Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Is it time to buy REA, SEEK and Carsales.Com?

For more than a decade, I’ve returned many times to a simple, rewarding idea. That is, to buy the market’s big-three platform-advertising stocks during bouts of price weakness.

There’s no rocket science involved. REA Group (REA), SEEK (SEK) and Carsales.Com (CAR) usually have eye-watering valuations because they are fantastic companies. Their growth potential warrants a premium valuation. So, you need to watch and wait for better value during share market corrections – and be ready to pounce.

This year fits that mould. With tech stocks badly out of favour in the first half of 2022, high-priced technology companies were belted. Like other growth stocks on lofty valuation multiples, REA, SEEK and Carsales.Com tumbled.

The market should know better by now, but it continues to underestimate these stocks. So far this profit-reporting season, REA Group and Carsales.Com have delivered two of the better results. SEEK disappointed initial expectations with its result.

For years, investors have underestimated the power of the underlying trend supporting these companies: the migration from print to digital classified advertising. This trend still has a long way to run, particularly in emerging countries.

Another criticism I’ve heard is that there is nothing particularly special about REA, SEK or CAR – at least relative to their valuations. Will SEEK still be the dominant jobs platform when more people get job ads via LinkedIn and other sources? Will REA dominate when Google is a much bigger player in property advertising? What happens to CAR, with used cars more often sold on Facebook?

Lately, cyclical fears have dominated discussions about the big-three platform stocks. The concern is that job, car and property advertising will fall as surging interest rates crunch demand and raise the risk of local recession.

Job advertising is booming now with unemployment near a 50-year low and companies screaming out for workers. But what happens this time next year if Australia is in, or near, recession (as rates peak) and companies are shedding workers?

I could list other reasons not to buy REA, SEEK and Carsales.Com. The valuations of these stocks leave little room for error. These companies need to continue delivering rapid growth to justify their market capitalisation.

My interest in these stocks is twofold. First, each stock is well down from its 52-week high, in line with broader market weakness this year.

Second, each company has significant pricing power due to its dominant market position. If growth slows, REA, SEK, and CAR have levers to maintain profits through price increases or by investing less in capital expenditure for future growth.

I don’t discount that advertising demand will fall as rates continue to rise – and as many homeowners face significant mortgage increases by Christmas (due to the lag between official cash-rate increases and the flow-on effect to monthly repayments). An economic slowdown or recession is never good for advertising, digital or print.

But the fall in valuations from the 52-week mark has factored in future bad economic news. For investors with at least a 3-5-year outlook – and who can withstand short-term volatility and potential price weakness – the platform stocks look interesting.

