Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Woolworths or Coles for the portfolio?

Australia’s supermarket duopoly, Woolworths (WOW) and Coles (COL) reported full-year profit results last week. While they are major companies in their own right, the argument for owning both is not strong (particularly if you want to keep the portfolio to a manageable size) as they compete so directly for the “grocery dollar”.

There are differences of course. Woolworths has a supermarket business in New Zealand (Countdown) and owns the underperforming discounter ‘Big W’. Coles has maintained its liquor division, owning brands such as Liquorland, Vintage Cellars and First Choice, whereas Woolworths divested its drinks business into the separately listed Endeavour Group (EDV). (Woolworths maintained a 14.6% interest in Endeavour.)

But as the Australian supermarket business drives more than 75% of earnings in each, they are directly comparable. Here is my updated assessment.

Woolworths

Net profit of $1,514 million was up 0.7% on FY21 and Group EBIT of $2,690m was up 2.7%. Both were broadly in line with market expectations. The final dividend of 53c, although nominally down on FY21’s 55c, was actually up 1c when adjusted for the demerger of the Endeavour Group.

Momentum was strong in the second half, with Australian Food (the supermarkets business) lifting EBIT by 9.7%. Big W also lifted performance, but its contribution for the half of $30 million represented just 2.3% of the overall group. Challenges in NZ saw a decline in EBIT of 32.2% to $105 million.

In the final quarter, Woolworths grew sales (on a comparable stores basis) for Australian Food by 5.2% and at Big W by 11.9%. Commenting on the start to the FY23 year, CEO Brad Banducci said that sales in Australian Food are down 0.5% for the first 8 weeks. However, this is cycling the start of the Covid outbreak in FY22.

Importantly, Covid-19 costs are coming down, with team absenteeism and supply chain issues improving. Covid-19-related costs in the final quarter for the Group were $18 million compared to a quarterly average of $120 million in the first half.

Strategically, Woolworths continues to invest in its eCommerce and digital businesses.

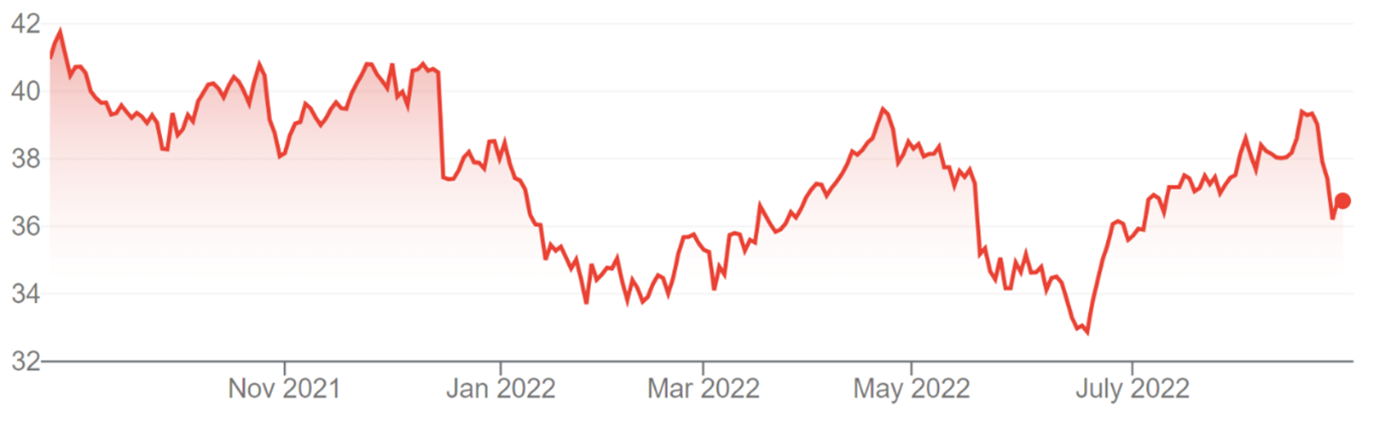

Woolworths Group Limited (WOW)

Source: nabtrade

Coles

Coles’ full-year result was also in line with market expectations. EBIT fell by 0.2% to $1,869 million, but NPAT rose by 4.3% to $1,048 million. Shareholders were rewarded with a final dividend of 30c per share, up 2c on FY21, taking the full-year payout to 63c per share.

