Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three stocks putting the 'S' in ESG

Environmental, social and governance (ESG) investing is now, of course, well beyond being a niche process, and is ever-more entrenched as mainstream – with the ‘E’ part component taking the lion’s share of both the assessment and the investor attention.

There is so much research and scoring that goes into ESG ratings and rankings, and much of it is directed at how the company operates and how it is structured. Personally, I would rather look at what the company does, than whether its board and management are as diverse as demanded by ESG purists. So, the three companies I am nominating here as 'Putting the ‘S’ in ESG' are companies where I believe the product offers a clear and demonstrable social good – while also, arguably, stacking up as an investment.

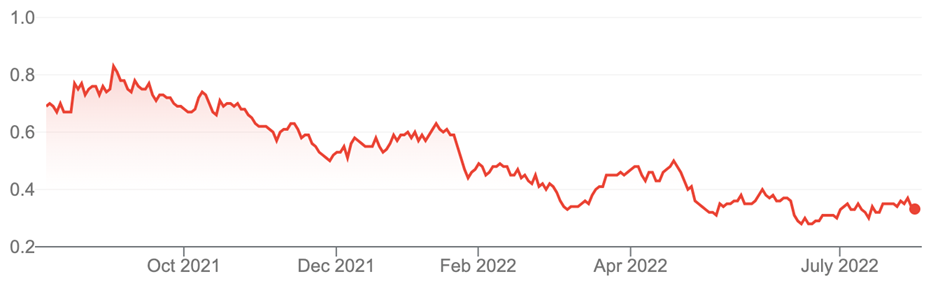

Family Zone Cyber Safety (FZO, 34 cents)

Market capitalisation: $291 million

12-month total return: –40.2%

Three-year total return: 15.5% a year

Estimated FY23 dividend: No dividend expected

Analysts’ consensus price target: 66 cents (Stock Doctor/Thomson Reuters, one analyst)

Tech company Family Zone Cyber Safety (FZO) has a unique business, built around school and family cyber safety, and also parental control of their children’s online access. FZO’s core technology allows time and access controls to be placed on selected devices while leaving others open to access the internet freely. Family Zone’s unique innovation is its patented cyber-safety ecosystem, a platform enabling a world-first collaboration between schools, parents and cyber-safety educators.

The company has built a much larger business through timely acquisitions and is emerging as the only true global online safety provider. In 2017 the company bought New Zealand-based Linewize, which had developed similar filtering technology, but its system processed data in the cloud rather than on a server, taking the pressure off the computing requirements of school systems. FZO incorporated Linewize technology into its own and FZO’s education-specific product offering is now marketed under the Linewize brand – this includes content filters and anti-circumvention tools; classroom screen monitoring; monitoring (human and AI) of students at risk of self-harm, depression, grooming, sexual content, bullying, school violence and other threats, in real-time.

In 2021, FZO struck a second transformational deal, raising $146 million to buy a major competitor, UK online safety business Smoothwall. Not only did Smoothwall bring a comprehensive and complementary portfolio of digital safety products, but it was also a global leader in the rapidly expanding cyber-safety segment of data analytics and monitoring. The deal greatly increased Family Zone’s global presence and scale, and the company is now a global leader on the field of online safety for K-12 (kindergarten to the end of secondary school) children. FZO also bought classroom cyber-safety tool Net Ref for $23 million in June 2021.

Earlier this year, FZO concluded a transformational deal, buying Spanish company Qustodio, a provider of comprehensive parental control solutions on all devices. The $78 million deal saw FZO acquire a business operating in eight languages, with more than four million users in more than 180 countries, in countries such as Spain, France, Singapore, Mexico, Japan, Brazil and Chile. The deal gives FZO access to the non-English-speaking world and new geographies and cements FZO’s place as a meaningful global player in the cyber-safety space for children, schools, and parents.

Most parents would agree that this product offering is a definite social good – although the children might not always agree! While FZO is not yet profitable, analysts expect to see earnings and cash flow break even in FY24.

