Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three cracking new, or almost new, miners for your portfolio

There are always companies in the resources world on the ASX moving down the chain from exploration to development to mining and actual production – and here are three of the very best on offer, across a range of commodities.

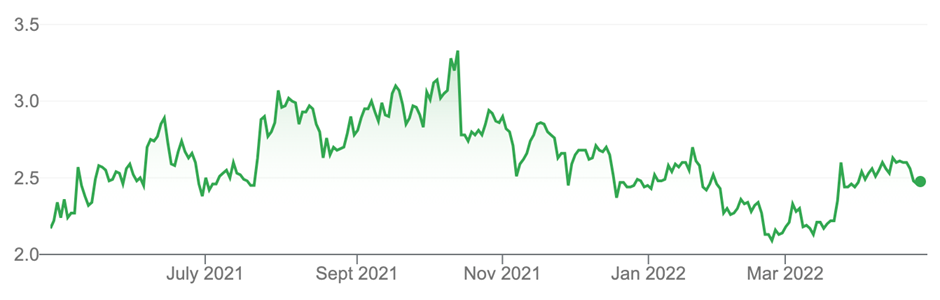

1. Adriatic Metals PLC (ADT, $2.48)

Market capitalisation: $657 million

Three-year total return: 34.7% a year

Analysts’ consensus target price: $4.43 (Thomson Reuters, four analysts)

Adriatic Metals has just about ticked every box on bringing its flagship project, the world-class Vares project in the Balkan nation of Bosnia and Herzegovina, to production. The polymetallic Vares project is often described in the media as a silver project, but the planned processing plant will create both a zinc concentrate and a silver-lead concentrate; copper, gold and antimony will also be produced.

Vares will have a mine life of at least ten years once production commences, which is expected in the second quarter of 2023, but Adriatic expects to more than double this mine life through further exploration. In August last year, and again in December, the company hit mineralisation at a grade similar to the main Rupice orebody in drilling to the north-west of the core deposit. If this mineralisation proves to be a repetition or extension of the Rupice orebody, that mine life extension could be just the start.

The reserve currently stands at 8.41 million tonnes at average grades of 179 grams per tonne (g/t) of silver, 1.66 g/t of gold, 5.04% zinc, 3.18% lead and 0.55% copper. The resource is 12 million tonnes at 149 g/t silver, 1.4 g/t of gold, 4.1% zinc, 2.6% lead and 0.5% copper, for 58 million ounces of contained silver, 526,000 ounces of gold, 488,000 tonnes of zinc, 312,000 tonnes of lead and 56,000 tonnes of copper.

To mine this, in an underground operation, Adriatic estimates an all-in-sustaining cost (AISC) – a figure that incorporates not only the “cash cost” of production but all the costs that allow production to be sustained – of US$7.30 an ounce of AgEq (silver equivalent). That would put Vares in the lowest-cost 10% in its peer group of equivalent mines in the world. To put that in context, silver currently trades at US$24.30 an ounce.

According to the definitive feasibility study (DFS), silver and gold will account for almost half of the forecast revenue, which is estimated at US$377 per tonne of ore milled, or about US$2.7 billion over Vares’ initial ten-year mine life. The DFS also projects a net present value after tax for the operation of a huge US$1.06 billion, with an internal rate of return (IRR) estimated at 134% – those are very big numbers, and they’re predicated on lower commodity prices than currently prevail.

Vares is fully-funded through to production. This month, Adriatic struck early-stage offtake deals with four international companies for concentrate production from Vares: the company has pre-sold 82% of the total projected concentrate production from the first two years of Vares’ operations to the four buyers. Adriatic wants the flexibility to sell the remaining 18% of concentrate production on the spot market, or into other long-term offtake deals.

Further down the track, Adriatic will look to develop its Raska zinc-silver project in Serbia. But for now, the focus is squarely on Vares, which is considered one of the best mining projects in development anywhere in the world in terms of its quality, its economics, and its positive relationship with the host government and communities. There is also the prospect that a lot of big miners, who would like to boost their base metals exposure (and inventories), and see Adriatic Metals glowing bright green on their mergers and acquisitions (M&A) radar screens.

Adriatic Metals PLC (ADT)

Source: nabtrade

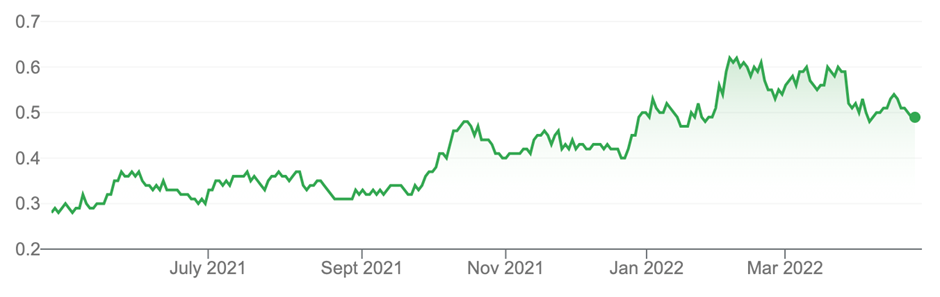

2. Tietto Minerals (TIE, 49.2 cents)

Market capitalisation: $370 million

Three-year total return: 45.4% a year

Analysts’ consensus target price: 90 cents (Thomson Reuters, one analyst)

Tietto Minerals is on the brink of producing gold at its 3.45-million-ounce (Moz) Abujar gold project in the West African nation of Côte d’Ivoire, where it is expected to be West Africa’s next big gold mine. The company says construction of the gold plant is on-target for the first gold to be poured in the fourth quarter of calendar year 2022.

