Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three healthcare companies on the rise

One of the best performing sectors in recent weeks has been the health care sector. That shouldn’t come as too much of a surprise because that is also the case in the US – and our market tends to follow.

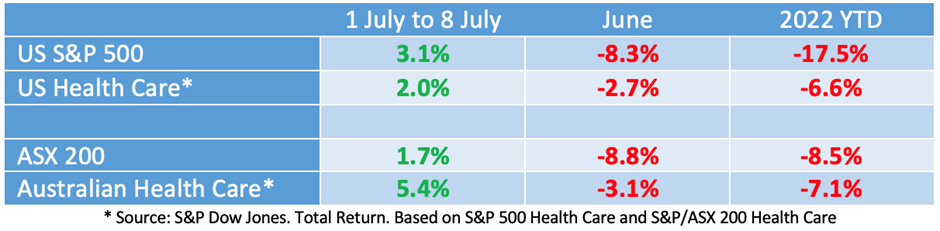

The table below shows the performance of the health care sector in July (the six trading days to last Friday), in June and in calendar 2022. The top half shows the performance of the US healthcare sector compared to the US S&P 500, and the bottom half shows the performance of the Australian sector compared to the S&P/ASX 200.

Total Return – Health Care vs Broader Market

Health care is traditionally considered to be a defensive sector, particularly in the US, so in times of market turbulence and downward trajectory, it is not surprising that it has outperformed on a relative basis.

However, Australian health care companies tend to be quite different in that they are global in operation, highly specialised and focused on overseas markets. Typically, they trade on higher PE multiples than their American counterparts. So in an environment of higher interest rates where higher multiple stocks have been under pressure, their recent performance stands out.

I put this down to several factors. Firstly, they are seen as being largely “recession proof”. The demand for blood plasma products, ear implants, sleep apnoea products etc won’t be too badly hit if there is a sharp economic downturn. Next, they are benefiting from a lower Australian dollar relative to the US dollar. Although they report in “constant currency”, the US is their biggest market and their Australian share price is “cheaper” in US dollars. And finally, their share prices haven’t been going down – so if they can’t go down, they must go up.

We are also coming in to reporting season, and some of the companies have strong track records in delivering positive earnings “surprises”.

My hunch is that health care stocks will continue to outperform over the coming months. In part because the major sectors have gone out of favour with recession talk hurting materials, and higher interest rates impacting financials. Here are 3 health care stocks to consider.

1. CSL (CSL)

Probably no surprise that I would nominate my favourite stock, CSL. The global leader in blood plasma products, number two in influenza vaccines and hopefully, a leader in the treatment of chronic kidney disease (when its acquisition of Vifor Pharma completes).

The price action looks like CSL has found a bottom, the analysts like it, and we are coming into reporting season (CSL is one of those companies that has a habit of surprising on the upside).

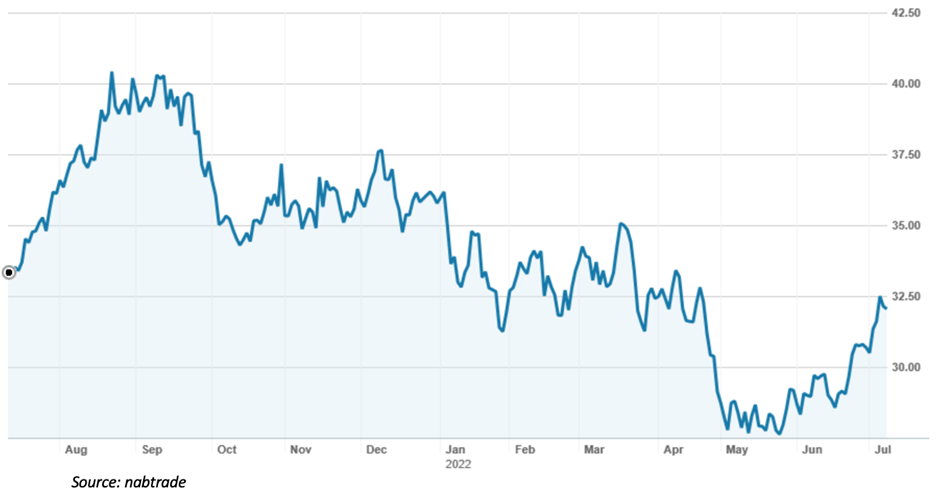

CSL Limited (CSL) – last 12 months

The consensus target price for CSL (according to FNArena) is $319.32. Of the major brokers, Macquarie and Morgan Stanley are the lowest at $312.00, Citi is the highest at $330.00. All have “buy” recommendations.