Family Zone Cyber Safety (FZO)

Source: google.com

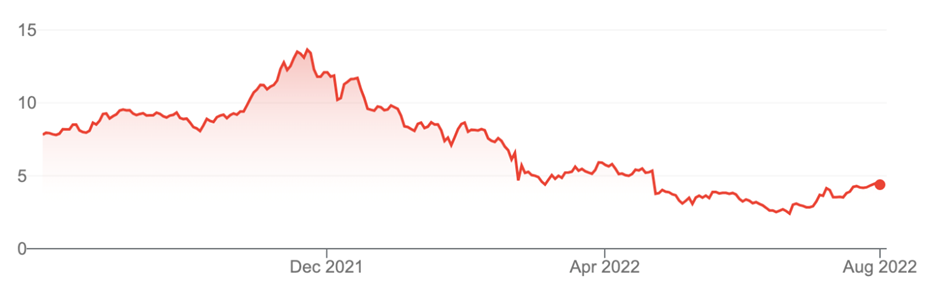

Life360 (360, $4.51)

Market capitalisation: $694 million

12-month total return: –43%

Three-year total return: 4.8% a year

Estimated FY23 dividend: No dividend expected

Analysts’ consensus price target: $10.81 cents (Stock Doctor/Thomson Reuters, three analysts), $5.50 (FN Arena, one analyst)

This San Francisco-based company, which listed on the ASX in May 2019, developed the Life360 mobile app, a market-leading app that provides a safety and coordination service for families, with features that range from location and communication, driving safety (including real-time speed monitoring), car crash alerts and roadside assistance, SOS alerts, identity protection, and disaster, medical and travel assistance.

The app is billed as a platform for families, bringing them closer together by helping them better know, communicate with and protect the people they care about. As of April 2022, the app had more than 40 million monthly active users (MAU), located in 195 countries. The app has had more than 100 million downloads across the Google Play Store and the Apple App Store.

The company says the mission of its app is to “simplify family safety,” both physical and online. One of its major attractions is that it allows parents to track teenage drivers – not just their location, but lets the parents know their child’s driving behaviour, such as speed, phone distraction, hard braking, and acceleration. And if your teenage driver gets into an accident, the app will send you an automatic message and SOS alert for emergency assistance. Life360 does not hide its light under a bushel: in a May presentation, chair John Coghlan said, “Life360 quite literally saves lives, dispatching almost 20,000 ambulances during the year.” Life360 is free, but if users want to enjoy benefits such as stolen phone coverage, silent SOS help alert, live agent support, and 24/7 roadside assistance, they need to pay for a premium package.

Over the last year, Life360 has made some transformative acquisitions. In April 2021, Life 360 bought Jiobit, a Chicago-based provider of wearable location devices for young children, pets, and older people, in a US$37 million ($52.9 million) transaction expanding its smartphone base into the wearable device sphere. Then, in November 2021, it bought the California-based Tile, a pioneer in finding technology, in a US$205 million ($293 million) deal, bringing on-board Tile's Bluetooth-enabled device trackers, which can equip nearly any item — such as wallets, keys or remotes — with location-based finding technology.

Life 360 co-founder and CEO Chris Hulls says the acquisitions of Tile and Jiobit dramatically expand the total addressable market for Life360, but also “hypercharge” the company’s change from a provider of a location-tracking app to offering a suite of membership services. Hulls says the membership model enables members “to find, connect with and protect everything that matters to them most, including people, pets and things.” Life360 says the deals extend the reach of its brand into new demographic sectors, allow it to upsell and “bundle something that people can touch and feel as part of what was previously solely a digital experience”

Life360 is not yet profitable: the company has told the ASX that it expects to “be on a trajectory to consistently positive operating cash flow by late calendar-year 2023, such that we record positive operating cashflow for CY2024.”

In the meantime, although the stock has suffered along with most of its tech peers, analysts are quite bullish on the company. And the bottom line is, I think, that the product demonstrates clear social good – helping users to know that the people, pets and things that they care about are safe.

