Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three ASX gold stocks offering glittering value

With the gold price down 18% since March, the Australian gold miners have struggled – the All Ordinaries Gold Index is down just over 23% so far in 2022. But analysts feel the sector looks over-sold, with valuations starting to show significant upside on analysts’ consensus price targets.

It starts at the top, with heavyweights Newcrest Mining, Evolution Mining, Northern Star Resources and Regis Resources all showing price discounts to analysts’ consensus that look very appealing.

But I think there’s even better value to be had in some of the smaller producers, and companies poised to enter production.

Here’s my top three gold picks.

1. Bellevue Gold (BGL, 72 cents)

Market capitalisation: $743 million

12-month total return: –24.6%

Three-year total return: 5.7% a year

Analysts’ consensus target price: $1.20 (Stock Doctor/Thomson Reuters, three analysts), $1.20 (FN Arena, one analyst)

Bellevue Gold is developing the project of the same name in the northern Goldfields region of Western Australia, at which it has just this month awarded the engineering, procurement and construction (EPC) with ASX-listed GR Engineering Services Limited, to build the gold processing plant; mining contractor Develop Global started underground work in May, and the company has told investors to expect first commercial gold production in June 2023 (first development ore is expected in the September 2022 quarter).

Bellevue has probable reserves of 6.8 million tonnes at a grade of 6.1 grams per tonne (g/t) gold, for 1.34 million ounces of contained gold, over an initial estimated mine-life of ten years, producing 200,000 ounces of gold a year over the first five years, at an all-in sustaining cost (AISC) – a figure that incorporates not only the “cash cost” of production but all the costs that allow production to be sustained – of between $A1,000 and A$1,100 an ounce, which compares favourably to the current A$ gold price of $2,492.60 an ounce. If borne out that would make Bellevue one of the lowest-cost gold producers on the ASX. The company forecasts total pre-tax free cashflow of $2.1 billion over the ten-year initial mine-life, which it hopes to extend through exploration.

Using an estimated gold price of A$2,500 an ounce, Bellevue Gold estimates that the project set will generate average life-of-mine (LOM) free cash flow of $231 million a year (pre-tax), at a pre-tax internal rate of return of 68%. Moreover, BGL says it is fully funded through to production, with its existing liquidity sitting at $351 million, including an undrawn debt facility of $200 million from Macquarie.

The company has done some great work this year in locking-in more than 90% of its pre-production costs, with either fully awarded contracts or the receipt of tendered pricing, which insulates the development from any potential cost escalation. It was also interesting to see GR Engineering Services accept Bellevue shares as part-payment for its EPC work, which Bellevue describes as “a strong vote of confidence in our project and the outlook for our company.”

It doesn’t surprise me that the analysts that follow Bellevue are quite bullish on the stock – it has excellent prospects.

Source: nabtrade

2. Alkane Resources (ALK, 71 cents)

Market capitalisation: $426 million

12-month total return: –37.6%

Three-year total return: 22.4% a year

Analysts’ consensus target price: $1.40 (Stock Doctor/Thomson Reuters, two analysts), $1.50 (FN Arena, one analyst)

Alkane mines gold at its Tomingley operations about 50 kilometres southwest of Dubbo in central western New South Wales, and in 2019 it made a big gold-copper discovery at Boda, within its Northern Molong porphyry (a type of rock) project, also in central western New South Wales. The discovery hole at Boda was a real stunner, showing a 502-metre drill hit that grades of 0.5 g/t gold and 0.2% copper. The company’s Boda ground also hosts the Kaiser prospect, as well as multiple others; while Alkane is still drilling the Kaiser-Boda exploration target, in May 2022 it released an initial inferred mineral resource for the Boda deposit, which it estimated at 10.1 million ounces of gold equivalent, or 5.21 million ounces gold and 900,000 tonnes of copper.

Tomingley also hosts the Tomingley gold extension project, with the first deposits slated to be developed as part of this project the Roswell and San Antonio deposits, which are located just to the south of Tomingley; Alkane intends to develop these deposits as soon as possible.

The Indicated and inferred mineral resource for the Tomingley Extension Project – not including the recently discovered McLeans and Plains prospects – currently stands at 21.4 million tonnes grading 1.90 g/t gold, for 1.31 million ounces.