Tietto has racked up a string of bonanza high-grade drilling results at Abujar, having drilled almost three kilometres of holes in total, including the project’s best result of 1.1 metres at 2,853 g/t gold.

The definitive feasibility study (DFS) completed for Abujar last year forecasts gold production at Abujar of 260,000 ounces in the first year, at an AISC of US$651 an ounce – about one-third of the current gold price.

Further out, Abujar is expected to deliver 1.2 million ounces of gold over the first six years at 200,000 ounces a year, at an average AISC of US$804 per ounce. The project is fully funded to production.

Earlier this month, Tietto reported a maiden measured gold resource at Abujar of 7.7 million tonnes at 1.4 g/t gold, for 350,000 ounces. The company is working on updating Abujar’s life-of-mine (LOM) production plan over the rest of the year, factoring in the updated mineral resource estimate, increased mill throughput and higher gold prices: the current spot price is 35% higher than the US$1,407 an ounce that was used in the DFS. It is virtually certain that Tietto will be able to posit a material increase to existing LOM production and mine life – which is currently estimated at 11 years.

Abujar boasts a $1.3 billion pre-tax and $970 million post-tax net present value (NPV), with a post-tax internal rate of return (IRR) of 95%. As first mines go, it’s shaping up to be a cracker.

Tietto Minerals Limited (TIE)

Source: nabtrade

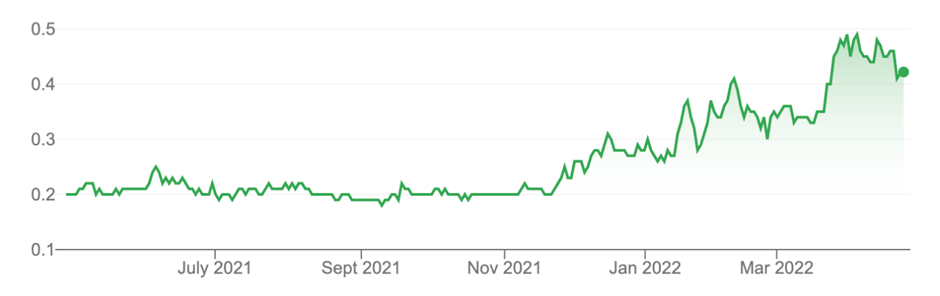

3. Strandline Resources (STA, 42 cents)

Market capitalisation: $466 million

Three-year total return: 53.2% a year

Analysts’ consensus target price: 75 cents (Thomson Reuters, two analysts)

Mineral sands company Strandline Resources is developing its wholly-owned Coburn mineral sands project in Western Australia, which is located near Denham, just 240 kilometres north of the established mineral sands export port of Geraldton. Coburn is a world-class mineral sands deposit, with a whopping ore reserve of 523 million at 1.11% total heavy mineral (THM), in a mix particularly rich in zircon and titanium, which underpins an initial mine life of 22.5 years at the planned mining rate of 23.4 million tonnes of ore a year.

The deposit has strong geological continuity across and along strike, which augurs well for Strandline’s ability to expand the reserve and extend the mine life: the company says there is the potential to extend the Coburn mine life beyond 2060, which would take it to about 40 years, by converting the mineral resources that exist adjacent and immediately north and along strike of the existing ore reserves.

Earlier this month, Strandline told the ASX that construction at the $338 million Coburn development is over 65% complete, and the project is on budget and on schedule to achieve initial production of heavy mineral concentrate (HMC) in the December quarter of 2022. It is projected to deliver about $4.4 billion in revenue over its initial 22.5-year mine life, producing 34,000 tonnes of premium zircon, 54,000 tonnes of zircon concentrate (containing zircon, monazite, rare earths and titanium), 110,000 tonnes of chloride ilmenite and 24,000 tonnes of rutile, for an average annual EBITDA (earnings before interest, tax, depreciation and amortisation) of $104 million, at an EBITDA margin of about 55%.

Broker Morgans describes Coburn as a “world-class, long-life mineral sands project that will provide 5% of the global zircon market – zircon will represent about 55% of Strandline’s revenue from the operation – and 10% of the chloride ilmenite market once fully commissioned, before any expansion is contemplated.” It is a major new Australian minerals project, backed by a pipeline of equally impressive proposed growth projects: Strandline’s mineral sands growth portfolio also includes the Fungoni and Tajiri mineral sands projects in Tanzania, which will be developed in a joint venture company with the Tanzanian Government, known as Nyati Mineral Sands Limited, which will hold all Strandline’s Tanzanian mineral sands assets. Fungoni is set to be Nyati’s first mine development, followed by Tajiri. Strandline says Tajiri alone will deliver strong financial returns over a 23-year mine life.

The Tanzanian growth projects offer significant long-term earnings upside and exploration appeal. The focus, however, is on bringing Coburn to production, to capitalise on high mineral sands prices and strong demand for offtake among leading customers in the US, Europe and China.

Surging demand for mineral sands is increasingly being driven by urbanisation, rising living standards, global growth and the minerals’ extensive array of applications; they are “critical minerals” used in everyday life, vital to the economic health of the world’s major and emerging economies – as well as in a wide range of high-tech applications. But supply is restricted by mine suspensions/closures, declining grades and low stockpiles. Demand growth continues to outpace supply, which means the fundamentals of the market are very strong: already, current spot prices are at least 25% above the assumptions contained in the Coburn definitive feasibility study (DFS), which was released in June 2020.

Strandline Resources Limited (STA)

Source: nabtrade

All prices and analysis at 28 April 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531). This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities