Three stocks under 75 cents to consider for your portfolio

Today I’m going back to ‘Small-cap Land’ for a look at three potential great buys under 75 cents. Each of them is viewed as cheap by the analysts that follow them, and each of them has big potential global markets that they’re working to tap. I think these are great representatives of the type of interesting stories to be found at these market-capitalisation levels – for investors that appreciate both the potential, but also the risks.

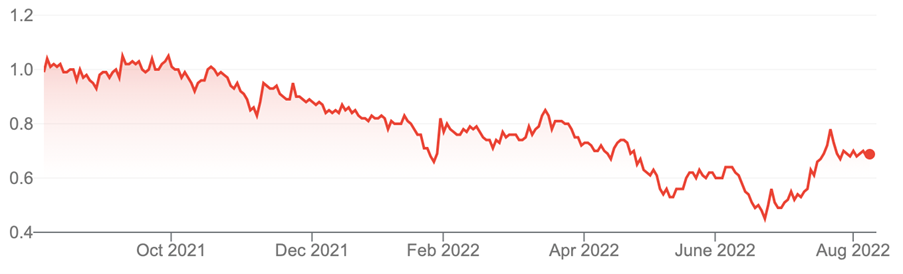

Mach7 Technologies Limited (M7T, 70 cents)

Market capitalisation: $162 million

12-month total return: –33%

3-year total return: 0.7% a year

FY23 estimated yield: no dividend expected

Analysts’ consensus price target: $1.27 (Stock Doctor/Thomson Reuters, two analysts), $1.34 (FN Arena, one analyst)

I looked at Mach7 Technologies (M7T) in May at 53 cents, and I’m happy to double down at 68 cents. The company (formerly known as 3D Medical Limited) develops software platforms for the healthcare industry, specialising in image management systems and patient data management. Its products allow healthcare enterprises to identify, connect, and share diagnostic images and patient-care intelligence where and when needed. M7T develops data management solutions that create a clear and complete view of the patient to inform diagnosis, reduce care delivery delays and costs, and improve patient outcomes.

The core of these offerings is the Mach7 Enterprise Imaging Solution, which encompasses enterprise data management, enterprise diagnostic viewing and departmental workflow applications. Mach7’s Enterprise Data Management solution, consisting of a powerful vendor-neutral archive (VNA) and data administration tools, allows for the fast storage, access, retrieval and viewing of images across a healthcare network, with connectivity to the cloud. Mach7 is progressively moving to more software-as-a-service (SaaS)-style contracts: currently about 40% of contracts are SaaS, but analysts expect that to become the majority going forward.

With more than 150 customers across 15 countries, the company says it has built a global network of diverse customers that range from expansive Integrated Delivery Networks, National Health Systems, medical research facilities, and large academic medical institutions to regional community hospitals, private radiology practices, and independent provider groups. Mach7 is targeting a US$3 billion ($4.3 billion) global market.

Mach7 posted some strong numbers for the year to 30 June 2022:

- Sales orders were up 30%, to a record total contract value (TCV) of $33.2 million (the second consecutive record figure);

- Sales orders from existing customers rose by 46%, to $15.3 million;

- Cash receipts rose 34%, to a record $28.2 million;

- Operating cash flow was up almost five-fold, to $6.7 million;

- Cash on hand at 30 June 2022 was a 40% increase on the 2021 figure, at $25.8 million;

- The annual recurring revenue (ARR) run rate was up 8%, to $14.4 million;

- Mach7 achieved its third consecutive year of positive operating cashflows, and forecasts continued positive operating cashflows for FY23 and beyond.

Analysts don’t see profit before FY24, but the company is showing very strong progress in building the base of installations from which profit will come.

Mach7 Technologies Limited (M7T)

Source: nabtrade

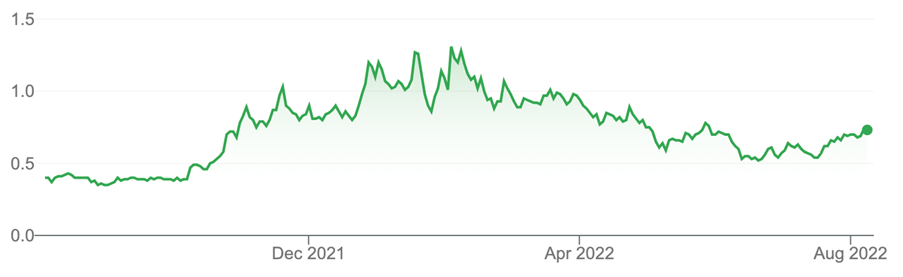

Starpharma (SPL, 72 cents)

Market capitalisation: $286 million

12-month total return: –45.3%

3-year total return: –17.7% a year

FY23 estimated yield: no dividend expected

Analysts’ consensus price target: $2.20 (Stock Doctor/Thomson Reuters, one analyst)

Biopharmaceutical company Starpharma (SPL) is a highly promising biotech stock. The company is a world leader in the development of new pharmaceutical and medical products based on proprietary polymers called dendrimers, with programs based on its proprietary drug delivery platform technology, DEP; its VivaGel technology and VIRALEZE, its antiviral nasal spray for COVID-19.

The DEP drug delivery platform is being used to improve pharmaceuticals, reduce toxicities, enhance their performance, and ensure that the drug is delivered to the right part of the body at the right time – thus enhancing both the commercial and therapeutic value of the drug. The platform can also carry antibodies, proteins or radioisotopes.

