Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Five uranium stocks to light up your portfolio

The uranium price was dealt a massive blow by the Fukushima crisis in Japan in March 2011, and the subsequent shelving of most of Japan’s reactor fleet, plunging the price from US$72 a pound (of uranium oxide, or U3O8) to a low point below US$8.00 in 2016. The market was over-supplied, and many uranium mines were mothballed. With renewable energy the mooted replacement for nuclear and fossil-fuel power, there seemed little incentive to mine or explore for uranium.

But a couple of factors have worked in favour of uranium.

Demand has bubbled along at a lower level, and slowly the inventory stockpile is being worked through. More recently, Russia’s invasion of Ukraine has slammed gas supplies and forced countries that rely heavily on energy imports (coal, oil and gas) to re-think nuclear energy. And on top of that, there is the growing realisation that if the world is to proceed with a “green energy” transformation, nuclear power stands ready as a very low-emission source of baseload power.

Last week, Prime Minister Fumio Kishida announced that Japan will re-open seven closed plants, increasing the number in operation to 17 of 33 (nuclear energy provided just 7% of the nation’s electricity in 2021, compared to 25% before Fukushima). With gas and coal prices going through the roof, the decision was a no-brainer for an energy-hungry economy like Japan.

Moreover, Prime Minister Kishida stated that Japan would look into the feasibility of developing next-generation small-modular reactors (SMRs), which the nuclear industry says are safer, more mobile and flexible energy creators, that can offer cost-competitive clean energy without the perceived problems associated with traditional large-scale nuclear power plants.

For its part, Japan is targeting carbon neutrality by 2050. Under an “ambitious outlook,” the country’s sixth Strategic Energy Plan envisages renewables accounting for 36-38% of its power generation mix in 2030, but with nuclear responsible for 20-22%. It does not take much imagination to think that this kind of mix might become the template for many nations.

According to the International Energy Agency (IEA), global nuclear capacity will need to double by 2050 to meet the IEA’s net-zero-emissions scenario. The IEA sees annual global investment in nuclear power rising from US$30 billion during the 2010s to more than US$100 billion by 2030, and remaining above US$80 billion to 2050.

All over the world, uranium producers and deposit-owners are moving to take advantage of this scenario. At present, uranium trades at US$49.30 a pound, up more than 10% from US$44.67 at the start of 2022, and more than six times higher than the lows of 2016. The price traded as high as US$63.60 a pound in April. Research firm Trading Economics expects the price to push above US$50 by the end of the current quarter, and keep rising, to reach US$55.19 in a year’s time.

As with all commodities, whether any given project goes ahead will depend on what its costs of production are, where the uranium price will go – and even more crucially, where it can be maintained. But there is a great deal of action in the uranium space – and the ASX is the home to a lot of it. Here are the five best scenarios.

Boss Energy (BOE, $2.47)

Market capitalisation: $871 million

12-month total return: 93%

Three-year total return: 74.6% a year

Analysts’ consensus price target: $3.20 (Stock Doctor/Thomson Reuters, four analysts), $2.60 (FNArena, one analyst)

Boss is poised to become Australia’s next uranium producer, at its Honeymoon uranium project in the north of South Australia, near the New South Wales border. Discovered in 1972, the Honeymoon deposit was mined between 2011 and 2013 by a Canadian company called Uranium One, itself owned by the Russian state-owned nuclear company Rosatom. The mine was mothballed in 2013 due to low prices. Boss Energy bought the mine in 2015.

In June 2022, Boss made the final investment decision (FID) on re-starting Honeymoon. Estimated to cost $113 million, the project is planned to be commissioned in the December quarter of 2023, ramping up to a steady-state rate of 2.45 million pounds of U3O8 a year. The project has an initial mine life of 11 years, but there is potential to expand that through nearby deposits.

Boss is expected to be a very low-cost producer, with a cash cost of production of US$18.46 a pound of U3O8, and an all-in-sustaining cost (AISC) – a figure that incorporates not only the “cash cost” of production but all the costs that allow production to be sustained – of US$25.62 a pound. That implies healthy margins at current and forecast uranium prices: Boss says its schedule to production ensures that it will be able to take full advantage of the emerging strong nuclear market. The stock has been on a tear in recent years, but analysts think there’s still appreciation to go.