The supermarket business grew EBIT by 0.8% to $1,715 million, almost 92% of the Group’s total.

In the final quarter, Coles grew sales (on a comparable stores basis) in supermarkets by 3.7%. For liquor, the sales growth was 1.9%.

Coles CEO Steven Cain didn’t provide any sales data on the start to FY23 but did say that the company would be cycling Covid-19 lockdowns in the first half of FY22. Inflationary pressures are impacting the cost base.

Similar to Woolworths, Covid-19 costs are coming down. In the final quarter, these were approximately $26 million compared to a quarterly average for the whole year of $60 million.

Capex is forecast to rise in FY23 from $1.2bn to $1.4bn as Coles invests in key strategic projects (two new distribution centres and automated single pick fulfilment technology). Additional operating expenditure of about $140 million will be incurred as these projects are ramped up (implementation, transition costs, dual running etc).

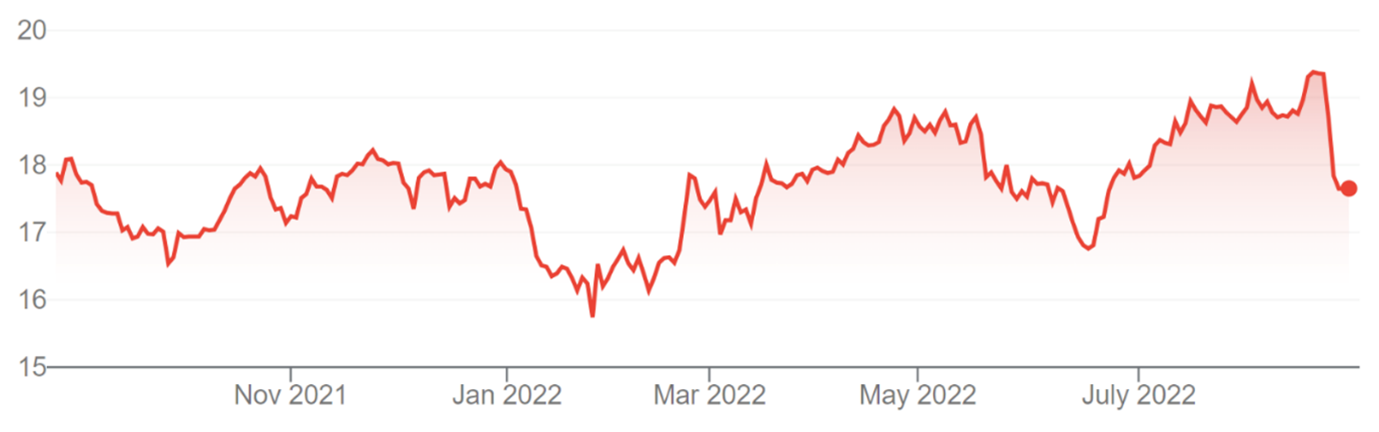

Coles Group Limited (COL)

Source: nabtrade

What do the brokers say?

