Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Assessing Australia’s three biggest agricultural exporters

Australia’s big global food exporters are dealing with a variety of influences – some good, like the effect of the Russia/Ukraine war on global grain supplies – and some bad, such as lower prices for their commodities, which is Select Harvests’ (SHV) problem with almonds.

The normal issues of agriculture remain, with the increased rainfall that comes with the La Nina pattern both helping in some areas and proving a problem in others. But analysts see a fair bit of value in some areas – and there are also some handy dividend yields on offer.

Here is the tale of the tape in three of our biggest exporters, in very different agricultural crops.

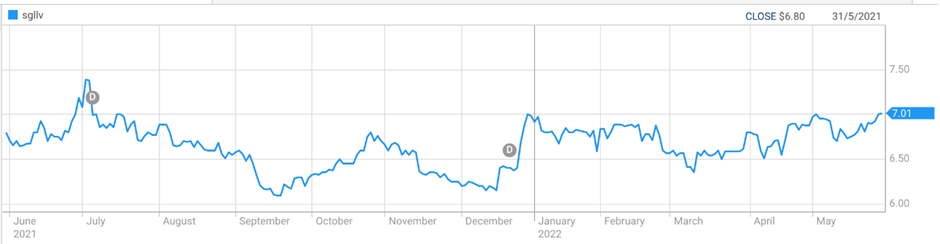

Ricegrowers (SGLLV, $7.00)

Market capitalisation: $432 million

12-month total return: 11.4%

3-year total return: 12.8% a year

FY23 estimated yield: 5.3% fully franked (grossed-up, 7.5%)

Analysts’ consensus price target: $8.86 (Thomson Reuters)

New South Wales rice farmers’ co-operative SunRice – which has its B-Class shares (SGLLV), offering dividends but no vote in the affairs of the co-op, listed on the ASX under the name Ricegrowers – is one of Australia’s leading branded food exporters, supplying about 50 countries with branded rice and rice-based foods, across 35 major brands. As well as its own brand portfolio, SunRice has moved into specialty businesses such as gourmet Mediterranean foods and food service supply (Riviana); stockfeed production and pet-feed nutrition expertise (CopRice); and supplying food ingredients to branded-food manufacturers.

The beauty of the SunRice business is that it is able to source rice from around the world to meet its export contracts when production from its New South Wales base is struggling. That strategy, built over the last 10 years, has been worth its weight in gold given the fact that the Riverina heartland has struggled with the impact of drought, low water availability and high water prices in the Murray-Darling Basin. The 2019 crop was just 54,000 tonnes, and with the impact of COVID-19 added to that, in 2020 Ricegrowers harvested just 45,000 tonnes, its second-smallest crop on record.

This is a business that normally sells more than 1 million tonnes of rice into its local and export markets. The global supply-chain strategy that Ricegrowers has built has – despite what the company describes as “incredible disruption” in the global shipping industry – enabled it to source rice from 12 countries in the last financial year, with just 5% of the total supply actually coming from Australia. To augment local supply, Ricegrowers sourced rice from Cambodia, China, Vietnam, Myanmar, India, Pakistan, Taiwan, Thailand, Uruguay, the US and Italy, and shipped 1 million tonnes into its contracts, generating revenue of $1.03 billion, down 9% for the year. Net profit was down 19%, to $18.3 million, while the fully franked dividend of 33 cents was in line with FY20.

The 2021 Riverina crop was a huge recovery on 2019 and 2020 levels, surging almost tenfold, to 417,000 tonnes. Despite the massive recovery, that is still a long way short of the 700 million tonne average of the 2010–2018 period. However, the company told the 2021 AGM that conditions were “favourable for a 2022 crop that exceeds the 417,000-tonne crop harvested last year”. The Australian crop is on the way back to being a major contributor to Ricegrowers’ global sales.

