Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three possible takeover targets by private equity firms for your portfolio

For years, private equity (PE) firms have been circling listed companies. The goal: acquire and privatise them, supercharge their growth and exit with a fat profit.

As equity markets tumble, I expect more PE firms to swoop on listed companies in Australia and overseas – setting the scene for a new wave of takeovers.

The global PE industry has been “supersized”. In February, The Economist reported that the PE industry was three times larger than a decade ago. The global value of leveraged buy-outs was US$1.2 trillion last year, from US$800 billion in 2006.

Put another way, the PE industry has a vast amount of “dry powder” to put to work. That is, capital that has been committed to PE funds and is waiting to be deployed. The next 12 months will provide ideal conditions to invest that money.

Make no mistake: we are at a critical inflexion point for financial markets. After decades of falling bond yields, inflation and interest rates are rising. Global recession looms.

Some good judges I follow argue that fewer rate rises will be needed to tame inflation, compared to previous cycles. They reason that we collectively have so much debt that even small rate rises will stretch household budgets and stomp inflation.

I disagree. For over a year, I’ve warned that inflation will be a bigger problem than realised. And that higher inflation was not just a transitory response to COVID-19.

I can’t see how a few rate rises will do the job, that inflation will go back into its box, and that asset prices will quickly resume their upward trajectory. We’re in for a brutal 12-18 months as rates rise, household budgets strain and asset prices fall.

Don’t get me wrong: I’m not warning that a share market crash is coming or that investors should cash out. I have consistently argued for 12 months that investors should hold more cash (and equities) in their portfolio (and avoid bonds).

If I’m right, PE firms will have more opportunities to pounce on struggling ASX-listed companies. Or bid for quality firms such as Ramsay Healthcare, as KKR did in April. I liked Ramsay when it traded closer to $60 but it took a while for that value to be realised.

I suspect we’ll see more listed companies, here and overseas, acquired by PE and taken private in the next few years. With so much private capital available, some companies don’t need access to public markets to raise funds. They’re better off in private hands.

Governance and activism are other issues. The costs of being listed and adhering to an ever-lengthening list of governance rules and expectations are becoming more onerous. The boom in shareholder activism is creating other headaches for listed companies.

No doubt, more companies will believe they can grow faster away from the glare of public markets and all their expectations. That’s why PE is attracting capital.

That could spark more takeovers but the usual investment rules apply. Never buy a stock based only on its takeover prospects. The company needs to be attractive regardless of its takeover merits. Think of a takeover as the cream rather than the cake.

It’s hard enough to pick takeover targets, let alone get the timing right. Moreover, predators are not paying the acquisition premiums they used to or engaging in the same types of heated bidding wars that drove prices sharply higher in the past.

Caveats aside, here are three companies that look a good fit for PE:

1. Ansell Limited (ANN)

The maker of medical gloves and personal protective equipment has had a horrible time. The one-year total return (including dividends) is -34%. The annualised three-year return is just 4.2%, marking a long period of underperformance by Ansell.

Investors who bought Ansell at the 52-week high of $44.07 have watched those shares sink to $25.77. The price tumbled after Ansell’s interim FY22 result in February.

Earnings (EBIT) fell 24% to $111 million in the half, compared to the same period in FY21. Sales were almost 8% higher in the half, but margin pressures ate into earnings. Ansell sold more products at lower prices due to softening demand.

The market has overreacted to Ansell’s margin compression. As supply chains unwind after COVID-19, prices for its products start to rise, and natural rubber latex costs retreat, Ansell should see some margin pressures abate.

Ansell has many challenges. Like other manufacturers, it faces higher energy, commodity and wage costs this year. The global protective-wear market is highly competitive with a few big players. Emerging markets are a source of growth, but commoditised, low-margin protective wear is favoured due to price sensitivities.

Risks aside, Ansell has a strong position in its market, has done much good work on restructuring and has balance-sheet firepower for acquisitions or further share buybacks.

