)

Estimated FY22 (December) yield: 9.2%, fully franked (grossed-up, 13.1%)

Estimated FY23 (December) yield: 9% fully franked (grossed-up, 12.9%)

Analysts’ consensus target price: $107.58 (Stock Doctor/Thomson Reuters, 18 analysts) $105.36, (FNArena, seven analysts)

Diversified mining giant Rio Tinto saw revenue slide by 10% in the first half (to US$29.8 billion) million, underlying earnings decline by 26% (to US$15.6 billion) and free cash flow slide by 30% (to US$7.15 billion), each of which figures were a bit lower than analysts were expecting, on the back mainly of weaker iron ore prices. Rio Tinto’s dividend disappointed the market, both in terms of its amount – US$2.76 a share, down more than half from the record 2021 interim – and the fact that Rio did not declare a special dividend to accompany its interim payment, as it has done for the past few years.

Rio Tinto CEO Jakob Stausholm defended the lower dividend, saying that the previous interim dividend was unusually high, and that the latest dividend reflects the company’s payout policy: on average, Rio Tinto returns between 40%–60% of underlying earnings through the cycle.

Rio Tinto also reports in greenbacks. Stock Doctor’s collation of analysts’ estimates expects A$8.35 a share in dividends in 2022, coming down to A$8.25 in 2023.

FN Arena’s collation of analysts’ estimates expects US$5.56 in 2022 and US$5.65 in 2023

At present exchange rates, that equates to 9.1% in 2022 and 9.2% in 2023 – with appreciation in the share price likely to augment that yield.

Rio Tinto Limited (RIO)

Source: nabtrade

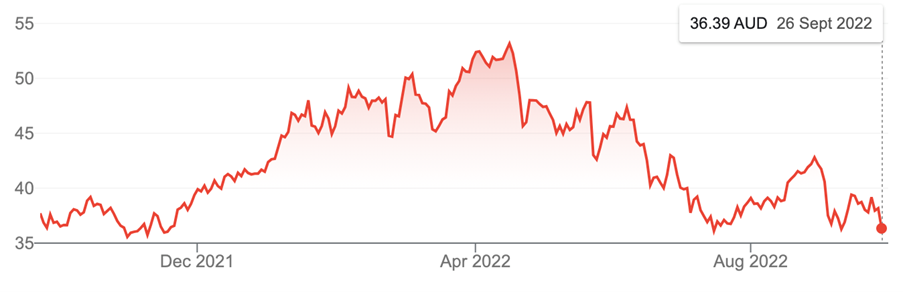

6. BHP (BHP, $36.39)

Estimated FY (June) 23 yield: 11.5%, 83.3% franked (grossed-up, 15.6%)

Estimated FY24 (June) yield: 7.1% fully franked (grossed-up, 9.7%)

Analysts’ consensus target price: $42.22 (Stock Doctor/Thomson Reuters, 20 analysts)

$41.35, (FN Arena, six analysts)

Mining giant BHP is also benefiting from higher commodity prices, with net profit for FY22 financial year coming in at US$30.9 billion, up 173%, and a full-year dividend of US$3.25 a share, up from US$3.01 in FY21. Despite iron ore prices being seen as weakening, FN Arena’s collation of analysts’ estimates expects dividends of US$2.41 in FY23 and US$1.99 in FY24: at present exchange rates, that equates to 9.6% in 2022 and 7.9% in 2023. Stock Doctor’s collation of analysts’ estimates expects A$3.35 a share in dividends in FY23, coming down to A$2.82 in FY24. Analysts expect a solid rise in the share price, too.

BHP Group Limited (BHP)

Source: nabtrade

7. Woodside Energy (WDS, $30.26)

Estimated FY22 (December) yield: 11.1%, fully franked (grossed-up, 15.8%)

Estimated FY23 (December) yield: 9.2% fully franked (grossed-up, 13.2%)

Analysts’ consensus target price: $35.65 (Stock Doctor/Thomson Reuters, 16 analysts), $35.78 (FNArena, seven analysts)

Adjusted for one-off gains, Woodside Energy’s interim (to June 2022) earnings numbers missed expectations, but the very healthy balance sheet and leverage to rising LNG prices give analysts plenty of confidence in the near-term outlook, particularly since the merger of BHP’s petroleum operations with those of Woodside. The company’s 2023 dividend will not be as bountiful as that of 2022, but the prospective yield is still very attractive, as is the potential capital-gain scenario.

Stock Doctor’s collation of analysts’ estimates expects A$3.52 a share in dividends in 2022, coming down to A$2.93 in 2023. FN Arena’s collation of analysts’ estimates expects US$2.56 in 2022 and US$2.08 in 2023. At present exchange rates, that equates to 12.2% in 2022 and 10% in 2023.

Woodside Energy Group Limited (WDS)

Source: nabtrade

All prices and analysis at 26 September 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.