Life360 (360)

Source: google.com

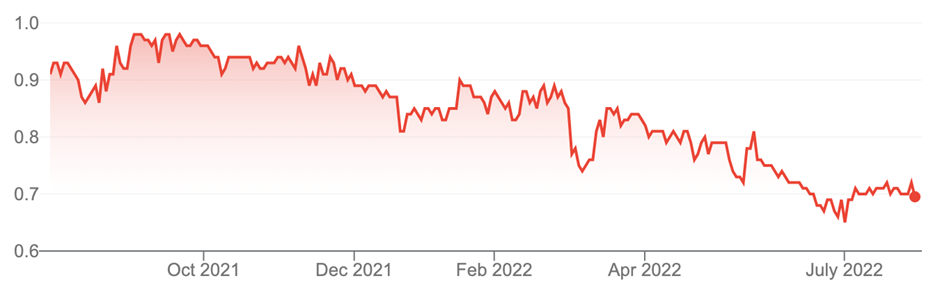

Apiam Animal Health (AHX, 72 cents)

Market capitalisation: $120 million

12-month total return: –21%

Three-year total return: 21.4% a year

Estimated FY23 dividend: 4.2%, fully franked (grossed-up, 5.9%)

Analysts’ consensus price target: $1.04 (Stock Doctor/Thomson Reuters, one analyst)

Victorian-based veterinary products and services provider Apiam Animal Health (AHX) is a stock that taps straight into Australians’ love of pets. Even before the pandemic, Australians spent $12.2 billion a year on their pets – feeding them, adopting them, and buying them toys, accessories and services – and that amount is expected to have surged in the wake of COVID. The Australian Bureau of Statistics (ABS) reckons Australians’ spending on pets and accessories has swelled by 11%.

Animal Medicines Australia’s August 2021 “Pets and the Pandemic” report showed that dog and cat owners were spending thousands on their pets each year, averaging about $3,200 per dog and $2,100 per cat. That means that dog owners across Australia had cumulatively spent $20.5 billion in the previous 12 months, while cat owners had spent $10.2 billion. The survey also found that pet numbers had exploded across Australia, with 69% of national households now having a pet, significantly higher than 61% in 2019.

People love their pets – and that’s where Apiam comes in.

Apiam serves two different markets: the production animal industry, and companion animals, or pets. In the former, Apiam serves the pig, sheep, poultry, feedlot cattle, and dairy cattle sectors, helping farmers to maintain productivity and profitability through on-farm service by trusted vets, who help primary producers to assess and monitor the health of their stock. This business generates about 30% of the company’s revenue. Apiam is expanding beyond Australia, in areas such as the pig and turkey industries in the US, sheep genetics and consultancy services in China, and vaccine export opportunities. At present, it provides veterinary consulting services to more than 10 countries.

The rest of the revenue comes from the companion animals business, a category in which Apiam includes horses (it is the leading equine veterinary provider in the three main eastern states).

In July 2019, Apiam launched its “Best Mates” program, which encompasses a whole-of-life health and wellness program with an annual subscription charge, paid monthly, offering total care for pets. For $550 a year for a first Pet – and $485 a year for additional pets, and annual renewal per pet – the Best Mates program gives members unlimited free vet consultations all year-round, plus discounts on essential services and items such as diagnostic tests, medications and vaccinations, de-sexing, blood testing, preventative screening, parasite treatments, dental work, and pet food.

There is a very sound business sense, in fact, “Pet humanisation,” in which pets are treated more like humans than animals, is fast becoming a global investment megatrend. But the social benefits of pet ownership are unquantifiable, and offering a business product that gives pets the best veterinary care they could have, while giving the owners peace of mind that this will always be the case, is a pretty clear social good, in my book (although I recognise that some ESG-oriented investors might balk at the association with intensive animal farming). And as a bonus, Apiam Animal Health offers an attractive dividend yield and what analysts think is a cheap entry point.

Apiam Animal Health (AHX)

Source: google.com

All prices and analysis at 02 August 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.