On multiples, CSL is relatively pricey, trading on a multiple of 39.8 times forecast FY22 earnings and 33.7 times forecast FY23. The company is due to report its full-year result on 17 August. It has guided to a net profit of between US$2.15bn and US$2.25bn in constant currency, which includes about US$100 million in Vifor Pharma transaction costs.

2. ResMed (RMD)

ResMed is a global leader in the treatment of sleep disorders, with a portfolio of sleep apnoea therapy, respiratory care therapy and digital health solutions. Originally based in Australia, the company is run out of the US (which is its main market). Its primary listing is on the NASDAQ, with a secondary listing on the ASX.

As a US company, it reports quarterly. For the 9 months to 31 March, it reported revenue growth of 12% (14% in constant currency terms). Operating profit grew by 5%, as the impact of higher freight and manufacturing costs led to a decline in gross margin of 1.5% to 58.1%. Revenue growth in its recently acquired software as a service segment grew by 8%.

ResMed Inc (RMD) – last 12 months

ResMed’s share price has pulled back from a high of over $40.00 in September last year to a low of $27.37 in May (refer to chart above). On Friday, it closed at $32.05.

The broker analysts like the stock, with a consensus target price of $35.76. The range is a low of $29.10 from Morgan Stanley through to a high of $38.50 from Credit Suisse. On multiples, the brokers have Resmed trading on a multiple of 38.2 times forecast FY22 earnings and 31.5 times forecast FY23 earnings.

3. Cochlear (COH)

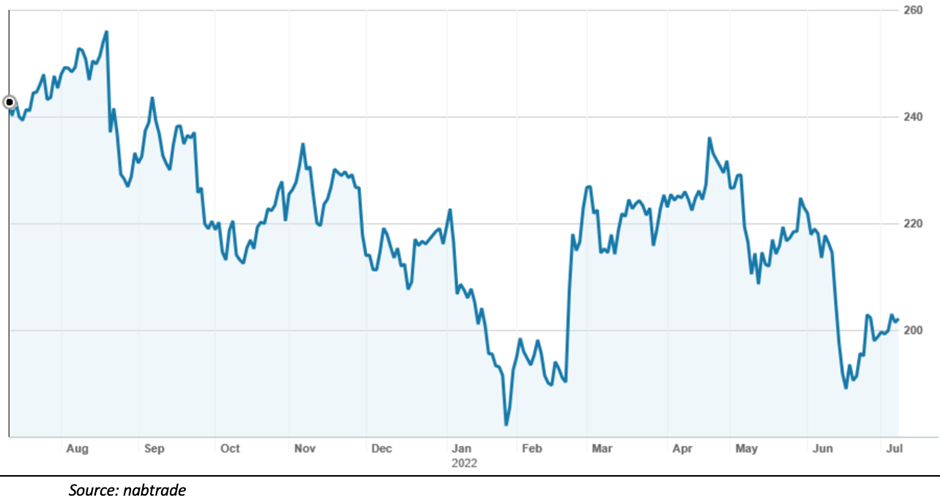

Ear implant manufacturer and distributor Cochlear has operations in over 30 countries and distributes its cochlear implantable devices in the Americas, Asia/Pacific and Europe. Ten months ago, it peaked at about $267 before falling to $178 in January. Today, it is trading near $202.00.

Cochlear Limited (COH) – last 12 months

It has guided to a full-year profit of $265 million to $285 million, which is up by 13% to 22% on FY21. The guidance incorporates cloud computing expenses and anticipates some impact from Covid. Cochlear is due to report its results on 19 August.

On multiples, the brokers have Cochlear trading at a heady 47.5 times FY22 earnings and 42.5 times FY23 earnings. The consensus target price is $221.42, about 9.5% higher than the current ASX price. The range is wider, with a low of $194.00 from Morgan Stanley through to a high of $244.50 from Morgans.

Paul Rickard is co-founder of the Switzer Report. All prices and analysis at 11 July 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.