Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Four ASX small-cap stocks under $1 for your portfolio

It’s time for another batch of stocks priced under $1.00. There is nothing meaningful about the $1.00 barrier, other than that investors have a psychological preference for round numbers, and feel that a $1.00 stock is inherently better than an 80-cent stock. But there are plenty of good stories brewing under the $1.00 mark – here are four of them.

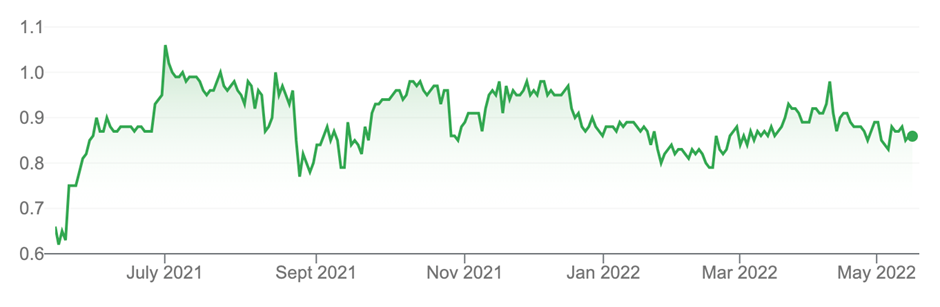

1. LaserBond (LBL, 86 cents)

Market capitalisation: $94 million

12-month total return: 31.1%

3-year total return: 29.5% a year

Analysts’ consensus price target: $1.35 (Stock Doctor/Thomson Reuters, one analyst)

LaserBond is almost the perfect example of a stock that flies not so much under the radar on the ASX, but completely off it – even though it is quite a high-tech business. Listed in December 2007, LaserBond is a specialist surface engineering company that develops materials, using advanced additive manufacturing technologies, to increase operating performance and life of wearing components in capital-intensive industries.

Its customers mostly come from the mining, equipment, technology and services (METS), oil, gas and energy; the steel, aluminium and manufacturing sectors; transport; fluid handling; agriculture; defence; and infrastructure industries. Customers are usually seeking better-than-new repair of mostly wear-related machinery maintenance problems; within the industries that LaserBond supplies, the wear of components can have a huge effect on the productivity and total cost of ownership of customers’ capital equipment. Almost all components fail at the surface, through a combination of abrasion, erosion, corrosion, cavitation, heat and impact, but LaserBond develops a range of tailored surface metallurgy technologies that can dramatically extend life and enhance performance. The company generates about 75% of its revenue from proprietary technologies (that is, that it owns.)

For example, LaserBond has developed E-Clad, an environmentally friendly and stronger alternative to chrome plating, which has for a long time been the standard for protecting hydraulic cylinders against wear and corrosion attacks in heavy industries such as mining. Chrome is generally applied using highly toxic and energy-intensive processes, but E-Clad metallurgically bonds with the metal underneath to create a strong and more resistant product, replicating the functionality of chrome plating in an environmentally friendly way.

Much of what LaserBond does has similar ESG appeal, not least because, as the company says, its products and services can typically extend the usage life of wear-prone plant and equipment between five and ten times, meaning it does not have to be discarded and replaced as frequently.

As at June 2016, LaserBond generated $10.5 million in revenue and $79,000 in net profit; at June 2021, it had expanded that to $24.7 million of revenue and $2.8 million in net profit. In the process, the LBL share price has moved from 8 cents to 89 cents. LBL also pays a fully franked dividend, but with the share price appreciation, the 1.2-cent dividend from FY21 represents a historical yield of 1.3% (grossed-up, 1.9%). Think of the yield as a bonus addition to what the only analyst in the Stock Doctor/Thomson Reuters survey thinks is a very healthy return situation.

COVID has held back international marketing, but there is huge potential for LaserBond overseas, with large and lucrative markets in North America and Asia for its proprietary technologies.