Boss says it is fully funded with no debt, fully permitted and has extensive infrastructure in place, and is ready to go – which puts it in “an extremely strong negotiating position with utilities and ensures [it] can capitalise on the looming uranium supply deficit”.

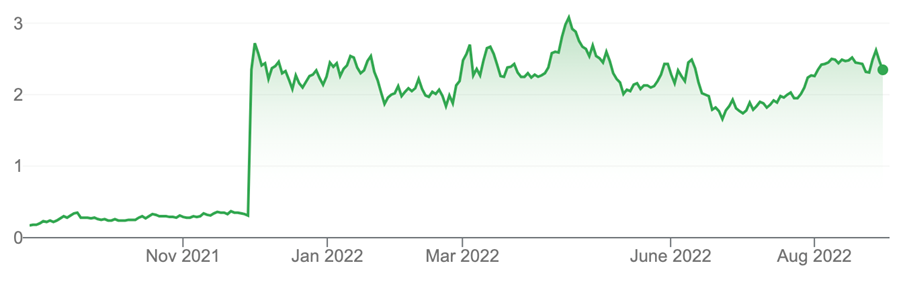

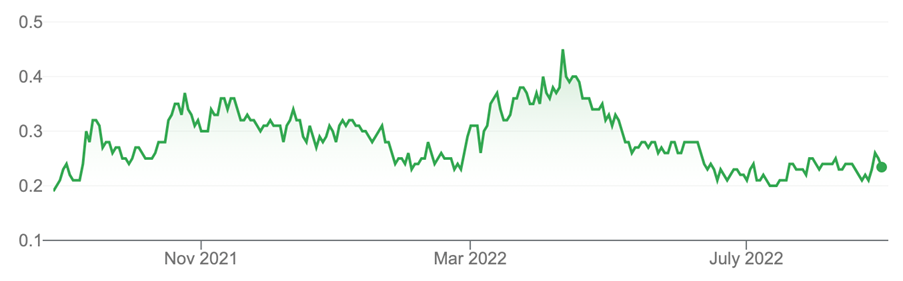

Boss Energy (BOE)

Source: nabtrade

Deep Yellow (DYL, 90.5 cents)

Market capitalisation: $351 million

12-month total return: 35.1%

Three-year total return: 47.9% a year

Analysts’ consensus price target: n/a

Deep Yellow also looks likely to become a uranium producer, with its recent merger with Vimy Resources (announced in March and completed in July) bringing two advanced, geographically diverse uranium projects and a world-class exploration portfolio under the one corporate roof, to create a Tier-1 uranium company with assets in Australia and Namibia.

Vimy’s flagship project was its wholly-owned Mulga Rock Project, one of Australia’s largest undeveloped uranium resources, located in the Great Victoria Desert of Western Australia, which has a mineral resource of 71.2 million tonnes at 570 ppm U3O8 for 90.1 million pounds of U3O8. A revised definitive feasibility study (DFS) is underway at Mulga Rock.

Vimy also owned and operated the largest granted uranium exploration package in the world-class Alligator River uranium district, located in the Northern Territory, and was exploring large high-grade uranium deposits identical to those found in the Athabasca Basin in Canada.

Deep Yellow brought to the table its Tumas project in Namibia, where a DFS is on track for completion by end of calendar-year 2022, and other projects in that country. Deep Yellow has previously stated that it needs a minimum uranium price of US$65 a pound to bring Tumas online.

At a stroke, the merger created a company with 389 million pounds of attributable uranium resource inventory − one of the largest in the world – with two advanced uranium assets, with annual production capacity potential of about 3 million pounds for Deep Yellow and 3.5 million pounds for Vimy. If it could bring both of these mines into production, Deep Yellow could become the largest pure-play uranium producer on the ASX.

Deep Yellow says it is now building a multi-project, global uranium company aiming to sustain production of up to 10 million pounds of U3O8 a year after 2025. After the two flagships, the next development targets are Omahola in Namibia, where the resource stands at 125Mlbs (at a grade of 190ppm U3O8) and Alligator River in the Northern Territory, where the resource is 26 million pounds at 1.29% U3O8.

