Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three fintechs to consider for your portfolio

The fintech sector has been hammered in 2022 as growth stocks have fallen from favour, but there are still some babies sitting in the remaining bathwater, and still building businesses to address large potential markets.

Here are three fintechs that I think are well worth a look at current price levels:

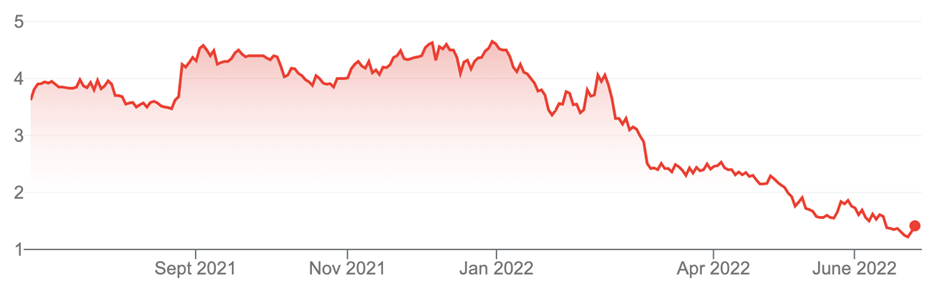

1. FINEOS Corporation Holdings Plc (FCL, $1.45)

Market capitalisation: $690 million

12-month price performance: –67.8%

Analysts’ consensus price target: $3.41 (Stock Doctor/Thomson Reuters, five analysts) Wallmine has $6.00

Fineos Corporation is an Irish-based software development company specialising in software solutions for the insurance industry. The company provides enterprise software for life, accident and health insurers, and government social insurance. It has a cloud-based platform across three main product categories:

- FINEOS AdminSuite for core process administration (including the flagship product, FINEOS Claims, which provides clients with an end-to-end software solution that manages insurance claims, from initial uptake through to closure). AdminSuite also has modules in Payments, Provider, Absence, Policy and Billing.

- FINEOS Engage for digital engagement capabilities; and

- FINEOS Insight for data analytics, intelligence and insights.

The company is a global leader, with 60 major insurers around the world as customers, including seven of the top 10 US insurers and six of the top 10 Australian insurers. About 80% of its revenue comes from North America.

The beauty of FINEOS’ business (and its investment proposition) is that its insurer customers rely on its software to manage the insurance claims process; FINEOS enables full “quote-to-claim” administration. The increased regulatory pressure in the industry – for example, on privacy of customer data, and the audit trail of transactions – is a big business driver for FINEOS; as is the demand for a better customer experience. The legacy systems that most insurers use can’t cope easily with these pressures; but using FINEOS’ software, which can both automate most processes and improve customer service, can bring significant cost savings to insurers.

FINEOS is not yet profitable but is targeting a free-cash-flow-positive position in FY24. The company lifted subscription revenue by 39.5% in the first half, and services revenue by 16.4%. As it wins more business FINEOS is improving its client concentration all the time: as of August 2021, its top 10 clients were accounting for 74% of revenue – that proportion has been reduced to less than 61%.

For FY22, FINEOS is guiding for revenue to come in at the lower end of the previously posted range of €125–€130 million, with subscription revenue to grow at an annualised rate of about 30%.

At the time of writing, FCL is up 15 cents, or 11.5%, on Monday morning, but that’s still a long way short of where analysts see the stock. Stock Doctor/Thomson Reuters has an analysts’ consensus price target of $3.41, while Wallmine.com has $6.00.