LaserBond Limited (LBL) stock price chart

Source: nabtrade

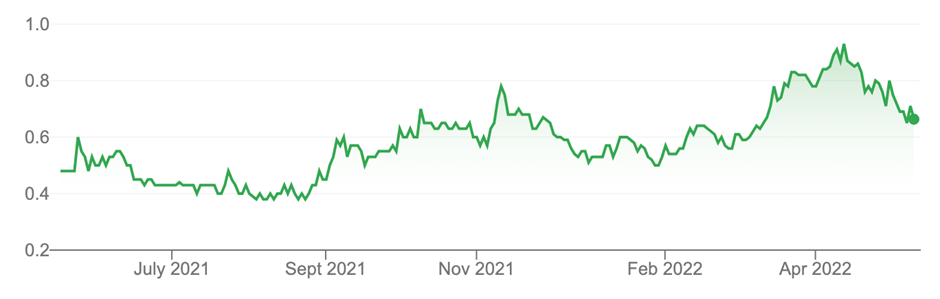

2. Elementos (ELT, 70.5 cents)

Market capitalisation: $125 million

12-month total return: 48.4%

3-year total return: 78% a year

Analysts’ consensus price target: n/a

Tin does not get the laudatory publicity of its “green” metal peers such as lithium, nickel, copper, zinc and the rare earths, but it is arguably the metal that is most important for new technology, decarbonisation and electrification – firstly, for its use in solder, as a crucial part of electronic circuits, a market it dominates; and the role it plays in batteries and battery anodes. Of all its metal peers, tin has the broadest potential uses in lithium-ion batteries, autonomous and electric vehicles (EVs), renewable energy, advanced robotics, the telecommunications shift to 5G, and advanced computation/IT.

Tin also offers a potential solution for one of the most concerning problems with the increasing use of lithium-ion batteries in EVs and other applications – their propensity to catch fire, in a manner that is very difficult to extinguish, in a “thermal runaway” phenomenon in a lithium-ion battery. This is the alarming “secret” of EVs, but if tin is used as a coating inside the parts of lithium-ion batteries, it could be the solution to the problem.

Elementos is very well-positioned for rising tin demand – production at present falls short of forecasted rising demand. The company is focusing mainly on the Oropesa Tin Project in Spain, which it acquired in January 2020, and which is regarded as one of the world’s largest undeveloped, open-cut mineable tin deposits, with access to world-class infrastructure. In March, Elementos’ optimisation study boosted the projected scale of, and improved the economics for Oropesa, forecasting that the operation would produce significant quantities of tin concentrate for at least 13 years, with a payback period of about 2.5 years, producing about 3,350 tonnes of contained tin per year (up from 2,440 tonnes in the company’s previously released study.) The optimisation study also indicates annual revenue of US$108 million, 125% higher than estimated for the previous mine design.

The pre-tax internal rate of return (IRR) at Oropesa is approximately 46%; giving a post-tax net present value (NPV) of about $198 million. But the study used a base-case tin price of US$32,500 per tonne – compared to the current price of US$33,370 a tonne, which would improve the numbers.

Elementos has submitted the main regulatory documentation to progress the Oropesa project; the assessment timeframe is expected to be approximately 15-18 months. In line with the approvals process, Elementos expects to deliver Oropesa’s definitive feasibility study (DFS) around the first quarter of 2023. Construction of Oropesa is expected to take about 1.5 years: Oropesa could come into production in 2024.

Elementos also owns the Cleveland tin project, about 80 kilometres southwest of Burnie in the mineral-rich northwest region of Tasmania. Cleveland is amenable to both open-cut and underground mining techniques. The project retains plenty of exploration upside, and also hosts copper and tungsten mineralisation; Elementos is still drilling to define the reserve, but Cleveland is several years behind Oropesa in the company’s development wishlist.

After a 25-into-one share consolidation in December 2021, ELT, previously trading at 2.72 cents, became 68 cents and has moved slightly higher (with a peak of 93 cents in April.) Investors are buying into the prospect of the company bringing into production a major new source of tin, particularly one located within the European Union (EU), which is trying to source its own internal supply to feed its advanced manufacturing and EV industries. Having retreated to 70.5 cents, I think Elementos looks very attractive.

Elementos Limited (ELT) stock price chart

Source: nabtrade

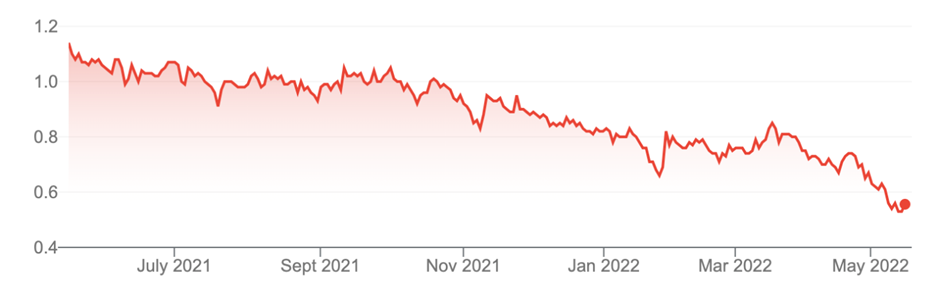

3. Mach7 Technologies (M7T, 53 cents)

Market capitalisation: $127 million

12-month total return: –50%

3-year total return: 28.8% a year

Analysts’ consensus price target: $1.375 (Stock Doctor/Thomson Reuters, two analysts), $1.55 (FN Arena, one analyst)