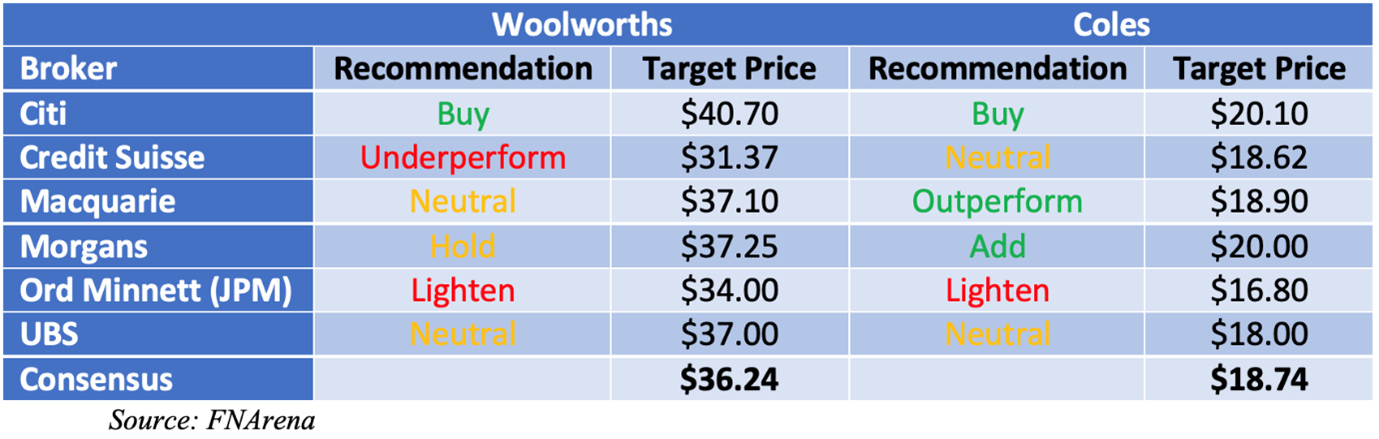

The brokers were relatively ambivalent about the Woolworths result, with a small reduction in the consensus target price to $36.24. This is 1.4% less than Friday’s closing ASX price of $36.76.

Ord Minnett (JP Morgan) downgraded Woolworths to a ‘Lighten’. Credit Suisse couldn’t find any compelling reason to own a stock that is trading at a significant premium to the sector. Others were more positive, noting strong sales growth driven by inflation and margin expansion. The performance of the NZ business and cost inflation are common concerns.

While Coles delivered an ‘in-line’ result, most brokers moderately cut their target price and reduced forecasts for earnings in FY23 and FY24. The consensus target price is $18.74, 6.2% higher than Friday’s closing ASX price of $17.65.

Three of the major brokers have ‘Buy’ recommendations. Apart from the weaker economic environment, the main concerns are for cost inflation and the Capex required to build the distribution centres.

Comparing the individual broker recommendations (see table below), Credit Suisse, Macquarie and Morgans prefer Coles. Cit likes both, while Ord Minnett likes neither.

Broker Recommendations

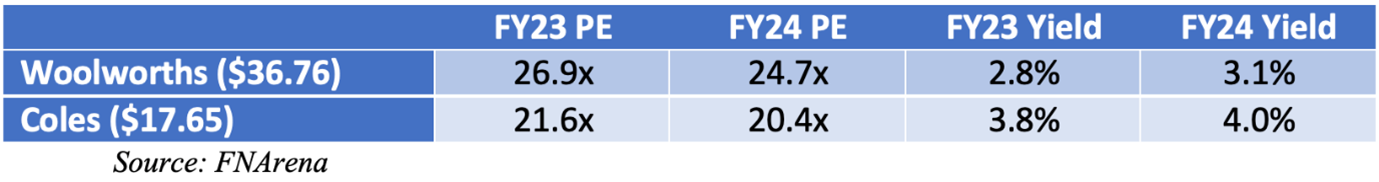

On multiples, the brokers have Woolworths trading on a multiple of 26.9 times forecast FY23 earnings. Coles is trading at a multiple of 21.6 times forecast FY23 earnings and 20.4 times forecast FY24 earnings. Woolworths’ prospective dividend yield is 2.8%, Coles’ is 3.8%.

Broker Forecasts at Current Price

And the winner is?

I am always reluctant to back the “number 2”. Market leaders trade at a premium for a reason and there is no doubt that Woolworths is the leader. The June quarter comparable store sales increase, where it grew at 5.2% compared to Coles’ growth of 3.7%, is yet further demonstration.

The question for investors is whether Woolworths’ premium on earnings multiples (about 24%) is too high.

Most of the brokers think it is, but I am inclined to back Citi’s position that it is about right. I also seek risks with Coles’ Capex expansion as it builds two new distribution centres and commits to new fulfilment technology. By a nose, Woolworths. Although, neither is a super bargain.

All prices and analysis at 29 August 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.