FINEOS Corporation Holdings Plc (FCL)

Source: nabtrade

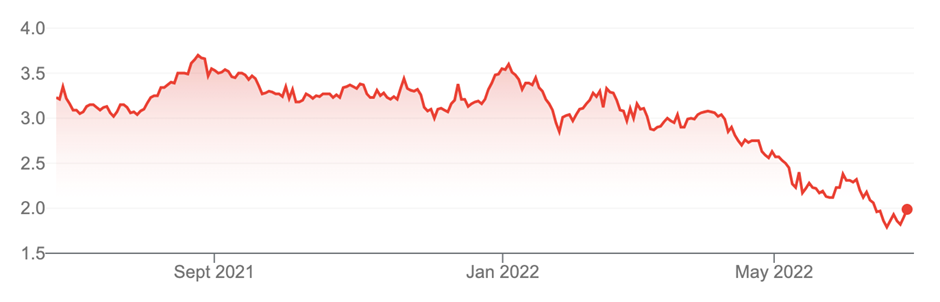

2. Money 3 (MNY, $1.97)

Market capitalisation: $406 million

12-month price performance: –38.4%

Analysts’ consensus price target: $3.75 (Stock Doctor/Thomson Reuters, two analysts)

Money3 is a small lending and financing business with three subsidiaries:

- Money3 (“non-conforming” loans in Australia: payday lending, car loans, personal loans);

- AFS Automotive Financial Services (prime-borrower personal and commercial vehicle loans in Australia);

- GoCar Finance Limited (prime-borrower and “non-conforming” personal and commercial vehicle loans in New Zealand).

In 16 years on the ASX, Money3 has transformed from a high-risk payday lender to a lending business underpinned by secured loans, particularly since the January 2021 acquisition of asset finance lending business Automotive Financial Services (AFS). When Money3 first listed in 2006, it had $10 million in unsecured loans; in the half-year ended December 2021, MNY reported that its loan book grew by 45.7%, to $690.8 million.

This month, the company reported that its funding capacity was now capable of growing its loan book well beyond $1 billion; it expects to hit the $1 billion gross loan book mark in FY23. At the end of the March 2022 quarter, the financial-year-to-date had seen new lending increase by 39.4% to $352.5 million, despite ongoing pandemic-related weakness. Revenue in the first nine months was up 32.2%, to $138.7 million, while net profit was running at $39 million, up 37%. Cash collections were running at a record figure of 327.9 million, up 30%, with the strong cash flows maintaining good bad-debt performance, which the company expects to come in between 3.5-4.5% of the loan book in FY22, compared to pre-pandemic (FY20) levels of 5.4% of the loan book.

It is very impressive growth, and more importantly, it is profitable growth. MNY has given guidance predicting it will have a loan book of approximately $800 million at the close of FY22 (compared to $601 million at the close of FY21), and make a net profit for FY22 of $50 million, which would represent an increase of 27.7% on FY21.

In FY21, MNY made earnings per share (EPS) of 19.8 cents, up 64.3%, on its way to a net profit of $39.2 million, up 76.6%. The company paid a fully franked dividend of 10 cents a share for the year.

Analysts polled by Stock Doctor/Thomson Reuters expect EPS of 24 cents in FY22, and a dividend of 13 cents (six cents was paid for the first half). That informs a consensus estimated FY22 dividend yield of 6.6% (grossed-up, 9.4%), and for FY23, analysts expect 15 cents, for a prospective yield of 7.6% (grossed-up, 10.9%). For this, investors are being asked to pay just 7.2 times expected FY23 earnings.

The analysts’ consensus price target is $3.75.

Money 3 Corporation Limited (MNY)