Mach7 Technologies develops software platforms for the healthcare industry. It specialises in image management systems and patient data management. The core of these offerings is the Mach7 Enterprise Imaging Solution, encompassing Enterprise Data Management, Enterprise Diagnostic Viewing and Diagnostic Workflow applications. Mach7’s Enterprise Data Management solution, consisting of its Vendor Neutral Archive (VNA) and data administration tools, allows for the fast storage, access, retrieval and viewing of images across a healthcare network, connected through the cloud.

With more than 150 customers across 15 different countries, the company says it has built a global network of diverse customers that range from expansive Integrated Delivery Networks, National Health Systems, medical research facilities, and large academic medical institutions to regional community hospitals, private radiology practices, and independent provider groups.

In the December 2021 half-year, Mach7 Technologies more than doubled its revenue to $14.3 million, of which $6.5 million was recurring revenue, consisting of subscription revenue and support and maintenance revenue. Software licence fee revenue was $6.7 million for the half-year, which represents capital software deals that are generally contracted over a five-year term. The company said that it had a record $22.1 million of sales orders (total contract value) for the half-year; it says “sales orders are an indication of strong future revenue streams across all products and services”.

Then, for the third quarter of the financial year – ending 31 March 2022 – M7T reported a further $4.4 million TCV worth of sales orders, taking the total for the financial year so far to $26.5 million; the company said it was on track to deliver sales orders of $30 million (TCV) for FY22. For the financial year so far, revenue is running at a record $21.2 million, up 57% on last year, with a record financial-year-to-date EBITDA (earnings before interest, tax, depreciation and amortisation) of $3.2 million, up $4.7 million from the $1.5 million EBITDA loss recorded at March 2021.

During the quarter, Mach7 Technologies received signed agreements from two existing customers, Trinity Health and Penn State Milton S. Hershey Medical Center: Trinity Health has signed a statement of work (SOW) that encompasses the first deployment wave of Trinity Health’s Unified Clinical Imaging Platform which will see the company’s Enterprise Imaging Platform, Universal Worklist, eUnity Enterprise viewer and eUnity Diagnostic Viewer implemented at Trinity Health’s facilities across southeast Michigan. Penn State signed a contract renewal and licence expansions for the company’s Enterprise Imaging Platform.

Broker Morgans certainly feels good growth in new sales orders and positive net operating cash inflow is coming through – it says new reseller agreements covering new regions Singapore (servicing Asia-Pacific) and Italy/UK will make a material contribution to future revenue streams. Morgans has a $1.55 target price on M7T, which, if borne out, would almost triple an investor’s money from here.

Mach7 Technologies Limited (M7T) stock price chart

Source: nabtrade

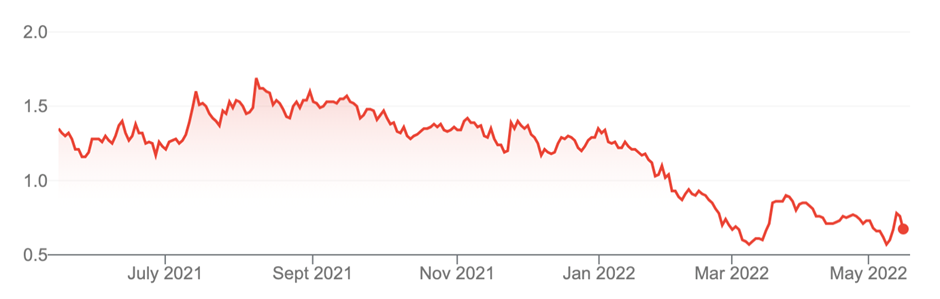

4. 4D Medical (4DX, 75.5 cents)

Market capitalisation: $222 million

12-month total return: –41.7%

3-year total return: n/a (listed August 2020)

Analysts’ consensus price target: $1.785 (Stock Doctor/Thomson Reuters, one analyst)

Listed in August 2020, 4D Medical is a medical technology company specialising in the treatment of lung disease through respiratory imaging and analysis.

