Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three biotech picks for your portfolio

Biotech is always an exciting sector on the stock market: there is always some good news circling around somewhere. But the risk is always that stocks fail or languish for long periods between news. Here are three candidates where the risks of life science product development appear to be in investors’ favour.

1. Dimerix (DXB, 14 cents)

Market capitalisation: $45 million

12-month total return: –37.8%

3-year total return: 10.1% a year

Analysts’ consensus target price: n/a

Melbourne-based biotech Dimerix works on developing new therapies to treat inflammatory causes of kidney and respiratory diseases and has multiple late-stage clinical programs in both. Dimerix’s lead drug candidate, DMX-200, is in Phase 3 trials for the treatment of Focal Segmental Glomerulosclerosis (FSGS), which is a rare kidney disease with no approved treatment anywhere in the world.

FSGS is a particularly cruel disease, with half of all children who acquire it likely to endure kidney failure within five years. The disease, in which scar tissue develops in the glomeruli – the capillary networks that work as the microscopic filtration units in the kidney – and degrades their effectiveness, has no treatment approved anywhere in the world. For this reason, DMX-200 has been designated an “orphan drug” for FSGS by the US Food & Drug Administration (FDA), the European Medicines Agency (EMA) and the UK Medicines and Healthcare Products Regulatory Agency (MHRA). An orphan drug is a drug developed to treat medical conditions which, because they are so rare, would not be profitable to produce without government assistance.

Dimerix’s proprietary technology has also yielded the DMX-700 drug candidate, which is aimed at chronic obstructive pulmonary disease (COPD), a chronic inflammatory lung disease that causes obstructed airflow from the lungs; COPD is a progressive and life-threatening disease that is the third-largest cause of death worldwide, with more than 3.2 million deaths a year attributed to it. This month, Dimerix announced promising new results for DMX-700 in an industry-standard preclinical model of COPD, conducted in mice: DMX-700 demonstrated statistically significant (80% reduction versus control) in induced lung injury in the mice. The data supports the progression of DMX-700 into a clinical trial; this is planned for the first half of 2023.

As well as FSGS, Dimerix is developing DMX-200 for the treatment of diabetic kidney disease and acute respiratory distress syndrome (ARDS) in patients with COVID-19. DMX-200 is in Phase 2 trials for the treatment of diabetic kidney disease. Two independent Phase 3 programs are in progress for patients in the early stage of COVID-19 infection, before the onset of pneumonia, and for patients in the late stage of COVID-19 infection with moderate to severe pneumonia.

There are few brokers following Dimerix, but one that does is US broker Arrowhead – the research is issuer-sponsored, meaning that Dimerix pays for the coverage. But based on its due diligence research on the three programs, Arrowhead values Dimerix in the range of 36-45 cents a share.

Dimerix Limited (DXB)

Source: nabtrade

2. Telix Pharmaceuticals (TLX, $5.47)

Market capitalisation: $1.7 billion

12-month total return: –2.7%

3-year total return: 57.5% a year

Analysts’ consensus target price: $8.05 (Stock Doctor, six analysts)

Nuclear medicine company Telix Pharmaceuticals bills itself as a “theranostic” – diagnostic and therapeutic – company, because it delivers targeted radiation to cancer cells with precision, regardless of where the cancer is in the body, using a technique called molecularly-targeted radiation (MTR). It uses radiopharmaceuticals, which are systemically delivered radioactive isotopes or compounds that “localise” to tumours while sparing normal tissues and cells. The benefit is that MTR is only delivered to areas where the cancer target is expressed, and thus inflicts significantly less damage to healthy tissue when compared to traditional radiation therapy. As well, the treatment can target much smaller tumours.

Telix’s lead product, Illuccix, (a kit for the preparation of gallium Ga 68 gozetotide injection), also known as 68Ga PSMA-11 injection, was approved by the FDA in December 2021. Since then there have been quite a few other approvals, including by the Australian Therapeutic Goods Administration (TGA). Telix is also progressing marketing authorisation applications for Illuccix in Europe and Canada.

The reception of Illuccix as its launch rolls out – the first US sales were struck in April 2022 – will be the big driver of the stock. Telix believes that Illuccix has a total addressable market (TAM) of US$725 million ($1.05 billion) and that it could capture 40% of that within three years from commercial launch.

Telix currently has trials of its radiopharmaceutical assets in prostate cancer, renal cancer, glioblastoma (a severe kind of brain tumour) and bone marrow conditioning is performed prior to hematopoietic stem cell transplant (HSCT), a procedure where the patient’s bone marrow is cleared of cells and replaced by stem cells (cells that can develop into different types of cells), to encourage production of new bone marrow that produces healthy blood cells. The FDA has granted orphan drug designation for the company’s TLX66 candidate for bone marrow conditioning; this designation qualifies the company for various drug development incentives, which may include FDA-administered market exclusivity for seven years, and tax credits for R&D and clinical development costs.

