Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Opportunities arise with Australia’s largest miners

Talk about gloom. Last week ended with the Dow Jones Index in the US slumping almost 3% amid fears of spiralling interest rates and disappointing corporate earnings. The Dow’s losses continued in the early part of this week.

China’s worsening COVID-19 crisis has hammered Australian resource stocks this year. Weaker-than-expected Chinese growth is terrible for iron ore and other commodities. BHP Group tumbled 5.8% on Tuesday; Rio Tinto tanked 4.6%; and Fortescue sank almost 7%. That’s an opportunity for long-term investors (more on that later).

Mass testing for COVID-19 in Beijing spooked the market. Having watched COVID-19 turmoil in Shanghai, the market fears a lockdown in Beijing and its impact on China’s already slowing economy. Economists are lowering growth forecasts for China.

It gets worse.

Stephen Roach, the high-profile economist and former Chairman of Morgan Stanley Asia, this week argued that a global recession is coming. Mohamed El-Erian, a prominent commentator, said further downgrades to global growth were likely.

As the International Monetary Fund (IMF) and other bodies downgrade global growth forecasts, inflation is surging. The annual inflation rate in the US in March 2022 was a whopping 8.5% higher than at the same time a year earlier.

In Australia, data this week showed headline annual inflation has surged to 5.1%, exceeding market expectations. I’ve argued for over a year in this Report that higher inflation was likely. I’d be surprised if Australia’s inflation rate doesn’t go even higher from here.

The upshot is slower-than-expected global growth as China struggles with COVID-19, US rates rise and European economic growth is hurt by the Russia/Ukraine war. Also, sharply higher global inflation due to wage, energy and commodity-price pressures.

Low growth and high inflation mean stagflation. Or put another way, the worst possible scenario for investors as equities suffer from lower corporate earnings and real returns on fixed-rate and cash returns fall as inflation rises.

How to respond

What should investors do? At times like these, it can feel like nothing is worth buying. Tech and other growth stocks have underperformed. Now, the market’s big bright spot – commodity producers – is under growing pressure.

Investors with a 6-12 month timeframe have problems. I see global growth contracting further as the Chinese growth engine splutters. At the same time, inflation has further to rise yet. I don’t agree with economists that US inflation has peaked.

However, for investors with a longer-term view, the current market dislocation will present opportunities to buy at better prices. The caveat is that investors who increase equities exposure now will need to withstand higher volatility.

Market recalibration of this magnitude rarely happens in an orderly manner. I can’t see how the US Federal Reserve can bring inflation under control through a series of rapid rate rises without causing a hard landing. I hope I’m wrong but a US recession looks unavoidable.

Most concerning is that two big drivers of global economic growth and thus equity markets – COVID-19 in China and Russia’s War – are wildcards. It’s impossible to know how long China will take to get COVID-19 under control. Or what Russian President Vladimir Putin will do next. A drawn-out conflict in Ukraine would be a tragedy for that country and European growth.

But it’s not all bad news.

Slowing global growth could mean less aggressive rate hikes by central banks. That’s good for equities. Slower growth could also take the steam out of energy costs and wage pressure. It’s hard to argue for a big pay rise – or get one from your boss – when global growth is falling and uncertainty is rising.

China, too, could have upside. Although it looks terrible now with Chinese cities in lockdown, there will be a lot of pent-up Chinese demand when restrictions ease. That’s been the experience in other countries when lockdowns finally end.

As I have written several times recently in this Report, investors need to hold more equities and more cash in their portfolio (and avoid bonds, for now). Well-chosen equities provide scope to maintain the portfolio’s real return as inflation rises.

Although cash provides a negative real return (after inflation), it provides the optionality to increase equities exposure during inevitable share market corrections, like we are seeing right now.

That said, there’s no rush to buy equities just yet. The odds favour further market weakness as the market prices in a larger COVID-19 effect on Chinese growth. As an aside, I’m surprised this has suddenly become big market news. China’s COVID-19 risks – and the challenges of its COVID-zero policy – have been known for months.

Investors should watch and wait for better value over the next few weeks. They must have a clear idea of which stocks to buy, a sufficient cash allocation to do so, and be ready to pounce. There will be a lot more selling if China’s COVID-19 problems escalate.

What to buy

This year, I have repeatedly argued that commodity producers and banks are the best assets to own as inflation rises. That view holds.

Mining companies will take a hit as global growth slows, but demand is not the full story. The big driver of the next commodities supercycle will be supply (due to lack of investment in new mines).

Banks will take a hit if the economy slows and bad and doubtful debts skyrocket. But I can’t see that happening given the Australian economy’s underlying strength.

Prospective investors should keep a close watch on the big miners: BHP Group, Rio Tinto and Fortescue Metals Group. BHP has fallen 16% from its 52-week high. Rio Tinto is down 21% from its 52-week high. Fortescue has fallen 25%.

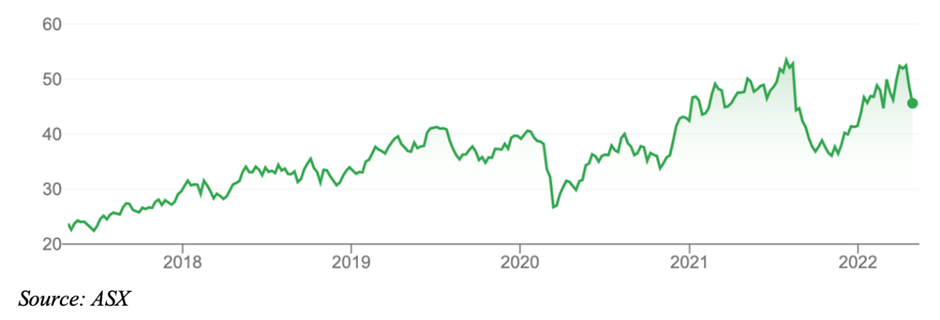

At $46, BHP is trading 8% below the consensus analyst price target. Rio Tinto is about 15% below the consensus target. Fortescue is still above target.

Consensus price targets will come down as analysts factor in lower commodity prices to valuation models. But sharp prices in BHP and Rio, in particular, this year have brought them close to value territory. BHP is the best bet.

At their current price, BHP and Rio Tinto have forecast double-digit dividend yields (before franking), based on consensus estimates. Mining dividends will be cut if commodity prices tumble but yields on the big miners still appeal.

From a charting perspective, BHP needs to hold at about $45 – a point of price support this year. If it breaches that, the next level of support is about $40. If current negativity persists, BHP could get to $40 or below in a hurry in the next few months.

BHP’s recently released third-quarter operational review did not excite the market. In an uninspiring set of numbers, the highlight was BHP retaining production guidance for its iron-ore operations.

BHP Group Limited (BHP)

If Rio Tinto breaches support at $106, the next stop is $100. As with BHP, I expect there will be opportunities to buy Rio Tinto at lower prices in the next few weeks.

Rio Tinto Limited (RIO)

Of course, it’s impossible to predict markets over weeks or months. What I do know is that BHP and (to a lesser extent) Rio Tinto are among this market’s highest-quality companies. Both have lower-cost mines, strong balance sheets, attractive dividends (for now) and the capacity to weather short-term commodity-price weakness.

Longer-term, I like the outlook for commodity prices. The market continues to underestimate looming supply constraints. A lack of investment, due to Environmental, Social and Governance (ESG) factors, has created complex supply challenges that can’t be solved quickly. Less new supply means higher commodity prices for longer.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. All prices and analysis at 28 April 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531). This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.