Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Is this stock sell off the buying opportunity we had to have?

The month of May, according to an old Disney cartoon song, is supposed to be merry. But with recession talk out of the US, headwinds from the Ukraine war and China’s return to pandemic-fighting lockdowns, the question being asked is whether a big crash is coming, or is this the buying opportunity we had to have?

Why “had to have”? Well, while the US stock market indices have plummeted into bear or correction territory, our stock market is down less than 3% from its high.

In contrast, the Nasdaq Composite at the end of April sits in bear market territory, off 23.9% from its intraday high. Meanwhile, the S&P 500 is off its record by 14.3% and the Dow Jones is 10.8% lower.

Bear markets start when there’s a 20%+ sell-off and corrections kick-in with a 10%+ drop.

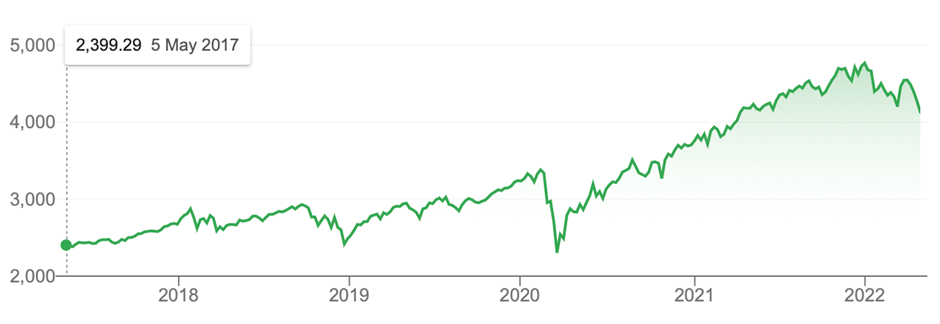

These charts show the US market was riding for a fall compared to us, following a huge surge out of the Coronavirus crash of the market from late March 2020.

US S&P 500

Chart of the US S&P 500.

Source: google.com

Compare the steep rise above with the rise of the S&P/ASX 200 rise over the same time.

S&P/ASX 200

Chart of the S&P/ASX200.

Source: google.com

Before looking at the reasons to worry about a recession hurting our stock plays, let’s look at the data that might suggest if you are investing locally, it might pay not to get too spooked.

First, after the Coronavirus crash of the stock market, the US market was up 106% while ours only gained 58%. But secondly, and more importantly, if you look at the old top of the market before the coronavirus crash and compare it to the top reading on the S&P 500 in the US and our S&P/ASX 200, they were up a whopping 43% while we gained only 6.8%.

It's why I’ve been predicting that we’d play catch up, to some extent, compared to the US market.

The fact that we’ve fallen only 3% while the S&P 500 is off 14.3% and the Nasdaq is down over 23% suggests our market has resilience compared to US equities in 2022.

Explaining a lot of that is the smashing of tech stocks ever since the money world started to agree that worrying levels of inflation was set to see interest rates go wildly higher this year and next.

Then along came two added inflation stimulants — the Ukraine war and a new lockdown edict from Beijing for China.

The combined double whammy of huge inflation rising interest rates was bad for confidence but it was all made worse because of the GDP-crushing effects of war and Chinese lockdowns.

All of this plays into the camp that believes investors should be worried about a US recession. One very informed colleague who has run banks and investment businesses says his US expert mates are expecting a “mild US recession” and that’s a part of the power taking stocks down. And the news that Amazon reported a surprise loss and issued weak revenue guidance for the second quarter added to the recession fears, as did the 14%+ slide in its stock price last Friday!

But there are others on the opposite side of this argument and one is AMP Capital’s Shane Oliver.

This is what he said in a recent note: “Our base case for investment markets remains that US, global and Australian recession will be avoided over the next 18 months at least and this will enable share markets to have reasonable returns on a 12-month horizon.”

And for those worrying about the fact that the US actually had a negative quarter of economic growth in the three months of March, note this from Dr Oliver: “While the US economy contracted by 1.4% annualised in the March quarter, underlying growth was strong, and this is not the start of a recession. The fall was driven by trade (which detracted 3.2 percentage points from growth) and inventories (which detracted 0.8 percentage points) but real final domestic demand grew at a solid 3% annualised rate with consumption up 2.7%, business investment up 9.2% and housing up 2.1%. So, a rebound in growth is likely this quarter – including from inventories where the ratio of inventory to sales is low. So, this is unlikely to be the start of a recession and partly also reflects payback from 6.9% annualised growth in the December quarter.”

So is this sell-off a buying opportunity?

Well, it depends who you are.

If you are a trader/short-term player of stocks, you have to be careful as I expect some more down days ahead — the market experts call it “volatility”, but I call it chance to lose money.

However, if you are a long-term investor, we’re in buying opportunity territory but you have to be willing to endure the risk of getting in too early knowing down the track you will get a pay day.

Remember, one day in the future the Ukraine war will end and China will get out of lockdown and if the US along with the world grows slower than expected because of the headwinds I named above, then interest rates will rise more slowly.

This would mean the global economic rebound that has been derailed by the headwinds of 2022, will eventually show up to power stocks higher.

Meanwhile, the inflation that fed all of this interest rate speculation, which then killed the stock prices of overvalued tech companies, should dissipate and this too will help stock prices.

At times like this, the old England proverb of “Good things come to those who wait” is relevant for the patient investor.

What would I buy?

The safe play is an ETF for S&P/ASX 200 such as IOZ, STW or A200. The higher risk investments are quality tech stocks such as Xero (XRO), which analysts expect a 25% upside, when the business world gets back to normal over the next year.

Other quality less risky plays would include CSL, with a predicted rise of 16.7% and BHP with 8.9% potential upside.

My thrill-seeker (don’t whinge if it’s a wrong play) is Megaport (MP1)! Analysts surveyed by FNArena see 75% upside and fund manager Eleanor Swanson of Firetrail Investments, who picked this stock in November at the Sohn Hearts & Minds conference last year, tells me she and her colleagues still like the stock despite a big sell-off after a disappointing report.

After asking her if she still liked MP1, this is what she emailed me: “The company’s quarterly result was a slight miss versus our and the market’s expectations in terms of revenue and cashflow. We believe the company is still coming to terms with how best to manage expectations internally and externally given they have only established their new sales channels in the last 12mths.

“Despite the slower than expected ramp-up so far, we continue to maintain a very high level of conviction in our Megaport investment thesis. Channel checks with Megaport’s partners has confirmed this view. We believe the recent share price move is an overreaction and continue to see upside as Megaport executes on its strategy over the medium term.”

All prices and analysis at 2 May 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531). This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.