Source: nabtrade

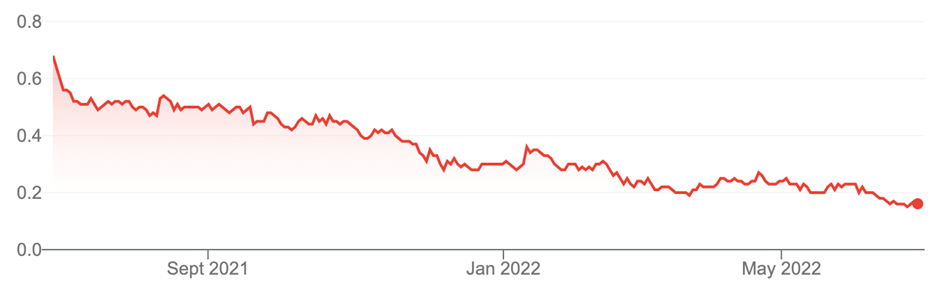

3. Novatti Group (NOV, 15 cents)

Market capitalisation: $51 million

12-month price performance: –77.4%

Analysts’ consensus price target: n/a

While the stock has struggled over the last 12 months, I think that international payments processor Novatti is worth a look, for speculatively-minded investors. Novatti operates a digital payments platform that specialises in online business-to-business payments (B2B). The platform handles overseas bill payments, cross-border transfers, digital wallets and vouchers, digital financial transactions management, collections, subscription management and embedded payments, removing the complexity of billing and driving processes for customers to get paid faster.

Novatti enables businesses to keep up with consumer demands to go cashless. As a principal Issuing partner of Visa, Novatti issues virtual and physical prepaid cards which can be used across more than 38 million locations, in 176 currencies; and can tailor solutions to small or large clients. Novatti’s Acquiring business allows merchants to accept payment from consumers, including through credit cards, direct debits, and other mechanisms such as Alipay and WeChat Pay.

The company says its business is to provide its business customers with everything they need to pay and be paid, covering the complete payments value chain – from issuing payment cards, enabling merchants to accept payments, processing cross-border settlements, and automated billing to banking services. Novatti’s services can be provided using any device, anywhere; the Novatti platform is a highly customisable and scalable solution that can be deployed as enterprise software or on a cloud-based subscription-as-a-service (SaaS) basis. The company says it has established a global B2B payments ecosystem, which is now being monetised as fintechs and businesses use Novatti’s capabilities.

In late 2019, Novatti lodged an application with APRA under the banking regulator’s P-plate scheme, to enable fintechs to transition to a bank structure.

in June, Novatti launched a new business payment and banking service in Europe, called Verv. Using Verv, business customers in Europe can open a digital bank account with its unique IBAN (International Bank Account Number) for standardised banking services worldwide. This is the international equivalent of Australia’s BSB system but on a standardised global scale. Once an account has been set up on Verv, European-based customers will be able to send and receive money, make payment requests and schedule recurring payments. The services will be further enriched in the future to include corporate card issuing, payroll payments, merchant payment gateways, invoicing analytics and more; all of these services will be Apple, Google and Samsung mobile-friendly for ease of payments. In the European Union (EU), Novatti has applied for a licence as an E-Money Institution, which will enable it to issue a range of financial products to the European payments landscape.

Last year, Novatti made a strategic investment in the accounting software platform operated by Reckon Limited, buying 19.9%. In April, Novatti struck an agreement to provide its payment solutions to Reckon’s 114,000 cloud users, in another move to monetise its ecosystem further. The initial focus will be incorporating payments into the Reckon One accounting software platform and a new invoicing app, which will see Novatti services integrated into invoices issued. Novatti and Reckon will share equally any gross margin revenue generated from the integration, with any revenue subject to service demand.

This month, Novatti announced that it will develop a new stablecoin pegged to the Australian dollar, in partnership with both Ripple and Stellar.

The March 2022 quarter was a record period for Novatti, with sales revenue of $10.4 million, largely attributed to the January 2022 integration of Malaysian fintech business ATX. But even excluding ATX, Novatti lifted year-on-year sales revenue by 65%, to $6.8 million, with the payment processing business showing year-on-year growth of 73%, to $5.3 million.

Total cash receipts for the quarter were $16.1 million, a 21% increase from the previous quarter. But after operating expenditure, the company reported an operating cash outflow of about $4.3 million. At the end of the quarter, Novatti had $8.3 million in cash.

These might sound like perilous numbers – but as the global move to digital payments continues to accelerate in the wake of the pandemic, Novatti is well-poised to grow with the demand, and start to leverage the strong position it has built. For a stock with a tiny ASX market capitalisation, Novatti has built a quite impressive business and blue-chip base of customers and partners.

Novatti Group Limited (NOV)

Source: nabtrade

All prices and analysis at 28 June 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.