Starpharma has three internal DEP products – DEP docetaxel, DEP cabazitaxel and DEP irinotecan – in clinical development in patients with solid tumours. The most advanced program, DEP-docetaxel, enhances Sanofi-Aventis’ Taxotere drug: patients are being recruited into a Phase II docetaxel trial, which targets non-small cell lung cancer and prostate cancer. The cabazitaxel program adds DEP to Jevtana, another Sanofi-Aventis drug: a phase II trial recruited 61 patients and showed “encouraging efficacy signals in prostate, ovarian and gastro-oesophageal cancers.” The irinotecan program applies DEP to Pfizer’s drug Camptosar: its Phase II program showed efficacy in multiple tumour types, including colorectal, breast, ovarian, pancreatic, lung and oesophageal.

Its biggest external commercial partnership is with AstraZeneca, with DEP being used in a nano-medicine formulation of Astra Zeneca’s cancer drug AZD-0466, aimed at blood cancers such as leukaemia and lymphoma – this is currently in a phase 1 clinical trial, having been granted investigational new drug (IND) status by the US Food & Drug Administration (FDA). The partnership has been expanded to a new global clinical trial in an additional indication – non-Hodgkin’s lymphoma (NHL), one of the most commonly occurring cancers.

The company’s VivaGel technology is being used in a range of sexual/women’s health products, including the VivaGel condom, and for the treatment and prevention of bacterial vaginosis (BV) and the prevention of sexually transmitted infections (STIs). Based on the company’s proprietary SPL7013, or astodrimer sodium, VivaGel is antiviral and blocks bacteria. The VivaGel therapy for BV, the most common vaginal infection in the world, has been licensed in more than 160 countries around the world. Starpharma estimates the current market for the management of BV and associated symptoms at more than US$750 million ($1.1 billion) globally, with significant areas of unmet need for BV sufferers. Starpharma believes the addressable global market for the prevention of recurrence of BV is potentially over US$1 billion ($1.4 billion).

Lastly, there is the VIRALEZE antiviral nasal spray that Starpharma is developing for COVID-19, which is complementary to vaccines, also effective against influenza A and B, and also has potential use in future pandemics. The development of VIRALEZE is being expedited because it is repurposing an already-marketed, broad-spectrum antiviral dendrimer: the spray has been accepted as a medical device in more than 30 countries.

In the year to 30 June 2022, Starpharma doubled its receipts from customers to $4.8 million. It had a cash balance as at 30 June 2022 of $49.9 million.

Starpharma (SPL)

Source: nabtrade

PlaySide Studios (PLY, 72.5 cents)

Market capitalisation: $300 million

12-month total return: 94.7%

3-year total return: n/a

FY23 estimated yield: no dividend expected

Analysts’ consensus price target: $1.30 (Stock Doctor/Thomson Reuters, two analysts), 85 cents (FN Arena, one analyst)

The Melbourne-based PlaySide Studios (PLY) is a big name in the global video game industry, in which it is one of the top independent developers in the world. PlaySide develops its own intellectual property (IP) in the form of self-published games delivered across four platforms: PC, mobile, virtual reality (VR) and augmented reality (AR).

PlaySide has launched more than 20 original mobile game titles since its inception, including ‘Animal Warfare’, ‘Monkey Ropes’ and ‘Ghost Pop’. Monkey Ropes reached the top 10 and Ghost Pop reached the top 30 in the global App Store game charts for several consecutive weeks. Combined, PlaySide’s original games have received over 35 million downloads and ten number-one chart positions. Five of these titles have been sold to large Chinese publishers.

PlaySide also develops game content under contracts with studios such as Take-Two Interactive, Activision Blizzard, Meta Platforms, Disney, Pixar, Warner Bros, Sony and Nickelodeon. The company’s portfolio consists of 60 titles.

In June, PlaySide launched a third-party publishing division, PlaySide Publishing. This division will be focused on PC and Console games, given what the company describes as “the scale and revenue opportunities of titles in this segment”.

The company has also identified E-sports as a major growth area of gaming and has invested in BIG Esports. It is also developing multiple Web3.0 products, with a range of projects in the development pipeline. This year, PlaySide launched Metaverse-based franchise Beans by Dumb Ways to Die, involving the sale of non-fungible tokens (NFTs) representing the Beans, the characters within the game. In June, PlaySide signed a 16-month extension and expansion of its work-for-hire development agreement with Meta Platforms (formerly Facebook); it also signed a six-month contract to provide “an important new VR initiative” for Meta to be delivered in October 2022.

The company says it is seeing strong growth in its work-for-hire business – where its existing contracted backlog stood at $15.7 million as of 30 June 2022 – while its original IP business segment prepares to launch several titles, including the global launch of Legally Blonde and The Godfather in the September 2022 quarter. For the year to 30 June 2022, PlaySide told the market last month that unaudited full-year revenue had grown by 169%, to $29.2 million, driven primarily by its original IP titles and Web 3.0 initiatives. “Given our strong cash position, strong pipeline of original IP titles, newly established third-party publishing division, and our ability to deliver projects with some of the world’s largest and best-known clients such as Meta, we are confident of continuing our momentum in FY23,” PlaySide studios said.

PlaySide Studios could come into profit when the FY22 result is released, but investors should still consider the stock speculative – however, its stature in its industry is world-class, and its growth potential is considered very strong.

PlaySide Studios (PLY)

Source: nabtrade

All prices and analysis at 08 August 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.