Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Two industrial stocks for dividend yield investors

It is a good time for yield-oriented share investors, with potential dividend yields on offer that stretch well into the high-single-digit area on nominal yields alone, before the impact of franking pushes equivalent grossed-up yields into the double digits.

That is, of course, with the huge caveat on company dividend yields – that the dividends cannot be considered reliable until they are paid into your account. Companies can cut and even forego their dividend payments, if the circumstances demand it. Dividends are certainly not as reliable as coupons from a fixed-income investment – but of course, as interest rates ground ever-lower in recent years, reliability of interest coupons was not much use to investors because the payments were so low. Many looked to the share market, where yields were much higher, even with the lack of 100% certainty – and there is the ever-present risk of share prices falling.

But dividend yields are holding their own, with three of the big banks in the 8–9% range, in grossed-up terms: here are the FY23 prospective dividend yields for ANZ Bank, Westpac and National Australia Bank, on analysts’ expectations collated by Stock Doctor/Thomson Reuters:

The banks

ANZ Bank (ANZ, $21.93)

FY23 (September) forecast yield: 6.9% fully franked, grossed-up 9.8%.

National Australia Bank (NAB, $28.30)

FY23 (September) forecast yield: 5.7% fully franked, grossed-up 8.2%.

Westpac (WBC, $19.94)

FY23 (September) forecast yield: 6.5% fully franked, grossed-up 9.2%.

Big miners

There are also – on the back of high commodity prices – some outlandish yields on offer based on prospective dividends from the big miners, such as:

Fortescue Metals Group (FMG, $16.33)

FY23 forecast yield: 11.8% fully franked, grossed-up 16.9%.

BHP (BHP, $36.10)

FY23 forecast yield: 10.9% fully franked, grossed-up 15.5%.

Rio Tinto (RIO, $93.27)

FY23 (December) forecast yield: 9.6% fully franked, grossed-up 13.7%.

Coal producers

Coal producers New Hope and Whitehaven Coal have some mouth-watering prospective yields, for the risk:

New Hope Corporation (NHC, $4.18)

FY23 (July) forecast yield: 16.8% fully franked, grossed-up 23.9%.

Whitehaven Coal (WHC, $5.61)

FY23 (July) forecast yield: 14.5% unfranked.

Two industrials

The industrial part of the share market is also a ripe pasture for yield-hunting. Here are two industrials, from very different industries, with grossed-up prospective yields that push above 11%; and also have healthy share-price prospects, too, to make for a total-return proposition in which I think investors can feel reasonably confident – never forgetting the caveats.

1. CSR (CSR, $4.15)

Market capitalisation: $2 billion

12-month total return: –16.3%

3-year total return: 16.7% a year

FY23 (March) forecast yield: 8.2% fully franked, grossed-up 11.7%

Analysts’ consensus target price: $5.98 (Thomson Reuters, 10 analysts), $5.917 (FN Arena, 6 analysts)

Building products company CSR has a reasonably strong outlook in place in its core market of Australia and New Zealand, despite the labour shortages and supply-chain congestion in the building markets. CSR has a strong pipeline of work in the detached housing market, which it expects to continue in the year ahead (despite completion times lengthening). The company says alterations and additions approvals are at elevated levels, the multi-residential pipeline is “re-building,” and activity in the apartment and non-residential markets has improved after an extended slowdown in the last few years.

The building products business – which generates more than 70% of CSR’s earnings – is “well-positioned to continue to grow,” the company says, with “a clear strategy to drive improved performance from a strong portfolio of brands and customer solutions”.

CSR’s stable of building products includes Gyprock plasterboard, PGH bricks, Monier roofing, Hebel lightweight building blocks, Bradford insulation. Cemintel fibre cement, AFS permanent formwork and Martini acoustic insulation products.

CSR also has a property division that focuses on maximising financial returns from surplus former manufacturing sites and industrial land – this contributed about 21% of earnings – and owns a 25% stake in the Tomago Aluminium smelter near Newcastle, New South Wales, which accounts for about 9% of earnings.

The company reaffirmed its positive in May when releasing its result for the year ended 31 March 2023. For the year ended March 2022, revenue rose 9%, to $2.3 billion, while net profit was up 20%, to $193 million, on the back of high demand for building products and improved aluminium prices. The full-year dividend was down 5 cents, or 13.7%, on the 36.5 cents paid in FY21. Earnings before interest and tax (EBIT) for the crucial building products division were up 24% to a record $228.2 million, and CSR finished the year with $178 million in net cash.

According to the analysts polled by FNArena, earnings per share (EPS) for CSR is expected to come down by about 24% in FY23, but the dividend is expected to improve, from 31.5 cents to 33.4 cents, pricing CSR, at $4.15, on a fully franked dividend yield of 8%, or 11.5% grossed-up. At Stock Doctor/Thomson Reuters, the analysts’ collation sees EPS of 43 cents in FY23, and a dividend of 34 cents, for a projected yield of 8.2% fully franked (grossed-up, 11.7%).