4DMedical aims to disrupt the US$31 billion ($44.9 billion) respiratory diagnostic imaging market with its unique four-dimensional lung imaging technology, XV Lung Ventilation Analysis Software (XV LVAS), which maps and measures lung motion and airflow by converting sequences of X-ray images into four-dimensional quantitative data. The 4DX technology accurately and quickly scans lung function as the patient breathes, to provide sensitive, early diagnosis and to monitor changes over time. At the heart of the process is a proprietary technique 4DMedical has developed, inspired by wind-tunnel technology, which combines fluoroscopy and advanced visualisation to generate high-resolution images of the motion of, and airflow through, lung tissue.

In May 2020, the XV LVAS technology received 510(k) clearance from the US Food & Drug Administration (FDA) – which demonstrates that the FDA accepts that the device to be marketed is as safe and effective as a legally marketed device – following a major confirmatory clinical trial of the XV Technology, conducted at Cedars-Sinai Hospital in Los Angeles, California. The clinical trial showed that XV gave clinicians much more detailed information than the commonly used pulmonary function test (PFT) and computed tomography (CT) imaging methods, confirming 4DX’s belief that the unique and non-invasive XV technology enables unprecedented insight into pulmonary functioning, which is critical in the analysis and treatment of respiratory diseases.

The clinical trial demonstrated that XV not only matched the performance of current “gold standard” measures and other clinically available measures, but it was also more predictive than other measures in assessing the onset of conditions such as radiation-induced pneumonitis and/or pulmonary fibrosis. In addition, the trial found that XV was clearly superior to the major incumbent testing technologies, PFT and CT, in detecting loss of regional lung function associated with early-stage disease progression, both in terms of sensitivity to structural changes in the lung (where it was compared to CT) and in standard lung function tests (where it was compared to PFT.) 4DMedical says XV is a break-through medical technology and a potentially world-changing advance in better and more timely diagnosis – and thus, improved treatment outcomes – for all lung disorders, including asthma, chronic obstructive pulmonary disease (COPD), cystic fibrosis and cancer.

In March, 4D Medical extended the use of its proprietary XV technology by combining it with purpose-built hardware to create the world’s first dedicated lung scanner, the XV Scanner. The new scanner can provide detailed quantitative data on respiratory function through an automated scanning process. The XV Scanner could have a huge addressable market: it will go through the usual clinical trials and FDA approval process. The Australian Government’s Medical Research Future Fund (MRFF) contributed $28.9 million towards the scanner’s development. In March, 4DMedical began the clinical pilot of the XV Scanner at Providence St. Joseph Hospital in California, with the first scans successfully delivered. According to 4DX, the scanner will give doctors “unprecedented and highly visual insight into lung function.”

These successful scans at St. Joseph Hospital build on previous and concurrent use of XV Technology in clinical trials undertaken at other US sites, including Johns Hopkins Medical Center, Cleveland Clinic, Vanderbilt University Medical Center, Duke University Hospital and the University of Miami. The company says it “continues to make progress towards other commercial pilots in the US,” and has a “strong near-term commercialisation pipeline in the US market, particularly within the large and important Veterans Health Administration (VHA) healthcare system, the largest integrated healthcare system in the US, providing life-long care and services to eligible military veterans and their families”.

Also in the March quarter, 4D Medical extended its partnership with I-MED Radiology Network (I-MED), Australia’s largest outsourced provider of radiology, with more than 200 clinics nationwide, installing its XV LVAS software at more I-MED clinics, and receiving first commercial payments for the delivery of scans at these initial I-MED clinics.

Investors must understand that it is very early days for revenue for 4D Medical: in the March quarter, apart from receiving $8.9 million (including GST) of the MRFF grant, it only received $74,000 from customers, including I-MED.

As at 31 March 2022, 4DMedical’s cash balance was $60 million, which the company says gives it a cash runway of at least seven quarters – investors at this price are banking on the commercialisation pipeline starting to deliver revenue before that runway is used-up. In their favour is that 4D Medical does have outstanding technology.

4D Medical Limited (4DX) stock price chart

Source: nabtrade

All prices and analysis at 16 May 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.