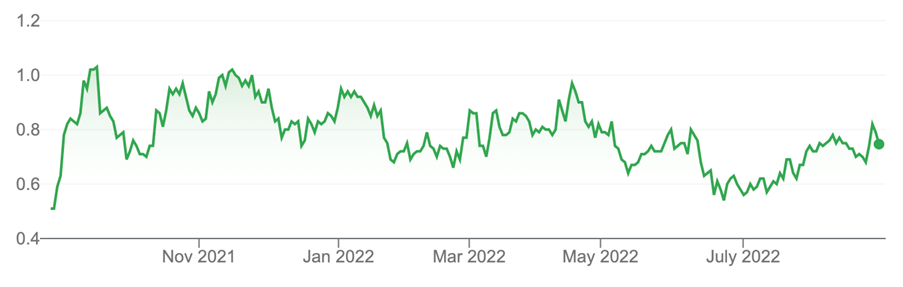

Deep Yellow (DYL)

Source: nabtrade

Paladin Energy (PDN, 79 cents)

Market capitalisation: $2.3 billion

12-month total return: 64.6%

Three-year total return: 83.8% a year

Analysts’ consensus price target: $1.09 (Stock Doctor/Thomson Reuters, four analysts), 80 cents (FNArena, one analyst)

Paladin Energy operates the Langer Heinrich Mine in Namibia, which was mothballed in 2018 due to low uranium prices. But the company says it has a “low-cost pathway” back to production: in July 2022, Paladin announced the decision to return Langer Heinrich to production, with first volumes targeted for the first quarter of calendar 2024.

In the meantime, Paladin is selling U3O8 from the stockpiles at the operation. In FY22, revenue increased 57% to US$4.7 million, while the statutory net loss narrowed by 39% to US$26.7 million. The amount of U3O8 sold was flat at 100,000 pounds, but the average selling price for Paladin’s uranium in FY22 was US$47 a pound, a 57% rise on FY21. But against that, the cost of sales increased by 58%, to US$4.7 million. One of the major achievements for the company in FY22 was winning the tender to supply uranium to a major North American power utility, announced in July.

In late March, Paladin raised $200 million from investors to support the planned restart of the mine, which is expected to cost $81 million. The re-start plan at Langer Heinrich has increased the estimated life-of-mine (LOM) production target from 76.1 million pounds to 77.4 million pounds, with the estimated LOM C1 (cash) costs raised from US$16.90 a pound to US$27.40 a pound. It will take 18 months from when the project re-commences for initial production, with full production estimated at 15 months after that – at its peak, Paladin says production will reach 5.9Mlbs of U3O8 a year, with a total mine life of 17 years.

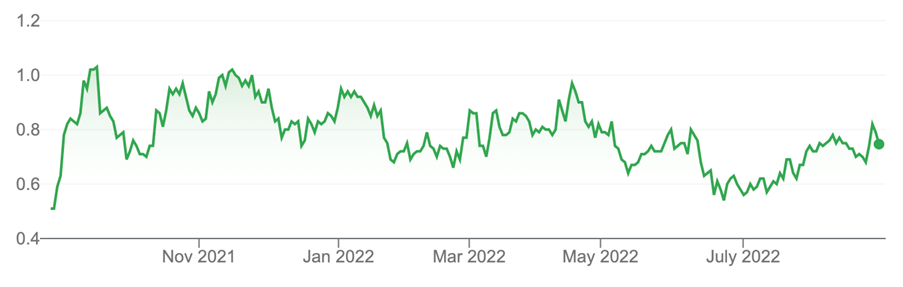

Paladin Energy (PDN)

Source: nabtrade

Bannerman Energy (BMN, $2.01)

Market capitalisation: $299 million

12-month total return: 38.6%

Three-year total return: 69.9% a year

Analysts’ consensus price target: $3.00 (Stock Doctor/Thomson Reuters, one analyst)

Bannerman Energy is developing its world-class Etango uranium project (of which it owns 95%), located in the Erongo Region of Namibia, the same region that hosts Paladin’s Langer Heinrich mine. Namibia is considered a very favourable jurisdiction for uranium, with an industry that has mined the metal since 1976, and which has both governmental support for the industry and excellent infrastructure already in place (the country is the world’s fourth-largest producer of uranium).