The first half of FY22 – ended 31 October 2021 – saw revenue lift 11% to $564.8 million, and net profit rise 38% to $16.7 million. FY22 ended for Ricegrowers on 30 April: analysts are expecting revenue of about $1.2 billion, and net profit of about $34.6 million, rising to about $41 million in FY23. With a full-year dividend of about 35 cents expected, Ricegrowers, at $7.00, is projected to pay a 5% fully franked yield, or 7.1% grossed-up. With the local crop recovering, Ricegrowers looks to be good buying at these levels, for a global food leader.

Ricegrowers (SGLLV) stock price chart

Source: nabtrade

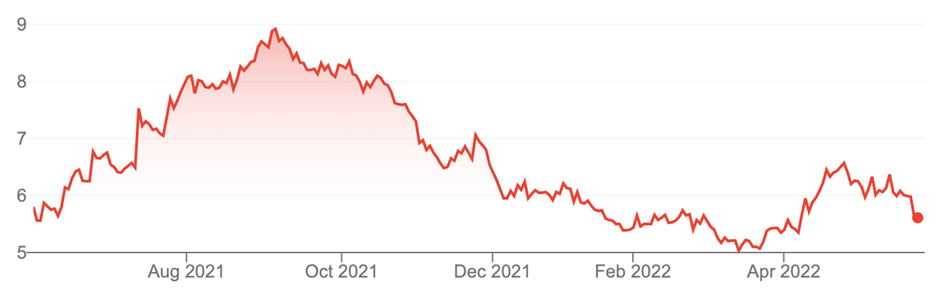

Select Harvests (SHV, $5.63)

Market capitalisation: $681 million

12-month total return: –4.3%

3-year total return: –1.3% a year

FY23 estimated yield: 3.2% fully franked (grossed-up, 4.5%)

Analysts’ consensus price target: $7.80 (Thomson Reuters, five analysts)

The vertically integrated Select Harvests is one of the world’s largest almond growers, supplying the industrial food markets globally – the company exports almonds and value-added food products to China, India, the rest of Asia, Europe and the Middle East, with about 80% of production exported. China and India account for 63% of export sales.

The US (mainly California) dominates the global almond production industry, with 79% of the market, but Australia slots in at second, with 8%, and a great position as a counter-seasonal supplier to the northern hemisphere. But Californian almond pricing dominates the market. With the US state producing a record 3.2 billion-pound (1.5 million tonnes) crop in 2021, that was aggressively sold to export, Select Harvests had to deal with global almond prices that slipped to very low levels, but the company says the silver lining was that demand for almonds grew by an unprecedented 22%, as buyers took advantage of the low prices. However, shipping backlogs are still depressing prices.

Notwithstanding that, Select Harvests says that over the last 30 years, the USD almond price has increased by a compound growth rate of 2.9% a year, with a nine-to-12-year cycle between peaks and troughs. The company received an average almond price of $6.80 a kilogram in FY21, but it cost it an average of $5.63 a kilogram to grow the crop – meaning that even with depressed prices, operating margins were still healthy.

Having exited its consumer brands, it sees its future in the value-added branded industrial almond market, where it has grown its almond sales by 2.5 times over the last five years, under its flagship brands, Allinga Farms and Renshaw.

In FY21, Select Harvests delivered a record almond volume of 28,250 tonnes, up 80% since FY18. By FY28, SHV expects to be producing almost 31,000 tonnes: of the orchard portfolio, the company says 25% of planted orchards are immature, and 4% are beyond their economic maturity, but 71% of its planted orchards are in the “economic sweetspot” – they are generating strong yields, and thus high cashflows, while the capital spending needed on them is low.

Select Harvests is very good at understanding the drivers of almond yield, which are improved horticultural practices and efficient use of water and fertiliser. However, there is still agricultural risk: this month, the company said the current harvest conditions were “the worst the industry has seen in the last ten years,” with wet weather hampering the harvest and increasing the amount of mechanical drying required.