In the meantime, Tomingley chugs along nicely, with FY22 full-year production coming in at 66,802 ounces, well above the company’s guidance of 55,000–60,000 ounces. It also beat guidance on cost grounds, too, with an AISC of A$1,460 an ounce, below the cost guidance of A$1,500–$1,650 an ounce. Alkane started open-cut mining at Tomingley in 2014 and moved to underground mining in 2019: Alkane says the mine has met or exceeded guidance in every year of operation. Alkane pushed one million tonnes of ore a year through the Tomingley processing plant, and in

May, the plant poured its 500,000th ounce of gold. Currently the Tomingley mine-life is pegged at 2030 – that’s where the development pathways at the extension project, and Kaiser-Boda, come into play.

Preliminary metallurgical studies have indicated the potential of two-stage ore processing from Boda, with the first stage producing a copper-gold concentrate for immediate sale and the second stage producing gold bullion from a cyanide leach. Preliminary recoveries are 85 per cent for gold, copper and silver.

Boda is a very exciting prospect – with copper a significant bonus – and alone justifies a fair bit of bullishness about Alkane, especially at the current share price. I think it looks very attractive.

Source: nabtrade

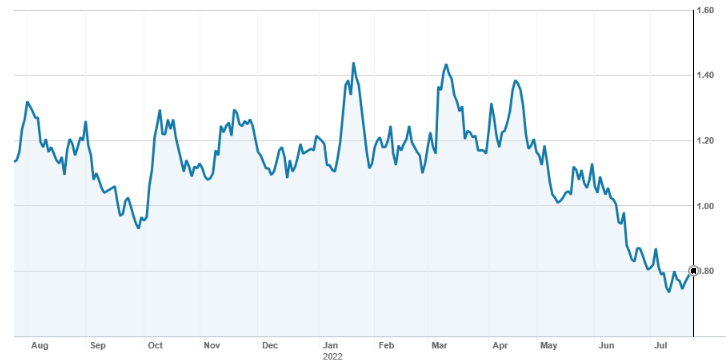

3. De Grey Mining (DEG, 80 cents)

Market capitalisation: $1.1 billion

12-month total return: –28.3%

Three-year total return: 137.4% a year

Analysts’ consensus target price: $1.70 (Stock Doctor/Thomson Reuters, four analysts)

Upside 113.8%

Ok, so we all know by now that De Grey Mining was trading at 5 cents a share when it made a big gold discovery at Hemi in the Pilbara region of Western Australia in December 2019, and became a 30-bagger.

Or, look at it another way: in April 2021, a De Grey Mining share was worth $1.61. That halving of the share price has opened-up great value.

Hemi is part of De Grey’s Mallina gold project, 60 kilometres south of Port Hedland, which is Australia’s largest undeveloped gold project – and it is still growing. The resource at Hemi is currently 192 million tonnes at a grade of 1.1g/t Au for 6.8 million ounces of gold, with the “regional resource” at Mallina at 9 million ounces.

The scoping study on Mallina, released in October 2021, outlined production of 4.3 million ounces over ten years, 80% of it coming from Hemi, with a production rate of 473,000 ounces a year for the first five years of operation, and 427,000 ounces a year for years five to ten, at a very low AISC of $1,224 an ounce.

Those are big numbers – in DEG’s presentations, it says those figures would make it a future top five gold mine in Australia, slotting in behind Boddington (owned by Newmont), Fosterville (Kirkland Lake), Tanami (Newmont) and Kalgoorlie Consolidated Gold Mines (KCGM, owned by Northern Star). The project, based on three mining centres (Hemi, Withnell and Wingina) would have an internal rate of return (IRR) of about 50% post-tax, and would pay back its investment in two years. De Grey is expecting production in 2025. The preliminary feasibility study (PFS) is expected in the second half of 2022. Meanwhile, investors can expect the resource to grow – exploration continues, targeting large-scale, near-surface discoveries, and DEG is particularly interested in major resource extensions below the Hemi deposits. Hemi is already a world-scale project – and I think it likely that there’s still plenty of upside. One day, 80 cents a share could well look a cheap entry point.

Source: nabtrade

All prices and analysis at 25 July 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.