Banking on a turnaround in financials

Tuesday’s larger than expected 50bpt interest rate increase from the RBA shocked markets, but the real reaction has come in more recent days, with the ASX200 falling 1.45% on Thursday, and down 2.2% over five days. Closing at 7019 points, the market has given back approximately 3 weeks’ worth of modest gains, while remaining above January’s lows. In the US, 10 year Treasuries rose above the key 3% threshold, spooking markets as investors worry that a combination of inflation and rising rates will tip the economy into recession.

While most pundits agree that higher rates will allow Australia’s banks to increase their net interest margin, which has been crushed in recent years as rates have fallen close to zero, a rapid increase in rates is also worrying investors. The concern now is that marginal borrowers, who had to take out large loans to finance homes that had increased 30% or more in value post Covid, will be unable to service mortgages with higher rates, and that banks may need to substantially increase their provisions for bad and doubtful debts. In addition, the extraordinary volumes seen in the last twelve months as property demand – and prices – soared are likely to fall more than expected; US mortgage demand is at 20 year lows. As a result, bank share prices have been crushed in recent days; the financials index is off nearly 8% over the week.

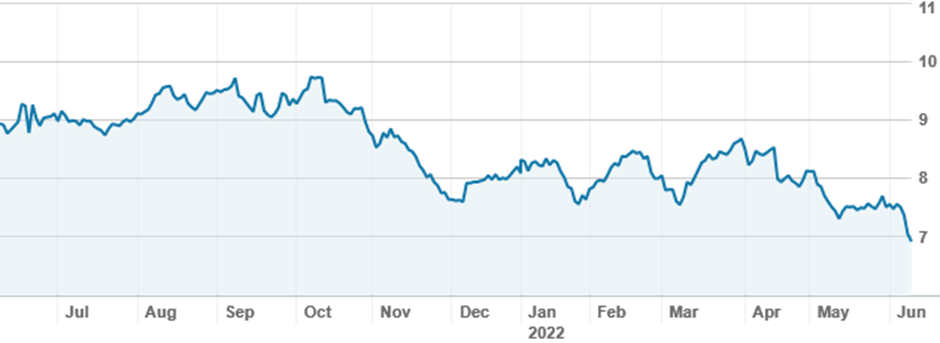

For nabtrade investors, a sell off in bank shares is worth getting excited about; while volumes remain subdued overall, there are plenty of bargain hunters willing to pick up one of the big four at a discount. After a brief window of enthusiasm for ANZ (ANZ), Westpac (WBC) is back to the top of the buy list, with Commonwealth Bank (CBA) in second place. The two companies have had different fortunes over the last twelve months – while Westpac is down 20% over one year and well off its 2018 high of $34, CBA is down just 6% over a year and still above its pre Covid high of $90. nab (NAB) and ANZ (ANZ) also found plenty of buyers, as did Bank of Queensland (BOQ), which is down 23% year on year.

Bank of Queensland shares over twelve months (BOQ)

Source: nabtrade

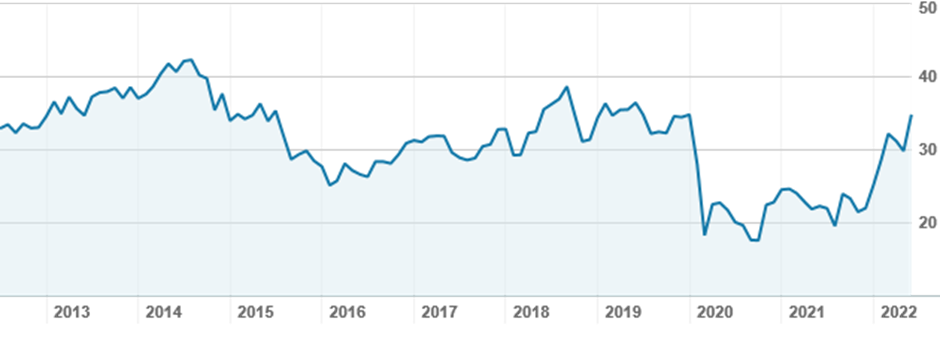

The energy sector is one of the spots of green on the screen, with Woodside Energy (WDS) the brightest. With the acquisition of BHP’s oil and gas assets, Woodside is now a top 10 company on the ASX. It is a longstanding favourite with nabtrade’s SMSF clients in particular, but recent strength is testing investors’ commitment; many have sold in order to buy into the weaker banking sector. Woodside has had a stellar year, up nearly 50%, but interestingly still remains below its 2014 and 2018 highs.

Woodside shares over ten years (WDS)

Source: nabtrade

Materials have also fared strongly in trading, with BHP (BHP) still a modest buy, and Fortescue Metals Group (FMG) actively traded. Ongoing weakness in the lithium space – or perhaps just a little bit of sanity – has seen prices fall across the sector, and nabtrade investors have enthusiastically bought up stocks they were loathe to own at higher levels. Pilbara Minerals (PLS) and Allkem (AKE), the larger and more established players, were the picks.

Finally, weakness is giving longer term investors a chance to enter the market, and they are consistently buying ETFs in order to get long term exposure. Vangard’s ASX200 ETF (VAS) as well as VGAD (their international flagship product) and GOLD, ETF Securities physical gold ETF all made the top 20.

Analysis as at 9 June 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.