Select Harvests told the market last week that it will not pay an interim dividend, following a weaker half-year result than it was expecting: revenue fell by 19% to $68.7 million, while net profit rose by 53.8% to $2 million, however, the company said that it would not pay an interim dividend “due to unfavourable market conditions”. Without an improvement in almond pricing, SHV said, it expects its second half will be similar to the first half.

That does not greatly faze analysts, who see very good value in SHV at $5.63, following the slide from $8.98 last September. There is also the not insignificant prospect of a grossed-up yield of 4.5% in FY23.

Select Harvests (SHV) stock price chart

Source: nabtrade

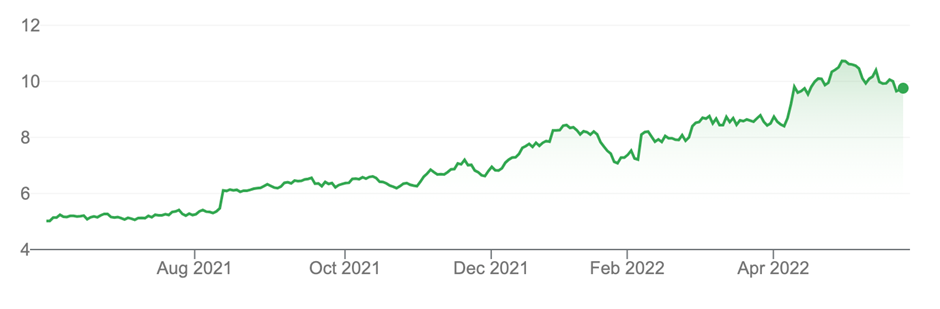

GrainCorp (GNC, $9.86)

Market capitalisation: $2.2 billion

12-month total return: 105.3%

3-year total return: 42.3% a year

FY23 estimated yield: 4% fully franked (grossed-up, 5.6%)

Analysts’ consensus price target: $10.00 (Thomson Reuters)

As Australia’s largest listed grain handler, and also a canola seed crusher and oil refiner. GrainCorp (GNC) has been a big beneficiary of the Russia/Ukraine war, with the disruption to Ukrainian grain and food oil exports causing customers to look for alternative supply sources – a situation that coincides with La Nina driving a second consecutive bumper grain crop on Australia’s east coast – in fact, the second-largest east coast grain crop on record.

Earlier this month, GrainCorp showed just how lucrative this combination of conditions is proving to be – trebling its half-year payout after its first-half profit surged to $246 million, from $50.5 million a year ago; while revenue jumped by 50%, to $3.84 billion. From an interim dividend of 8 cents a year ago, GNC sent out to shareholders a payout of 24 cents a share, comprising an interim dividend of 12 cents and a special dividend of 12 cents.

Even better, the company indicated that another massive crop is coming along. Planting of the 2022/23 winter east coast grain crop (which will flow into FY23 earnings) is underway and will continue in the southern grain-growing areas until the end of June. GNC says planting conditions have been “excellent” given the recent weather pattern, with current levels of subsoil moisture better than in the past two years.

GNC has maintained its FY22 (year ending September) earnings guidance of underlying net profit of $310-370 million, which broker Morgans feels will come in at the higher end, and could possibly be upgraded in the September quarter when additional grain stocks come into its system as growers sell on-farm grain as confidence builds that another big crop is on the way.

As the broker puts it, GNC is “currently benefiting from near-perfect conditions – big east coast grain crops and high grain and oil prices”. However, eventually, these conditions will revert, Morgans points out, and GNC is “unlikely to cycle these record-high earnings ever again”. In other words, future earnings results will result in falls, compared to those that GNC is racking up at the moment.

Unfortunately for investors, GNC has almost doubled in price over the last 12 months – the stock is up 39% since Russia invaded Ukraine – and analysts believe the value is gone from the stock.

GrainCorp (GNC) stock price chart

Source: nabtrade

All prices and analysis at 30 May 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.