At $25.77 Ansell trades about 18% below the target price of $30.51 using consensus analyst forecasts. Morningstar values Ansell at $32. If Ansell’s price keeps falling, watch PE pounce on an undervalued company that has done some good work in tough conditions.

Ansell Limited (ANN) stock price chart

2. Challenger Limited (CGF)

The annuities provider has rallied this year from a 52-week low of $4.78 to $7.14 but has much ground to make up. The five-year total return is -7.7%.

In December 2020 for this Report, I nominated Challenger as one of my top ideas for 2022 (at $6.54). For all its underperformance in the past few years, Challenger has a dominant position in a long-term growth market: the provision of annuities for retirees.

Rising interest rates are a tailwind for Challenger. Higher rates increase the appeal of annuities and support Challenger’s margins (much like higher rates help a bank’s Net Interest Margin). A better-than-expected sales performance in its third-quarter trading update shows market conditions are finally improving for Challenger.

Longer-term, more Australians will have a higher proportion of annuity products in their portfolio to mitigate against longevity risks (their retirement savings run out before they do). An ageing population here and in markets like Japan provides plenty of growth opportunities for Challenger.

Private equity is hovering. In July 2021, Athene (now owned by Apollo Global Management) took a position in Challenger. Apollo, an international PE powerhouse, has 18% of Challenger. In February, Challenger struck a non-binding agreement with Apollo to build a non-bank lending business – suggesting a closer alliance.

How long until Challenger is acquired by a PE firm? Who knows? What is clear is that Challenger, under new management, has more momentum than it has had in years and seems to be getting its mojo back.

A consensus analyst price target of $7.05 suggests Challenger is fully valued at the current $7.14. That looks a touch bearish. Any price weakness from here would be a long-term opportunity to buy a company that has good prospects in the retirement-savings market.

Challenger Limited (CGF) stock price chart

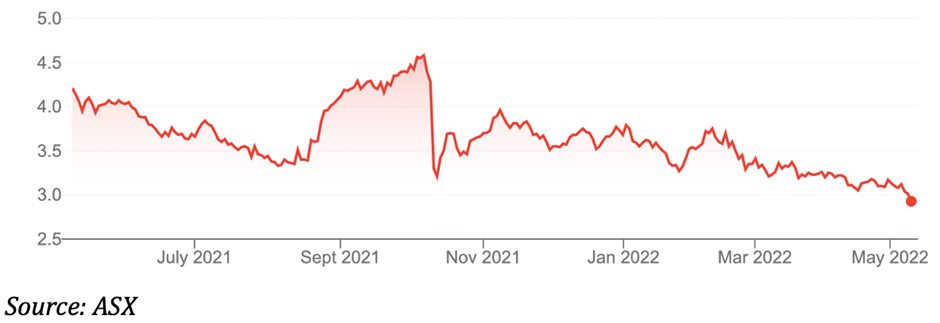

3. The Star Entertainment Group (SGR)

I have been consistently wrong on The Star for the past few years, underestimating regulatory risks for the business and the potential for scandals. I did much better on Crown, believing it was undervalued and a PE target (which it was).

In coming weeks I’ll write more on The Star. The embattled casino operator has many challenges, but savvy PE firms know that creates opportunity. They also know that the valuation of integrated casino/hotel resorts is often underpinned by prime property.

In Star’s case, it looks like an opportunity for a PE predator after recent price falls, and as development risks for its Queensland project recede. The Star is one to watch on the takeover front, but it has higher short-term risk as it goes through a licence-renewal process after recent scandals.

A consensus share price target of $4.18 suggests The Star is undervalued at the current $2.94. Several investment banks have buy recommendations in The Star after recent price weakness. Although the consensus looks too bullish, there’s long-term value there for a PE firm that can stomach short-term regulatory risk for The Star.

The Star Entertainment Group (SGR) stock price chart

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. All prices and analysis at 12 May 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.