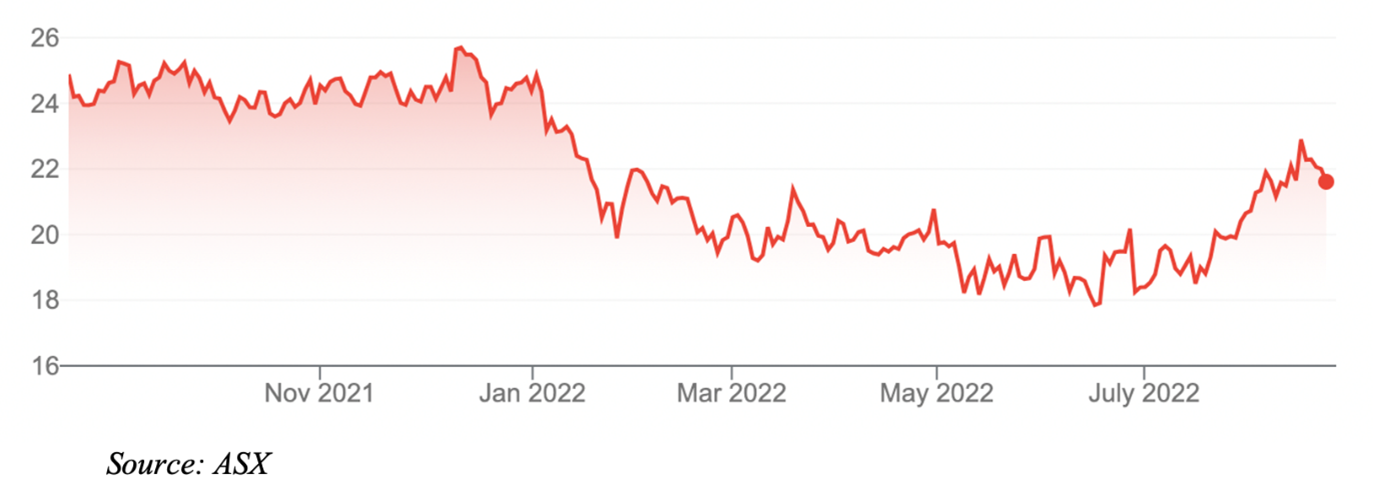

Of the three, I favour SEK and CAR. REA looks more interesting after its price fall (see chart below) this year. But its high valuation and the potential for lower property transactions as interest rates rise are persistent concerns.

REA Group Limited (REA)

Here is a snapshot of SEK and CAR:

1. SEEK (SEK)

SEEK’s FY22 result was harder to comprehend due to group restructuring initiatives. That might explain why the market’s initial reaction to the result was negative. SEEK fell about 5% after the result and edged lower in the following days.

SEEK has fallen from a 52-week high of $36 to $21.48. The stock was badly overvalued at its peak, but the 40% fall from its high seems excessive. It’s hard to think of a better job market for SEEK amid soaring employment-ad volumes and yields.

In its FY22 result, SEEK noted record job ads in Australia and New Zealand. Revenue of $1.17 billion was 47% up on FY21. Underlying earnings (EBITDA) were $509 million, or 53% higher than FY21. The value of the SEEK Growth Fund rose 36%.

Some brokers have share-price targets above $30 for SEEK. That looks too aggressive. But after recent falls from its high, SEEK looks much closer to fair value, which is usually about as good as it gets for prospective investors in the big platform stocks.

There’s long-term upside in SEEK through its investments in employment platforms in developed and emerging Asian nations; its investment in established businesses in China and other markets; and through the SEEK Growth Fund.

But SEEK’s short-term momentum – a job market that shows no signs of slowing, and employers desperate for workers – appeals most. We could have an unusual economic slowdown: sharply higher interest rates and an economy teetering on the edge of recession while the job market is unusually buoyant.

SEEK Limited (SEK)

2. Carsales.Com (CAR)

The car-advertising platform reported a 19% growth in revenue to $509 million for FY22. Underlying earnings (EBITDA) rose 23% to $161 million. It was one of the better results: Carsales.Com shares were almost 6% higher within 24 hours of its result.

The stock has rallied in the past few months, but at $22 is still well down on its 52-week high of $25.92. Like other tech-related stocks, CAR tumbled during the global rout in growth stocks earlier this year, even though it had strong earnings momentum.

Carsales.Com is the gorilla in its market. It advertised 2.1 million cars in FY22, attracted 19 billion page views and delivered 22 million leads to car dealerships. An estimated 80% of all online viewing time to find a car in Australia goes to Carsales.Com.

I like how Carsales.Com is sensibly expanding overseas and diversifying its earnings mix. Its international business will account for almost half of its earnings (after its Trader Interactive acquisition in the US). Moreover, about a third of CAR’s earnings are coming from services beyond auto advertising.

There’s no doubt that rising interest rates will put the brakes on car demand. It’s easy to keep the family car a little longer when times are tough. But Carsales.Com’s car-advertising inventory continues to grow and dealer profit margins on cars are the highest in years. That should enable dealers to advertise cars for longer if needed.

At $22, CAR is on a forward PE of almost 30 times, using Morningstar’s estimates. That’s a little higher than CAR’s long-term PE, but its earnings-per-share growth, international expansion and product diversification warrant a higher valuation multiple. Morningstar values CAR at $22.80 a share. That looks a touch conservative.

Like SEK, CAR is closer to fair value after recent price falls. Also like SEK, CAR has good momentum in its underlying advertising market.

It’s too simplistic to say rising interest rates over the next 12 months will be bad for jobs and car advertising. Valuations for SEK and CAR have priced in a slowdown, possibly excessively so, given their levers to keep growing profits through price increases, international expansion and acquisitions.

More than ever, investors need to focus on company fundamentals rather than macro-economic noise. On that score, SEEK and Carsales.Com are well placed.

Carsales.com Limited (CAR)

All prices and analysis at 29 August 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.