Those are very attractive yield forecasts. Even if CSR only matches its FY22 dividend, at $4.15 it trades on a dividend yield of 7.6%, or 10.8% on a grossed-up basis. If the dividend were cut to 28 cents, the yield would still be 6.7% or 9.6% on a grossed-up basis. And with broker analysts quite bullish on their price targets for CSR, the stock looks an appealing total-return proposition.

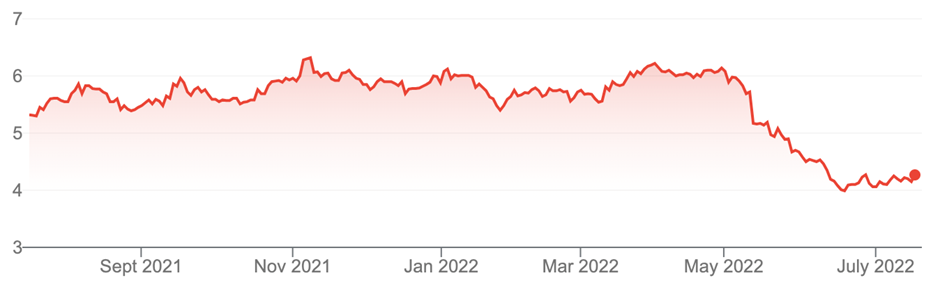

CSR Limited (CSR)

Source: nabtrade

2. Adairs (ADH, $2.28)

Market capitalisation: $391 million

12-month total return: –35.9%

3-year total return: 21% a year

FY23 forecast yield: 8.1% fully franked, grossed-up 11.6%

Analysts’ consensus target price: $3.26 (Stock Doctor/Thomson Reuters, eight analysts), $3.167 (FN Arena, 3 analysts)

Much of the attraction in homewares and furniture retailer Adairs comes from the halving of the share price since June 2021. 2022 kicked off with Adairs telling the market that December-half profits would almost halve, because of the combined impact of extended lockdowns in Sydney and Melbourne, and higher staff and warehousing costs in the pandemic. That hammered the share price, and the December 2021 interim profit, when it came out, was awash with the effects of global supply-chain problems, higher delivery costs and store closures.

Net profit dropped 60%, to $17.7 million for the six months, as revenue slipped 0.5% to $241.8 million. The company slashed its dividend by almost 40%, to 8 cents a share. But the underlying business went pretty well, with like-for-like sales, excluding its late-2021 acquisition of Focus on Furniture, managing a 2.7% rise, while online sales jumped 8.2% to $97.6 million, contributing nearly 42% of sales.

However, Adairs shares were slammed again last month following the Reserve Bank’s decision to aggressively increase interest rates to fight inflation. Certainly, the wider economic impacts of rising inflation and interest rates could hurt Adairs’ revenue, margins and profits.

But Adairs is a beneficiary of strong demographic trends. If you can get access to it, I urge you to read demographer Bernard Salt’s article in the Inquirer section of the Weekend Australian, July 16-17, titled ‘Inside the Bedroom’, for some insight into Australians’ love of the bedroom, and the increasing number of bedrooms in Australia. The bedroom is Adairs’ domain.

Adairs did not provide guidance for its FY22 result, but analysts expect it to be about 33% down in terms of profit and stabilising at that level in FY23. In terms of dividends, analysts see a 16.5-cent full-year dividend in FY22 – but a rise to 18.5 cents in FY23 in the Stock Doctor/Thomson Reuters analysts’ collation, and on FNArena’s collation, a little higher, at 19.3 cents.

If these expectations are met, Stock Doctor/Thomson Reuters has ADH trading on a prospective FY23 dividend yield of 8.1% fully franked (or 11.6%, on a grossed-up basis), while FNArena has it at 8.5% (or 12.1%, on a grossed-up basis). Even if those dividend expectations do not quite flow through, someone buying Adairs shares now – benefiting from the share price fall – would enjoy a very attractive yield kicker to complement a yield-oriented portfolio, and an even fatter total-return situation if the share price recovery the analysts expect plays out.

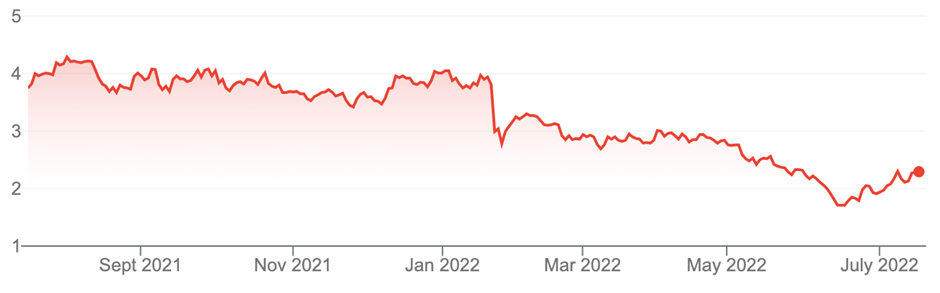

Adairs (ADH)

Source: nabtrade

All prices and analysis at 18 July 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.