Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

A tale of two retailers

During economic gloom, investors can make two big mistakes. The first is succumbing to unrelenting macroeconomic “noise” and making rash decisions.

The second is relying on accepted market narratives about sectors based on simplistic top-down views rather than bottom-up analysis of company prospects and valuations.

Consider retail. It’s hard to read a newspaper or listen to a radio report without another gloomy story about the economy. From inflation to rising interest rates and falling house prices… the media is awash with bad news.

The temptation is to apply this narrative in a blanket fashion to the retail sector. As the economy slows this year, non-discretionary retail is supposedly the last place to be.

Yet the latest reporting season showed strength in consumer spending, judging by retail results. JB Hi-Fi (JBH), an electronic goods retailer, reported a 7.7% increase in net profit to almost $545 million for FY22. JB Hi-Fi said it was pleased with its start to FY23.

Super Retail Group (SUL) was a standout. It reported a 20% fall in net profit to $244 million in FY22, from $306 million a year earlier. That was much better than the consensus forecast, thanks to stronger-than-expected sales growth.

Despite these results, JBH is down from a 52-week high of $56.85 to $39.18. SUL has fallen from $13.56 to $9.60 in a weak sharemarket. Both stocks look interesting.

The market, of course, is pricing in tougher conditions in the next 12 months as interest rates rise (this week’s 50-basis-point increase gets us closer to the rate peak).

Also, consumer confidence is lousy. The Westpac-Melbourne Institute of Consumer Sentiment dropped 3% in August from the previous period. It’s down nine months in a row and the lowest since August 2020. Consumers are spooked by unrelenting bad news.

Granted, there is much to worry about. We haven’t yet seen the full brunt of rate rises and cost-of-living increases. They are coming. It’s a no-brainer that more homeowners will spend less on luxuries this year as they struggle to pay their home loan. Sadly, some will struggle to afford necessities given mortgage stress and higher petrol prices.

That’s bad for retailers. Some small-cap fund managers I know won’t go near retail stocks or other companies exposed to the housing cycle. There’s too much risk and too many unknowns about how consumers will respond to soaring interest rates.

But this is an unusual economic cycle. As an economics student, never did I think we’d talk about the risk of recession when unemployment is 3.4% and falling.

The pandemic has changed everything. Excessive government handouts and deferred spending during COVID-19 boosted savings. The Reserve Bank’s chart pack on household income and wealth is telling. It shows a falling (though still high) household savings ratio and soaring household wealth over the past few years.

Remarkably, we could have a downturn where most people still have a job and many have savings to draw on due to deferring holidays and other consumption during the pandemic. In my view, the gloom about retail looks overstated, at least for some companies with a clever management team that can navigate the conditions.

Again, I don’t dispute that conditions for retailers will worsen in the next 12 months. The question is whether falls in retail-sector valuations this year have adequately priced in the deteriorating earnings outlook – or gone too far.

By this time next year, we might be talking about coming interest-rate cuts, rising wages growth, stabilising property and sharemarkets. There’s plenty of gloom now but investing in the retail sector means looking past the next 12 months of pain.

I like what the sector is doing at the micro-level. Some retailers I know continue to turn their shopfronts into mini-distribution centres as they fulfil online orders. I see other retailers using online marketing in clever ways to provide personalised offers.

Australia has some terrific retailers that have a knack for exploiting economic conditions, good or bad. Writing off entire sectors based on macroeconomic news is never a good idea, and that could be true of retail stocks this year.

That said, my preference is for retailers exposed to consumer segments less affected by the property downturn. As much as I rate Nick Scali, furniture and other homewares will be a more challenging market this year as people cut back.

Youth-focused retailers are another story. Their customer segment is far less affected by falling property prices – and a beneficiary of a booming jobs market, particularly for casual work in the retail and hospitality segments. Here are two retailers to watch:

1. Lovisa Holdings (LOV)

Long-term readers of this column know Lovisa (LOV) has been one of my favourite small-cap stocks for years. Lovisa’s jewellery offering is a hit among young women who love its cheap earrings, necklaces, and other disposable items.

I like Lovisa’s international growth prospects. The company had 629 stores in FY22, from 544 a year earlier. Lovisa added 55 stores in the US alone in FY22. It’s built a global footprint in Australia, Asia, Europe, the Middle East, and the Americas.

Lovisa’s booming store network underpinned sales growth of 59.3% in FY22. On a like-for-like basis, sales were almost 20% higher on the year – a terrific result.