Extensive exploration activity over the past 15 years has outlined a measured, indicated and inferred resource of 207.8 million pounds of U3O8. In 2015, an optimised definitive feasibility study was completed for a 20 million-tonnes-a-year throughput mine fully exploiting the asset (Etango-20), but more recently, a pre-feasibility study (PFS) for an 8-million-tonnes-a-year throughput operation (Etango-8) was completed in August 2021, with a new DFS expected to be finished in the September 2022 quarter.

The Etango-8 plan outlined a 15-year initial mine life, with 8 million tonnes a year throughput, for 3.5 million pounds of U3O8, and a total production of 53 million pounds of U3O8, giving a post-tax internal rate of return (IRR) of 20.3%, all based on a life-of-mine uranium price of US$65 a pound, which the project would need to break-even. The AISC (including royalties) was estimated at US$40.30 a pound. The forecast construction period is 24 months for an open-pit mine. The forecast average LOM U3O8 production is 3.53 million pounds a year, with a peak in year 2 of 4.15 million pounds. The post-tax payback period is estimated at 3.8 years from initial production.

These numbers suggest a globally significant output, but the Etango Project will not be feasible below the breakeven $65 U3O8 price. But if uranium prices were to rise significantly and remain elevated, Bannerman stands to benefit hugely. In the company’s best-case scenario, prices do stay well above that level, and it can expand the throughput, possibly up to 20 million tonnes a year, in due course.

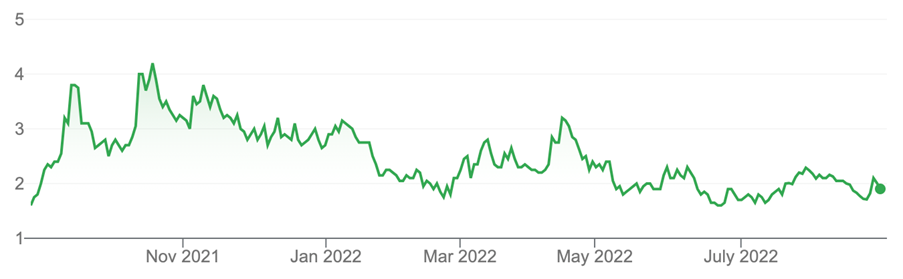

Bannerman Energy (BMN)

Source: nabtrade

Lotus Resources (LOT, 25 cents)

Market capitalisation: $302 million

12-month total return: 42.9%

Three-year total return: 79.3% a year

Analysts’ consensus price target: 30 cents (Stock Doctor/Thomson Reuters, three analysts)

Up until 2020, Lotus Resources’ main focus was its Hylea cobalt, platinum, nickel and scandium project in the Fifield district of New South Wales, but that all changed in March 2020 when Lotus bought an 85% stake in Paladin Energy’s Kayelekera project in the African nation of Malawi for just $5 million (the Malawi government owns the remaining 15%).

Paladin wanted to concentrate on restarting its Langer Heinrich operation. Kayelekera was a proven uranium operation that had successfully produced 11 million pounds over five years, but which had ceased operations in 2014 due to sustained low uranium prices.

Lotus started work on a definitive feasibility study (DFS) for re-commissioning Kayelekera in August 2021, and the study was completed earlier this month. Lotus proposes an initial capital cost of US$88 million to restart the project and says it can recommence production after 15 months of construction and refurbishment, once a final investment decision (FID) has been made. The company says the initial capital cost of US$88 million ranks the project as one of the lowest-capital-cost uranium projects globally.

The DFS envisages average production of 2.4 million pounds of U3O8 a year over the first seven years of an initial mine life of 10 years. The cash cost of production is estimated at US$29.10 a pound, with the AISC at US$36.20 a pound during the first seven years of production (excluding ramp-up). Life-of-mine (LOM) cash cost is projected at US$30.10 a pound with LOM AISC at US$37.70 a pound. The Restart DFS is underpinned by an ore reserve estimate of 15.9 million tonnes at 660 ppm U3O8, for 23 million pounds of U3O8.

Lotus Resources (LOT)

Source: nabtrade

All prices and analysis at 29 August 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.