Telix’s renal cancer imaging agent TLX250-CDx was granted breakthrough therapy (BT) designation by the FDA in June 2020, reflecting the significant unmet clinical need to improve the diagnosis and staging of ccRCC, the most common and aggressive form of kidney cancer. TLX250-CDx is going into a pivotal Phase III study of renal cancer later this year, in a trial called ZIRCON.

Telix also has a licence agreement with Eli Lilly and Company under which Telix holds exclusive worldwide rights to develop and commercialise radiolabeled forms of Lilly’s olaratumab antibody for the diagnosis and treatment of human cancers: Telix’s initial development focus will be on a rare type of cancer known as soft tissue sarcoma (STS).

Telix’s research pipeline is also looking to address the significant unmet medical needs in a range of immunologic and rare diseases. Share price catalysts could come not only from trial results but also from news of partnerships and licensing opportunities that further expand the company’s portfolio. Analysts see quite a bit of scope for this.

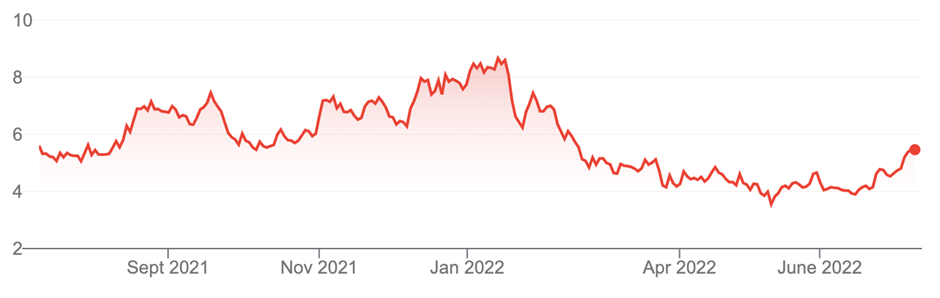

Telix Pharmaceuticals Limited (TLX)

Source: nabtrade

Imugene (IMU, 23 cents)

Market capitalisation: $1.3 billion

12-month total return: –30.3%

3-year total return: 143.1% a year

Analysts’ consensus target price: 50 cents (Stock Doctor, two analysts)

Imugene works in immuno-oncology, the anti-cancer field in which the body’s immune system is artificially stimulated to boost its natural ability to fight the disease (sometimes called “cancer immuno-therapy”). Imugene is developing four new treatments that activate the immune system of cancer patients to identify and eradicate tumours.

Oncolytic virus therapy involves viruses found in nature being genetically modified to infect, replicate in and kill cancer cells, while sparing healthy cells.

Imugene shares hit the headlines last month with a 45% surge in a day, after announcing positive results in a Phase 2 trial of its HER-Vaxx B-cell immunotherapy candidate in patients with advanced gastric cancer. Patients treated with HER-Vaxx were found to have a 41.5% less chance of death than if they had just been given chemotherapy. Overall, the median survival for patients treated with HER-Vaxx was 13.9 months, compared to 8.3 months for those patients only given chemotherapy.

HER-Vaxx is an oncolytic virus, injected like a vaccine, that targets cancers that cause an overproduction of the HER-2 protein. The protein ultimately allows cancer to spread faster in the body. The cancers associated with the overproduction of HER-2 are breast cancer, gastric cancer, ovarian cancer, lung cancer, and pancreatic cancer. By suppressing the production of the protein, Imugene has proven that HER-Vaxx – even though it is not a treatment on its own – can boost the lifespan of patients also receiving chemotherapy.

Imugene has decided against proceeding to a Phase 3 trial; instead, it will conduct another Phase 2 trial looking at how effective HER-Vaxx can be with a higher dosage rate. It is also assessing other treatment combinations with which it can trial HER-Vaxx in partnership.

Imugene also has a licensing deal with the California-based cancer research centre, City of Hope, for a new cancer therapy aimed at solid tumours. This immune therapy transforms T-cells – natural disease-fighting cells in the human immune system – into cancer fighters by extracting them from patients. In the lab, clinicians then insert structures called chimeric antigen receptors (CARs). The combined CAR-T cells produce a protein that allows them to recognise and destroy cancer cells throughout the body. At City of Hope, doctors have combined an oncolytic virus developed by Imugene with CAR-T cell therapy to infiltrate solid tumours.

In May, Imugene and City of Hope kicked off a Phase 1 clinical trial evaluating the safety of the novel cancer-killing virus CF33-hNIS VAXINIA when used in people with advanced solid tumours. The City of Hope-developed oncolytic virus has been shown to shrink colon, lung, breast, ovarian and pancreatic cancer tumours in pre-clinical laboratory and animal models.

It is very exciting times for Imugene, and analysts are fairly positive on the stock. US firm ROTH Capital Partners has a price target on the stock of 71 cents; while fellow US firm Noble Life Science Partners has 50 US cents (72.5 cents at the current exchange rate).

Imugene Limited (IMU)

Source: nabtrade

All prices and analysis at 11 July 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.