Lovisa also fits my theory that more consumers “trade down” when conditions tighten and treat themselves with cheaper items. If the economy is slowing, nobody has told young consumers who are spending more on cheap jewellery.

Lovisa shares soared on its FY22 result. At $22.96 a share, Lovisa is one of few retailers trading near a 52-week high ($23.95). A consensus share-price target of $22.84 suggests Lovisa is fully valued at the current price.

Lovisa is due for a pullback or pause after recent price gains, but its rapid store rollout provides a strong growth engine. Lovisa is another example of why it pays to look at stocks on a company-by-company basis rather than succumb to top-down gloomy economic narratives.

Lovisa Holdings Limited (LOV)

2. Universal Store Holdings (UNI)

The retailer of fashion for teenagers and ‘twentysomethings’ has had a rollercoaster ride since it listed on the ASX in November 2020 through an Initial Public Offering (IPO).

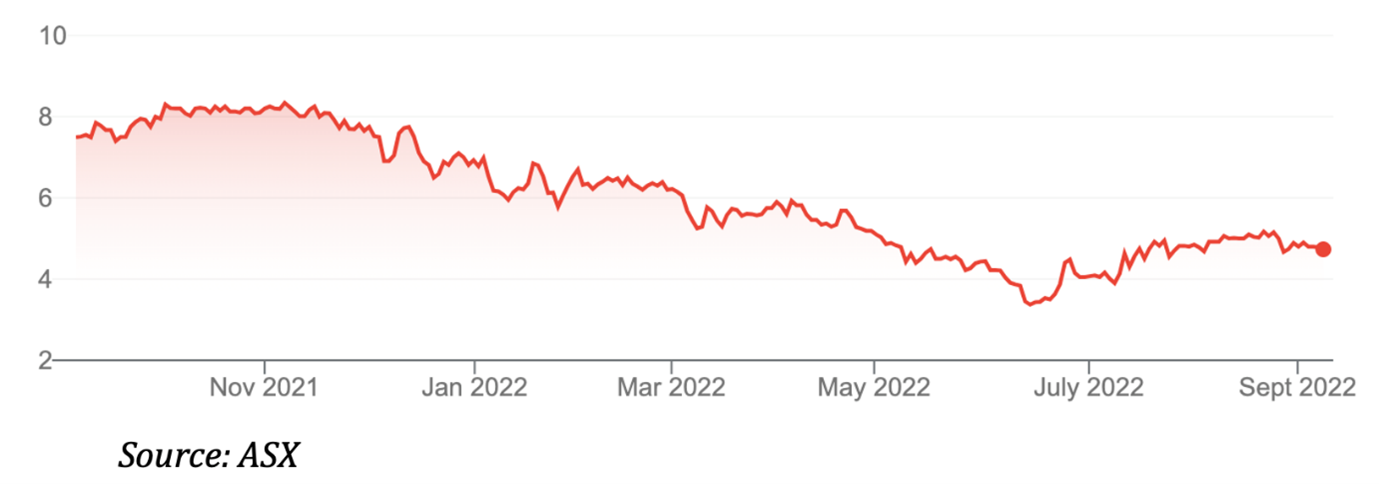

Universal’s (UNI) $3.80 offered shares soared to $8.56 in late November 2021, but now trade at $4.80. Like other retailers, Universal has been crunched by economic gloom.

In its FY22 results, UNI reported a 1.4% year-on-year fall in sales to $208 million. Like-for-like sales fell 3% (from very strong sales growth in FY21).

Underlying earnings (EBIT) fell almost 30% in FY22 but were still well up on the FY20 result. Booming online sales growth and 11 store openings were highlights.

Universal said it was encouraged by early sales trends in FY23 as social events and music festivals re-emerge. These are important sales triggers as young consumers often visit Universal Stores to buy an outfit for the next big event.

Understandably, Universal did not provide earnings guidance given the economic uncertainty. But it said its customer base will likely be less affected by the downturn than the general population. I agree.

I like how Universal is selling more goods online and increasing its share of private-label sales, which supports higher operating margins. The company looks well placed to have a reasonable Christmas trading period, even with all the gloom.

A consensus target of $5.52 suggests there is a modest upside in UNI at the current $4.90. That looks about right, for now.

Longer term, Universal is well placed to capture a higher proportion of sales from young consumers as it expands its store network.

Universal Store Holdings Limited (UNI)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. All prices and analysis at 7 September 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.