Why listed private equity is looking like a bargain

Private equity is the ownership or interest in a corporate entity that is not publicly listed. It can involve taking a stake in a growing business, making direct loans to a business, or it can be taking control of a company either through outright purchase or through obtaining a controlling equity interest (buyout). It’s considered high risk with high reward.

Private equity has attracted trillions of dollars in investment with investors capitalising on the higher return versus risk profile compared to traditional asset classes and diversification benefits.

However, the challenge with private equity investments is there are significant barriers to entry, often requiring large initial investments and multi-year financial commitments, with illiquidity and limited transparency. This is where listed private equity comes in. By investing in the stocks of publicly listed companies that specialise in private equity, investors can gain access to the realm of private equity while also avoiding the drawbacks traditionally associated with the asset class.

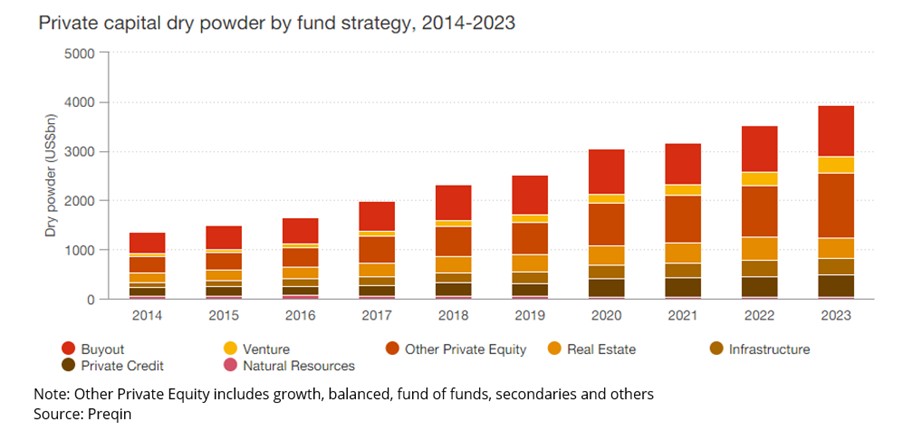

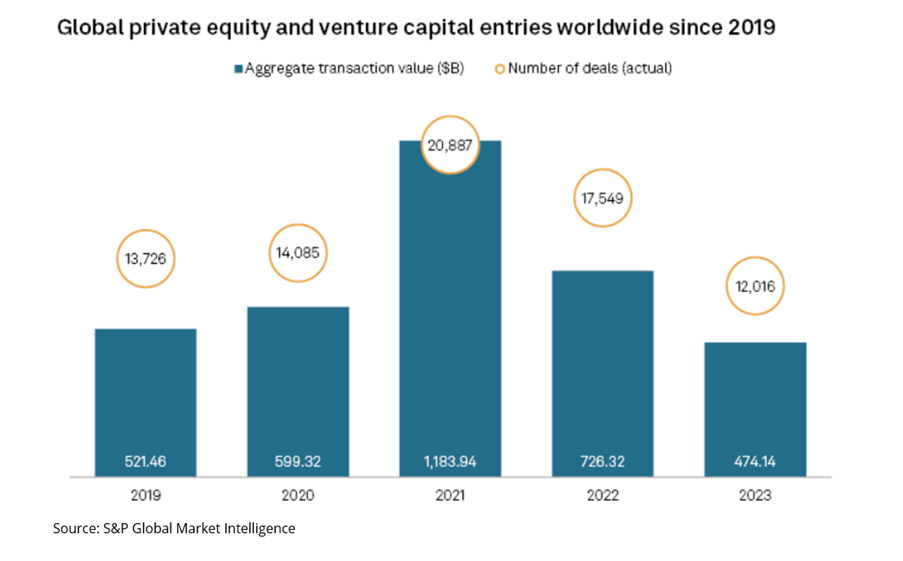

We expect to see activity in the private equity market to accelerate in the coming year. We’re at the end of the rate hike cycle. Rates should stabilise, improving confidence in the assessment of valuations and therefore investment activity. If central banks start cutting rates late this year, this is typically an environment where private equity outperforms listed equity given the higher levels of leverage and implications on the valuation of future earnings. Firms are also under significant pressure to deploy the accumulated record levels of dry powder.

In terms of sectors, we expect to see most activity happening across technology, media, and telecom (TMT), as firms seek to capitalise on the Artificial Intelligence (AI) revolution. Restructuring of distressed assets will likely pick up as select businesses struggle in a rates higher for longer environment.

Looking at the LPX50 Index, which is the market benchmark, we can find some of the biggest names in this space, including Blackstone and KKR. Blackstone manages over US$1 trillion, is famous for buying out Hilton in 2006 and realising US$14 billion in profit 11 years later, and now owns dating app Bumble, genealogy company Ancestry, along with more than 100 other companies. KKR owns Australia’s favourite biscuits, Arnotts and has a majority stake in Colonial First State, among its US$175 billion global private equity portfolio.

Listed private equity has been trading at a discount to book value since 2021. To capitalise on the discount, we’ve seen private equity managers buying back shares, saying to the market that they perceive listed prices to be undervalued. But these valuation discounts are unlikely to go on much longer.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 18 March 2024. This document was originally published on Livewire Markets website on 18 March 2024. This information has been prepared by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.